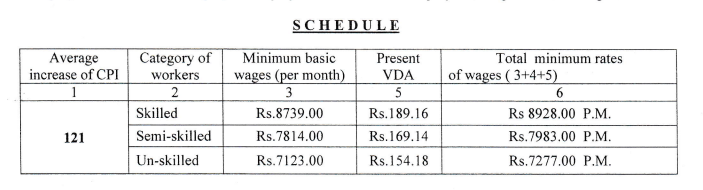

The minimum rates of wages for the employees employed in the following 30 (thirty) Scheduled Employments in the state of West Bengal shall be effective in the period from 1st July 2023 to 31st December 2023.

The minimum rates of wages have been updated with reference to the Fixation / Revision notifications as mentioned against each scheduled employment.

Implementing Areas:

1. Zone A: Areas under Municipal Corporations, Municipalities, Notified Areas, Development Authorities, Thermal Power Plant areas including Township Areas.

2. Zone B: Rest of West Bengal.

3. To arrive at daily rate, monthly rate shall have to be divided by 26 (to be rounded off to the nearest rupee) and to arrive at weekly rate, daily rate shall have to be multiplied by 6;

4. A normal working day shall consist of eight hours of actual work and not less than half hour of recess, subject to 48 hours of actual work in a week

5.One day in any period of seven days, as may suit the local convenience, shall be the day of weekly rest. The minimum rates of wages include the wages for weekly days of rest.

Payment for the work done on the day of weekly rest and for work done beyond the normal working hours shall be double the ordinary rates of wages.

6.Where the existing rates of wages of any employee based on contractor or agreement or otherwise are higher than the rates notified herein, the higher rates shall be protected.

7. The minimum rates of wages are applicable to the employees employed by contractors also.

8.The minimum rates of wages for disabled persons shall be the same as those payable to the workers of the appropriate category.

9.The men and women employees shall get the same rates of wages for the same work or work of similar nature.

10.The minimum rates of wages and variable dearness allowance, if any, both together shall constitute the minimum rates of wages to be enforceable under the Minimum Wages Act, 1948.

Post Views: 2,835