Effective from 1st November 2025)

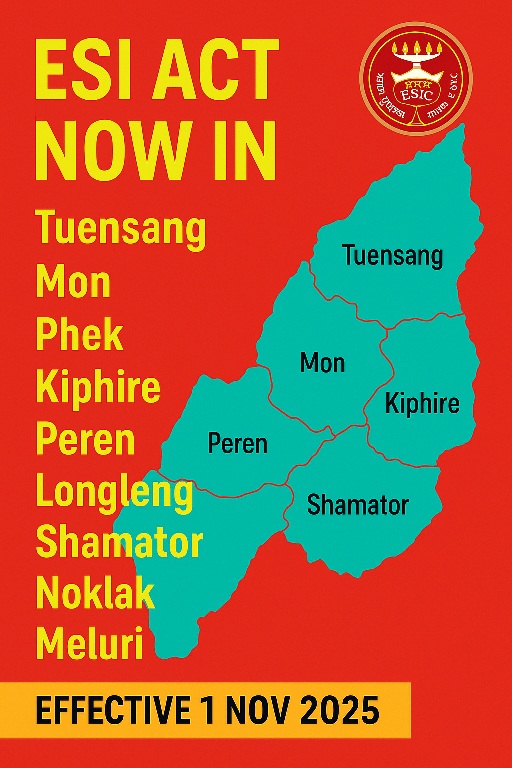

The Ministry of Labour and Employment, Government of India, through its latest Gazette Notification dated 17th October 2025, has extended the provisions of the Employees’ State Insurance Act, 1948 (ESI Act) to several districts of Meghalaya, marking a major step in expanding the reach of social security benefits in the North-Eastern region.

📅 Effective Date of Implementation

The Central Government has appointed 1st November 2025 as the date from which specific provisions of the ESI Act shall come into force in the following districts of Meghalaya:

- West Garo Hills

- South Garo Hills

- North Garo Hills

- East Garo Hills

- South West Garo Hills

- West Jaintia Hills

This expansion brings all industrial, commercial, and eligible establishments within these districts under the ESI coverage.

⚖️ Provisions Enforced

From 1st November 2025, the following provisions of the Employees’ State Insurance Act, 1948 shall be applicable in the notified areas:

|

Section Numbers |

Description |

|---|---|

|

Sections 38 to 43 |

Compulsory insurance for employees and contribution by employer & employee |

|

Sections 45A to 45H |

Determination and recovery of contributions |

|

Sections 46 to 75 |

Benefits payable to insured persons and their dependants (sickness, maternity, disablement, etc.) |

|

Section 76 (2)–(4) |

Constitution and jurisdiction of Employees’ Insurance Courts |

|

Sections 82 & 83 |

Powers to make rules and remove difficulties |

🏢 Applicability & Coverage

1️⃣ Establishment Coverage

- All factories and establishments (industrial or commercial) employing 10 or more persons using power, or 20 or more persons without power, as per ESI Act definitions.

- The Act applies irrespective of wages to determine coverage; however, employee contributions are applicable only for employees earning wages up to ₹21,000 per month (₹25,000 for employees with disabilities).

2️⃣ Employee Eligibility

- Every employee whose wages (excluding overtime) do not exceed the prescribed ceiling will be covered.

- Employers must ensure proper registration of all such eligible employees on the ESIC portal.

💼 Employer’s Action Points

Employers operating in the above-mentioned districts must take the following actions to ensure timely compliance from November 2025:

|

Step |

Action |

Deadline / Remarks |

|---|---|---|

|

1 |

Register establishment on the ESIC Portal (if not already registered) |

Before 1st November 2025 |

|

2 |

Obtain ESI Employer Code from the Regional Office |

One-time registration |

|

3 |

Register all eligible employees with valid Aadhaar and bank details |

Before first wage cycle in November 2025 |

|

4 |

Start deducting employee contribution @0.75% and pay employer contribution @3.25% of wages |

From wage month of November 2025 |

|

5 |

File Monthly Contribution (MC) Return |

By 15th December 2025 (for Nov-2025) |

|

6 |

Display ESI Notice (Form-1) at the establishment |

Mandatory display under the Act |

|

7 |

Maintain prescribed registers, attendance, and wage records |

For inspection and audit purposes |

🧾 Benefits to Insured Employees

Once registered under the ESI scheme, insured persons and their dependants become entitled to a wide range of medical and cash benefits, including:

|

Benefit Type |

Description |

|---|---|

|

Medical Benefit |

Full medical care to insured employees and their dependants from ESI dispensaries/hospitals |

|

Sickness Benefit |

Cash compensation at 70% of wages for certified sickness |

|

Maternity Benefit |

Paid leave for confinement, miscarriage, or sickness arising out of pregnancy |

|

Disablement Benefit |

Monthly pension for temporary or permanent disablement due to employment injury |

|

Dependants’ Benefit |

Monthly pension to dependants in case of death due to employment injury |

|

Funeral Expenses |

₹15,000 (or as revised) towards funeral cost of the deceased insured person |

🏛️ Administrative Jurisdiction

The implementation will fall under the administrative supervision of the ESIC Regional Office, Guwahati, and its Local Office network. Employers in Meghalaya may coordinate with their nearest ESIC Office for code allotment, branch office linkage, and dispensary mapping.

📢 Key Compliance Reminder

✅ The first ESI Contribution for the notified Meghalaya districts shall become due for the wage month of November 2025, and must be deposited by 15th December 2025 along with the Monthly Contribution filing on the ESIC portal.

Failure to comply may attract penalties under Section 85 of the ESI Act, including fines and prosecution.

🌐 Summary Table

|

Parameter |

Details |

|---|---|

|

Act |

Employees’ State Insurance Act, 1948 |

|

Notification Date |

17th October 2025 |

|

Effective Date |

1st November 2025 |

|

Applicable Areas |

Six districts – West/North/East/South/South-West Garo Hills and West Jaintia Hills |

|

Employer Contribution |

3.25% of wages |

|

Employee Contribution |

0.75% of wages |

|

First Return Due Date |

15th December 2025 |

|

Wage Ceiling for Coverage |

₹21,000 (₹25,000 for PwDs) |

🧭 PCS Compliance Insight

With this extension, the ESI Act coverage now expands deeper into the North-Eastern region, ensuring social security for a larger workforce.

Employers in the newly notified areas should immediately begin groundwork for registration, record preparation, and employee onboarding to avoid last-minute non-compliance.

PCS recommends initiating a pre-implementation compliance audit in October 2025 to verify readiness for ESIC deductions, portal setup, and wage register updates.

✍️ Disclaimer

This article is intended for informational purposes only. Employers are advised to refer to the official Gazette notification dated 17th October 2025 and consult with compliance professionals for case-specific applicability.