📜 Introduction

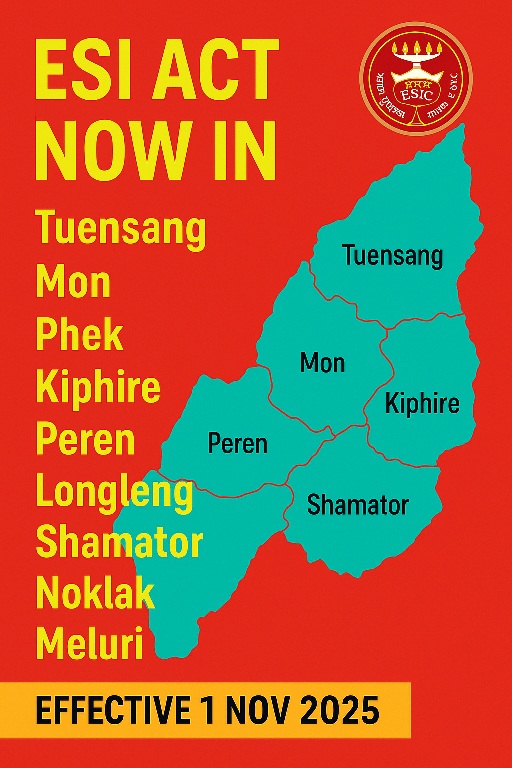

The Ministry of Labour and Employment has officially notified the extension of the Employees’ State Insurance (ESI) Act, 1948 to additional districts of Nagaland, marking another milestone in the nationwide expansion of social-security benefits for workers.

With effect from 1 November 2025, the Act will apply to the entire areas of the following nine districts:

Tuensang, Mon, Phek, Kiphire, Peren, Longleng, Shamator, Noklak and Meluri.

This notification ensures that eligible employees and employers operating in these districts become part of the ESIC social-security network, gaining access to medical, sickness, maternity, disablement, dependants’, and other benefits under the Act.

⚖️ Legal Basis

The Government has invoked the following provisions of the Employees’ State Insurance Act, 1948 (Act No. 34 of 1948):

- Sections 38 to 43 – Compulsory insurance and contribution obligations.

- Sections 45A to 45H – Assessment of contributions, inspection, and penalties for non-compliance.

- Sections 46 to 75 – Benefits (medical, sickness, maternity, disablement, dependants’, funeral, etc.).

- Section 76 (2) to (4) – Constitution and powers of ESI Courts.

- Sections 82 and 83 – Bar of jurisdiction and protection to officers for acts done in good faith.

These sections collectively operationalise the core functioning of the ESI scheme—mandatory registration, contributions, benefits, and dispute-resolution mechanisms.

🌍 Districts Covered Under the Notification

|

Sr No |

District Name |

Applicability Area |

Effective Date |

|---|---|---|---|

|

1 |

Tuensang |

Entire District |

1 Nov 2025 |

|

2 |

Mon |

Entire District |

1 Nov 2025 |

|

3 |

Phek |

Entire District |

1 Nov 2025 |

|

4 |

Kiphire |

Entire District |

1 Nov 2025 |

|

5 |

Peren |

Entire District |

1 Nov 2025 |

|

6 |

Longleng |

Entire District |

1 Nov 2025 |

|

7 |

Shamator |

Entire District |

1 Nov 2025 |

|

8 |

Noklak |

Entire District |

1 Nov 2025 |

|

9 |

Meluri |

Entire District |

1 Nov 2025 |

🧾 Key Provisions for Employers

From 1 November 2025, every establishment situated in these districts must –

- Register the Establishment

- Apply online via the ESIC portal and obtain an ESI Code Number.

- Register all eligible employees (earning up to the prescribed wage limit).

- Commence Monthly Contributions

- Deduct 0.75 % (employee share) and pay 3.25 % (employer share) of gross wages.

- File ECR (Electronic Challan-cum-Return) and make payment before the due date.

- Display Statutory Notices

- Exhibit ESIC information at the workplace in English and the local language.

- Maintain Registers and Records

- Keep employee attendance, wage, and contribution records available for inspection.

- Ensure Contract Labour Coverage

- Principal employers must verify that contractors register and deposit ESI contributions for their workers.

- Update Payroll and Compliance Calendars

- Incorporate ESI parameters from the wage period commencing on or after 1 November 2025.

💠 Benefits to Employees and Insured Persons

The extension of the ESI Act guarantees access to the following benefits:

|

Benefit Type |

Description |

|---|---|

|

Medical Benefit |

Full medical care for insured persons and dependants through ESIC dispensaries and hospitals. |

|

Sickness Benefit |

Cash compensation during certified illness (70 % of wages for up to 91 days). |

|

Maternity Benefit |

For female insured persons during confinement or miscarriage. |

|

Disablement Benefit |

Financial assistance for temporary or permanent disablement due to employment injury. |

|

Dependants’ Benefit |

Monthly pension to dependants of a deceased insured person. |

|

Funeral Benefit |

Lump-sum funeral expenses to the family of a deceased insured person. |

🧮 Compliance Timeline

|

Activity |

Due Date |

|---|---|

|

Registration of Establishment |

Before 1 Nov 2025 |

|

Employee Registration |

Before first ESI-liable wage payment |

|

ECR Filing and Payment |

By 15th of the following month |

|

Display of Notices |

Within 30 days of applicability |

|

Half-yearly Return (if applicable) |

Within 42 days after contribution period |

🏢 Who Is Covered?

- All factories and establishments employing 10 or more persons in the notified districts.

- Certain categories may also be covered as shops, restaurants, hotels, cinemas, road-transport, educational or medical institutions, as per previous ESIC notifications in the State.

- Wage ceiling for coverage remains ₹21,000 per month (₹25,000 for employees with disabilities).

❓ Frequently Asked Questions

Q1. From which date will ESI deduction start in Nagaland districts?

👉 From the first wage period commencing on or after 1 November 2025.

Q2. Does this apply to contract employees too?

✅ Yes. Principal employers must ensure coverage for contract and outsourced workers.

Q3. What if the establishment fails to register in time?

⚠️ Non-registration or non-payment may lead to interest, damages, and penal prosecution under Sections 85 and 85A of the ESI Act.

Q4. Can existing employees be registered after 1 Nov 2025?

Yes—but contributions and benefits will be counted prospectively. Timely registration is advised to avoid liability.

📈 Impact on Nagaland’s Workforce

This expansion of the ESI network is a progressive step towards universal social-security coverage for workers in India’s North-East region.

Employers gain structured medical support for their staff, while employees and families receive comprehensive health protection at nominal contribution rates.

🏁 Conclusion

The notification effective from 1 November 2025 brings nine districts of Nagaland under the ESI umbrella, ensuring that more workers enjoy medical and social security benefits.

Employers should immediately initiate registration and update their HR systems to align with the new requirements.

🪪 Reference

- Notification: Employees’ State Insurance (ESI) Act, 1948 – Implementation in Nine Districts of Nagaland

- Issuing Authority: Ministry of Labour & Employment, Government of India

- Effective Date: 1 November 2025