The Government of Maharashtra has revised the minimum wages effective from 1 Jan 2026 to 30 June 2026 through the bi-annual update of the Special Allowance (VDA) component. All establishments covered under scheduled employments must implement the revised wages from the Jan 2026 payroll.

This revision is crucial as it coincides with the expected rollout of the Labour Codes in 2026, requiring organizations to align wage structures with the new definition of wages and statutory compliance norms.

Key Compliance Points

- Minimum wages = Basic + Special Allowance (VDA)

- Revision applicable from 01.01.2026

- Mandatory for all scheduled employments in Maharashtra

- Employers must ensure no employee is paid below revised minimum wages

- Contractors and manpower vendors must also implement revised wages

Impact on Employers

The Jan 2026 minimum wage revision will affect:

- Payroll cost

- PF contributions

- ESIC applicability

- Bonus calculations

- Gratuity liability

Under the upcoming Code on Wages, 2019, basic wages must be at least 50% of total remuneration, making this revision an important opportunity to restructure salary components.

Immediate Action for HR & Payroll

- Review current wage structures

- Compare with revised rates

- Implement changes from July 2026 salary

- Inform contractors and vendors

- Update compliance records

Non-implementation may lead to inspections, recovery of short wages and penalties.

PCS Advisory

Employers should treat this revision as a strategic compliance exercise, not just a routine increase. Aligning salary structures now will help organizations avoid future disputes under the new labour codes.

For wage restructuring, compliance audit and payroll alignment support, organizations may conduct a professional review before July payroll processing.

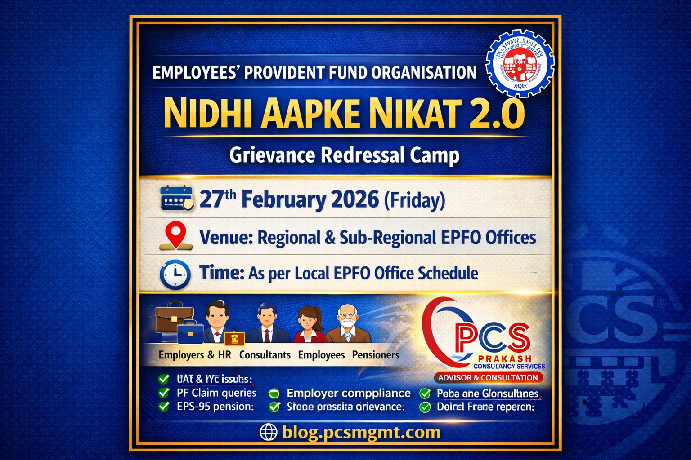

Notifications:-