ESIC Percentage for New Implemented areas reduce to 1 % Employee & 3 % Employer it is applicable only to the new areas which are implemented for the first time & district wise (i.e. from 1st May 2016 ) New areas implementation started district wise

Pls refer to My blog as publish on 6th of Sep 2016

https://blog.pcsmgmt.com/2016/09/new-district-covered-esic.html

1. Andhrapradesh:- 9 New District covered W.E.F from 1st Sep-2016

2. Bihar :- 16 New District covered W.E.F from 1st Sep-2016

3. Haryana :- 1 New District covered W.E.F from 1st July-2016

4. Jammu & kashmir :- 8 New District covered W.E.F from 1st Aug-2016

5. Karnataka :- 4 New District covered W.E.F from 1st Sep-2016

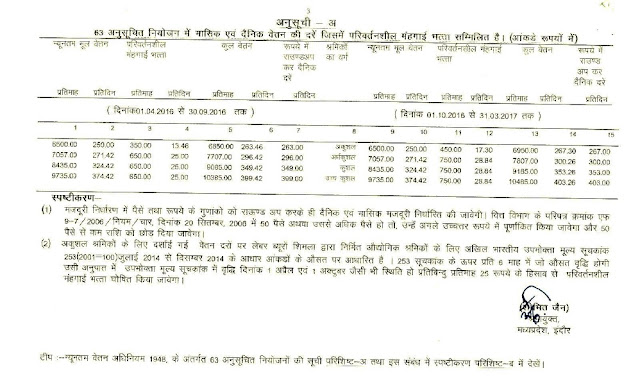

6. MadhyaPradesh :- 22 New District covered W.E.F from 1st Sep-2016

The respective reduction of percentage will be for only two years after two years Rule No 51 has to be implemented.

Notification :-

ESIC New Areas 1 Percent & 3 & W.E.F from 6th Oct 2016