Under the scheme of deduction of tax at source as provided in the Act, every person responsible for payment of any specified sum to any person is required to deduct tax at source at the prescribed rate and deposit it with the Central Government within specified time. However, no deduction is required to be made if the payments do not exceed prescribed threshold limit.

In order to rationalise the rates and base for TDS provisions, the existing threshold limit for deduction of tax at source and the rates of deduction of tax at source are proposed to be revised as mentioned in table 3 and table 4 respectively.

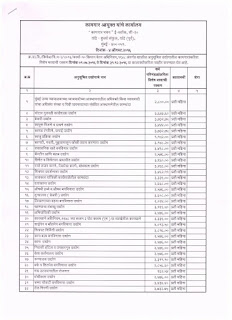

Table 3: Increase in threshold limit of deduction of tax at source on various payments mentioned in the relevant sections of the Act –

Section 192A is referred by the EPF dept while calculating the tax at the time of EPF withdrawal in regards to such employee who have not having Pan card & not submitted form No 15-G also there are some state where in minimum wages are low & the contribution is deducted & the amount of is less then 50000 where in service is less then 2 years or three years it is good news for EPF subscriber

| Present Section |

Heads |

Existing Threshold

Limit (Rs.) |

Proposed Threshold Limit

(Rs.) |

| 192A |

Payment of accumulated balance due to an employee |

30,000 |

50,000 |

| 194BB |

Winnings from Horse Race |

5,000 |

10,000 |

| 194C |

Payments to Contractors |

Aggregate annual limit of 75,000 |

Aggregate annual limit of 1,00,000 |

| 194LA |

Payment of Compensation on acquisition of certain Immovable Property |

2,00,000 |

2,50,000 |

| 194D |

Insurance commission |

20,000 |

15,000 |

| 194G |

Commission on sale of lottery tickets |

1,000 |

15,000 |

| 194H |

Commission or brokerage |

5,000 |

15,000 |

Table-4 : Revision in rates of deduction of tax at source on various payments mentioned in the relevant sections of the Act:

| Present Section |

Heads |

Existing Rate

of TDS (%) |

Proposed Rate of

TDS (%) |

| 194DA |

Payment in respect of Life Insurance Policy |

2% |

1% |

| 194EE |

Payments in respect of NSS Deposits |

20% |

10% |

| 194D |

Insurance commission |

Rate in force (10%) |

5% |

| 194G |

Commission on sale of lottery tickets |

10% |

5% |

| 194H |

Commission or brokerage |

10% |

5% |

The following provisions which are not in operation are proposed to be omitted as detailed in Table 5.

Table 5: Certain non-operational provisions to be omitted

| Present Section |

Heads |

Proposal |

| 194K |

Income in respect of Units |

To be omitted w.e.f 01 .06.2016 |

| 194L |

Payment of Compensation on acquisition of Capital Asset |

To be omitted w.e.f 01 .06.2016 |

These amendments will take effect from 1st June, 2016.

@courtesy http://taxguru.in/income-tax/

–

Post Views: 1,697