ESIC have increase the coverage in various states in various districts in different dates

details of the same is as under

Andhrapradesh:- 9 New District covered W.E.F from 1st Sep-2016

Notification:- New Distric Covered under ESIC -Andhrapradesh 1st Sept 2016

Bihar :- 16 New District covered W.E.F from 1st Sep-2016

Notification:-New District Covered under ESIC -Bihar 1st Sept 2016

Haryana :- 1 New District covered W.E.F from 1st July-2016

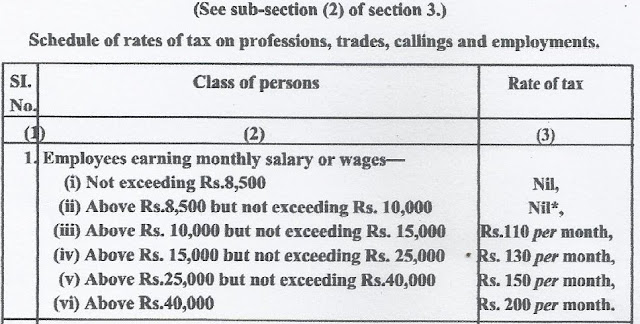

The New slab is as Under & respective Notification is enclosed below

Circular of P Tax WB-Aug-2016-2

Gazetted Copy

The amendments to Maternity Benefits Act has been drafted by Mrs Gandhi’s Ministry for Women and Child Development, but her colleague labour minister Bandaru Dattatreya introduced the bill in the upper house.

“All through the two years while we’ve been pushing for this, pregnant women have mailed me asking, `Is it through yet?” the minister said. They had asked for seven months’ maternity leave, but the government settled on making it compulsory for all offices in the public and private sector to give six months.

This, the minister hopes, will go a long way in fixing the problem of a shrinking woman workforce. Mrs Gandhi said it would affect about 70 per cent of the woman workforce.

“You may ask if it will dissuade companies from hiring more women but I don’t think so. I think women know how to multitask,” she said.

The bill was to have been introduced in the Lok Sabha on Tuesday, but then there was what government sources described as a “scheduling goof-up”.

With only three days of the session left, they then decided to bring it first in the Rajya Sabha, since a bill introduced in that house does not lapse with the end of a session.

It was slotted for Wednesday in the Rajya Sabha, which then decided to put aside all work to debate the crisis in Kashmir. Many see the delay as symptomatic of how women’s issues are prioritised.

31 of the 244 members in the Rajya Sabha are women. The 543 seat Lok Sabha has 61 women.

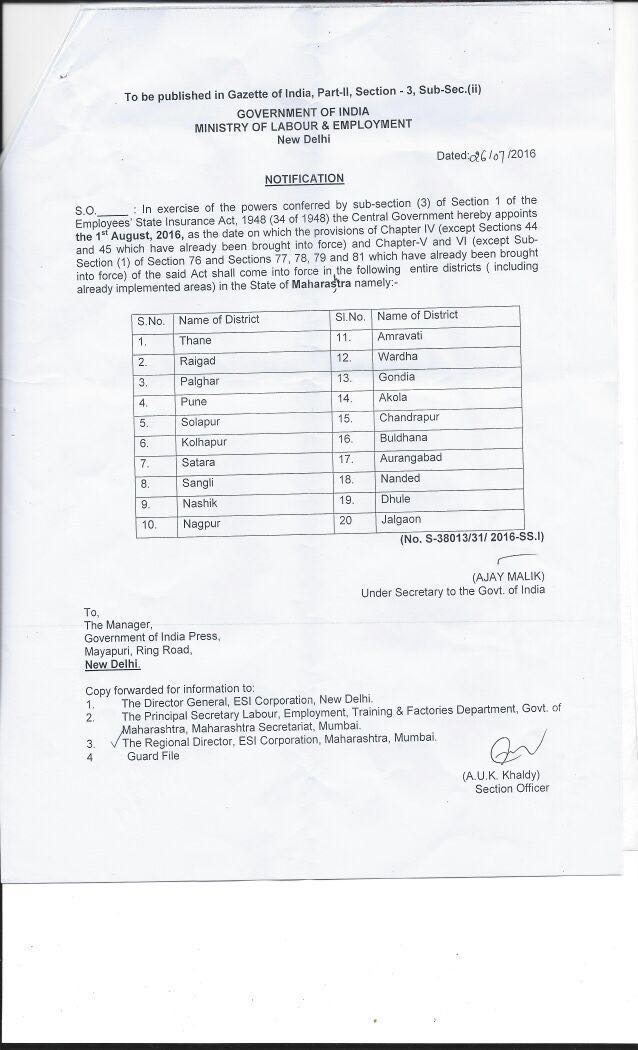

Pls refer to the said Notification 28 district of Rajasthan are covered under ESIC from 1st Aug 2016

- Every employer shall immediately at the time of employment of an employee, inform the employee of his rights to compensation under this Act, in writing as well as through electronic means, in English or in Hindi or in the official language of the area of employment’

- Penalty of non-compliance of any provision of the Act is revised to Rs.50000/- minimum to Rs.100000/- maximum;

- Appeal in the High Court has revised more than Rs.10000/- compensation from present Rs.300/-

- On the direction of High Court commissioner can withheld payment of any sum in deposit with him – This provision is omitted;

Good News for Exempted Establishment

An Internal Circular dated 5.8.2016 issued by the EPFO to its Field Functionaries states that:

- Section 17 of the EPF & MP Act stipulates that the Appropriate Government may, by Notification in Official Gazette and subject to such conditions as may be specified in the Notification exempt whether prospectively or retrospectively from the operation of all or any provisions of the any Scheme under the Act.

- The conditions for grant of exemption under Section 17 of the Act have been notified under Notification No. GSR 853(E) dated 29.10.2003 and the revised Guidelines have come into force w.e.f. 10.10.2003.

- The contribution to the Exempted PF Trust would get exemption from Income Tax provided the Trust is recognised/approved by the Income Tax Authorities.

- The Regional Provident Fund Commissioners have been insisting on the Employers to submit the recognition/approval of the Trust by the Income Tax Authorities along with the Application for Exemption.

- The Employees’ Provident Fund Organisation have re-examined the issues and clarified that the Field Functionaries of the Department will not ask the Establishment seeking grant of exemption from the operation of the EPF Scheme, 1952 to furnish copy of Income Tax Recognition Order as an ‘Essential Document’ to be submitted with the proposal for grant of Exemption. However, immediately after grant of exemption by the Appropriate Government, the Establishment should get recognition from the Income Tax Authorities for its Trust.

- Para 8 of the said circular of 2007 is omitted