Dear all,

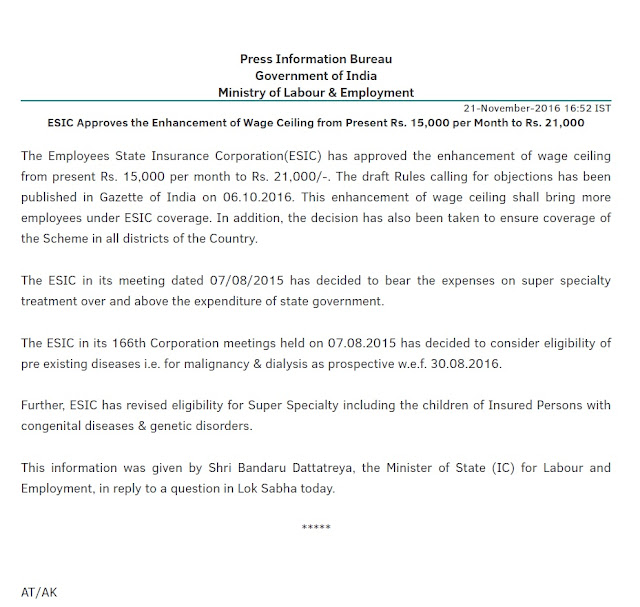

Pls refer to my blog dated September 7 2016 ( https://blog.pcsmgmt.com/2016/09/esic-raises-wage-threshold-to-rs-21000.html where in labour ministry had declared that ESIC Limit will Increases from Rs 15000 to Rs 21000 on 6th Oct 2016 Draft rules were released & 30 days time limit was given for calling for objections & suggestion Yesterday in the Press Information Bureau Ministry of Labour & Employment Shri Bandaru Dattatreya declared that The Employees State Insurance Corporation(ESIC) has approved the enhancement of wage ceiling from present Rs. 15,000 per month to Rs. 21,000/-.

The gazetted copy of the same will be published very soon

Dear all,

Amendment in the respective Employees’ Provident Funds (Sixth Amendment) Scheme, 2016 i.e in para 72

In the Employees’ Provident Funds Scheme, 1952, in paragraph 72, in sub-paragraph (6),-

(a) for the words “ceased to be employed”, the words “retired from service after attaining age of fifty-five years or migrated abroad permanently” shall be substituted;

(b) the words “or transfer, as the case may be” shall be omitted;

(c) after the proviso, the following new proviso shall be inserted, namely:-

Further a good Move by the labour Ministry where in one more provision has been inserted

“Provided further that if any amount becoming due to a member, as a result of supplementary contributions on account of litigation or default by the establishment or a claim which has been settled but is received back undelivered not attributable to the member, shall not be transferred to the inoperative account.”.

Gazette Notification :- Employees’ Provident Funds (Sixth Amendment) Scheme, 2016 para 72 changes

Dear all,

In the indian Market many employees come from Bhutan & Nepal for Job & specially this employees are working in Security Guard etc & when and they were treated as International worker & the respective employee cant withdraw the respective dues when he leave the job & he has to wait till age 58 as per International Worker rules as framed under EPF act

Considering the above fact & condition labour ministry & EPF Board of Trustees have made an amendment in Employees’ Provident Funds (Fifth Amendment) Scheme, 2016

In the Employees’ Provident Funds Scheme, 1952, in paragraph 83, in sub-paragraph (2), in clause (ja), after sub-clause (b), the following proviso shall be inserted, namely :-

“Provided that the worker who is a Nepalese national on account of Treaty of Peace and Friendship of 1950 and the worker who is a Bhutanese national on account of India-Bhutan Friendship Treaty of 2007, shall be deemed to be an Indian worker.”

In the Employees’ Pension Scheme, 1995, in paragraph 43A, in sub-paragraph (1), in clause (viia), after subclause (b), the following proviso shall be inserted, namely :-

“Provided that the worker who is a Nepalese national on account of Treaty of Peace and Friendship of 1950 and the worker who is a Bhutanese national on account of India-Bhutan Friendship Treaty of 2007, shall be deemed to be an Indian worker.”

Gazetted Copy :- Employees’ Provident Funds (Fifth Amendment) Scheme, 2016

In the indian Market many employees come from Bhutan & Nepal for Job & specially this employees are working in Security Guard etc & when and they were treated as International worker & the respective employee cant withdraw the respective dues when he leave the job & he has to wait till age 58 as per International Worker rules as framed under EPF act

Considering the above fact & condition labour ministry & EPF Board of Trustees have made an amendment in Employees’ Provident Funds (Fifth Amendment) Scheme, 2016

In the Employees’ Provident Funds Scheme, 1952, in paragraph 83, in sub-paragraph (2), in clause (ja), after sub-clause (b), the following proviso shall be inserted, namely :-

“Provided that the worker who is a Nepalese national on account of Treaty of Peace and Friendship of 1950 and the worker who is a Bhutanese national on account of India-Bhutan Friendship Treaty of 2007, shall be deemed to be an Indian worker.”

In the Employees’ Pension Scheme, 1995, in paragraph 43A, in sub-paragraph (1), in clause (viia), after subclause (b), the following proviso shall be inserted, namely :-

“Provided that the worker who is a Nepalese national on account of Treaty of Peace and Friendship of 1950 and the worker who is a Bhutanese national on account of India-Bhutan Friendship Treaty of 2007, shall be deemed to be an Indian worker.”

Gazetted Copy :- Employees’ Provident Funds (Fifth Amendment) Scheme, 2016

Dear EPS Pension Member no Pension will be credited without digital life certificate

From 1st November 2016, EPFO has launched the facility of online submission of life certificate. It is mandatory to submit the digital Life Certificate through jeevan Pramaan System life certificate.

The pensioners should carry the Aadhaar Card, Mobile phone, details of PPO and Bank account number for hassle free submission of Digital Life Certificate.

The digital Life Certificate can be submitted at

1.Bank branches from where pensioners are drawing their pensions

2.Common Service Centres(CSC) of IT department, the list of CSC are available at csc.gov.in

3.Jeevan Pramaan Centre, the Jeevan Pramaan centre can be located at jeevanpramaan.gov.in

This process is Aadhaar based; therefore pensioners are advised to update their Aadhaar details to reflect the accurate Name, Father Name and Date of Birth. The instructions and FAQs regarding the updation of Aadhar data are available on the website www.uidai.gov.in

In case, the Aadhar details are accurate but they do not match with the details in EPFO database, the Pensioners should forward an application to R.O. Of EPF from where the pension is disburse for change/modification of the concerned data along with the supporting documents like School Leaving Certificate, PAN card, Aadhar Card, Passport, Driving License, etc.

Please note that the payment of the monthly pension will be stopped after 31.12.2016, of those pensioners whose digital life certificates are not received

Highlights

Dear all

I have been receiving many calls in regards to pension disbursement in regards to Employee Pension Scheme , enclosed is the Pension Distribution agency State Wise as on 31st Mar 2015

Thought of sharing the same

I have been receiving many calls in regards to pension disbursement in regards to Employee Pension Scheme , enclosed is the Pension Distribution agency State Wise as on 31st Mar 2015

Thought of sharing the same

Dear all,

During Pragati Review Meeting which was held on 26th Oct 2016 Hon’ble Prime Minister had showed his concern regarding delay in settlement of EPF/EDLI /EPS claims especially in Death cases

Hon’ble Prime Minister has instructed and ensured that all Death cases claims should be settle within a period of 7 days from date of submission of claim form

All Death cases must be stamped as “DEATH CASE -TOP PRIORITY”

During Pragati Review Meeting which was held on 26th Oct 2016 Hon’ble Prime Minister had showed his concern regarding delay in settlement of EPF/EDLI /EPS claims especially in Death cases

Hon’ble Prime Minister has instructed and ensured that all Death cases claims should be settle within a period of 7 days from date of submission of claim form

All Death cases must be stamped as “DEATH CASE -TOP PRIORITY”

Notification:- Death Case Settlement within 7 days

Assam New District is covered under ESIC W.E.F from 1st Oct 2016 necessary

Haryana Minimum wages increase from 1st July 2016 which was declared on 21st Oct 2016