Goa Minimum wages have been revised from 1st Oct 2016 as the Consumer Price Index has been increase to Rs 1.90/- Per day pls find below the respective details

Old Minimum wages as on 25th May 2016 :- GG_Minwages-2016

New Minimum wages 1st Oct 2016:- Goa Mini. Wages Notification 1st Oct 2016

Old Minimum wages as on 25th May 2016 :- GG_Minwages-2016

New Minimum wages 1st Oct 2016:- Goa Mini. Wages Notification 1st Oct 2016

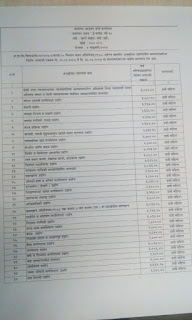

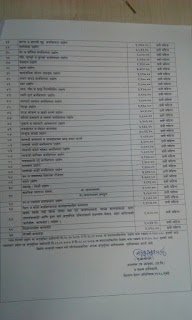

Government of West Bengal as per notification No.149/703/stat/2RW/29/2016/LCS/JLC, has released the minimum rates of wages effective 1st Jan 2017

As Per ESIC 2.0 Program Phase in regards covering Non implemented areas to Implement areas , in the State of Madhya Pradesh , Municipal Limits of Districts Headquarters of 29 District, is covered under Esic from 1st Feb 2017

Implementation of ESI Act 1948 within the Municipal Limits of Districts Headquarters of 29 District, in the State of Madhya Pradesh

Implementation of ESI Act 1948 within the Municipal Limits of Districts Headquarters of 29 District, in the State of Madhya Pradesh

As Per ESIC 2.0 Program Phase in regards covering Non implemented areas to Implement areas , in the State of Kerala, Municipal Limits of Districts Headquarters of 14 District, is covered under Esic from 1st Feb 2017

Necessary Notification is appended below

Implementation of ESI Act 1948 within the Municipal Limits of Districts Headquarters of 14 District, in the State of Kerala

Necessary Notification is appended below

Implementation of ESI Act 1948 within the Municipal Limits of Districts Headquarters of 14 District, in the State of Kerala

Dear all,

Enclosed is the Maharashtra Minimum Wages Maharashtra Minimum Wages 1st Jan 2017 to 30th June 2017, In the said Minimum wages revision Pls add 5% HRA( As per Maharashtra Minimum HRA Act 1983) if no of employee count is more than 50.

Enclosed is the Maharashtra Minimum Wages Maharashtra Minimum Wages 1st Jan 2017 to 30th June 2017, In the said Minimum wages revision Pls add 5% HRA( As per Maharashtra Minimum HRA Act 1983) if no of employee count is more than 50.

Pls refer to the said attach if anything have been missed out or any correction is to be done pls suggest me.

English Version :- Maharashtra MW 01-01-2017 to 30-06-2017

English Version :- Maharashtra MW 01-01-2017 to 30-06-2017

As Per ESIC 2.0 Program Phase in regards covering Non implemented areas to Implement areas entire Hooghly district is covered under Esic from 1st Jan 2017

Necessary Notification is appended below

ESIC Implementation of Entire Hooghly District

Necessary Notification is appended below

ESIC Implementation of Entire Hooghly District

G.S.R. 62(E).—Whereas draft rules further to amend the Employees’ State Insurance (Central) Rules, 1950 were published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (i) vide number G.S.R. 958(E), dated the 6th October, 2016, as required under sub-section (1) of section 95 of the Employees’ State Insurance Act,

1948(34 of 1948), inviting objections and suggestions from all persons likely to be affected thereby before the expiry of a period of thirty days from the date on which the copies of the Gazette containing the said notification was published were made available to the public;

And whereas, copies of the said Gazette were made available to the public on the 6th October, 2016;

And whereas, no objections and suggestions were received from persons in respect of the said rules; Now, therefore, in exercise of the powers conferred by section 95 of the Employees’ State Insurance Act,1948(34 of 1948), the Central Government after consultation with the Employees’ State Insurance Corporation, hereby makes the following rules further to amend the Employees’ State Insurance (Central) Rules, 1950, namely:–

(b) in rule 56, in sub-rule (2),–

(i) for the words “ twelve weeks of which not more than six weeks”, the words “twenty-six weeks of which not more than eight weeks” shall be substituted;

(ii) after the first proviso, the following provisos shall be inserted, namely:–

“

Provided further that the insured woman shall be entitled to twelve weeks of maternity benefit from the date the child is handed over to the commissioning mother after birth or adopting mother, as the case maybe:

Provided also that the insured woman having two or more than two surviving children shall be entitled to receive maternity benefits during a period of twelve weeks of which not more than six weeks shall precede the expected date of confinement.

Assessment of EPF dues solely on the basis of balance sheet without identification of beneficiaries is not sustainable

An appeal was filed by the appellant before the Employees’ Provident Fund Appellate Tribunal, challenging the order dated 23.09.2011, passed by the EPF Authority, under section 7-A of the Act.

Brief Facts:

Dues were assessed on the basis of balance sheet without identification of beneficiaries on EO’s report. Appellant’s contention is that employees were engaged through different registered contractors from time to time. EPF Authority submitted that the appellant neither produced list of contractors nor list of employees and in such circumstances there was no option with the department, except to pass the impugned order.

Reasons & Decision:

The entire case of assessment of EPF dues is for the period April 2005 to March 2011. Neither EO nor the EPF Authority is known to the beneficiaries till date. Dues, if collected, would not give any benefit to any of the employees. Hence, impugned order is sets aside. Matter is remanded back to the EPF Authority for passing a speaking order by getting joined the alleged contractors, having identified the beneficiaries and only on the basis of balance sheet, in accordance with law. Appellant is supposed to furnish complete list of contractors and employees within 2 months from the date of this order to the EPF Authority. Any amount deposited shall not be disbursed till further order.

Food Corporation of India vs. APFC, Jabalpur

ATA No. 09 (8) 2012 decided on 7.11.2016