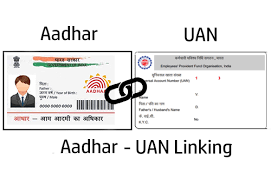

As per the provision of Social security code section 142 of the code on social security code which mandates aadhar number seeding to the UAN which was implemented from 1st June 2021 and due to this provision as implemented in the EPFO portal many employees & employer had to face many challenges for seeding the same against the respective uan.

However, considering the challenges faced by the employers & employees in expeditious seeding of Aadhaar in UANs particularly in view of corrections required in Aadhaar data of employees in aftermath of the second wave of Pandemic, the EPFO with prior approval of the Central Government extended the time for mandatory seeding of Aadhaar in UAN for filing ECR up to 01.09.2021 which was communicated vide reference. EPFO Head Office Circular No.WSU/15(1 )2019/ATR/529 dated 15.06.2021

The representations for extension of time beyond 01.09.2021 have been considered and it is noted that overall about 94% of contributory EPF members’ UAN have Aadhaar seeding but there is less percentage of Aadhaar seeding in UANs of contributory members in EPFO’s administrative Zone of North Eastern Region and in a certain class of establishments I industries such as Beedi making, Building & Construction, and Plantation. Since Aadhaar seeding is mandatory for any withdrawals, receipt of contributions in Aadhaar seeded UANs helps members to file online claims to avail withdrawals & file e-nominations without employer’s intervention & avoids delay in withdrawals due to non-seeding of Aadhaar in UAN.

E-Nomination Video Link:-

In regards to many obstacles as a face by the Employee & employer the revised date of extension has been revised to 31st Dec 2021, to some of the North East Zone wherein the special category of industries are mentioned like Beedi making, Building & Construction, and Plantation

Now, therefore, considering the foregoing, it is hereby decided as under

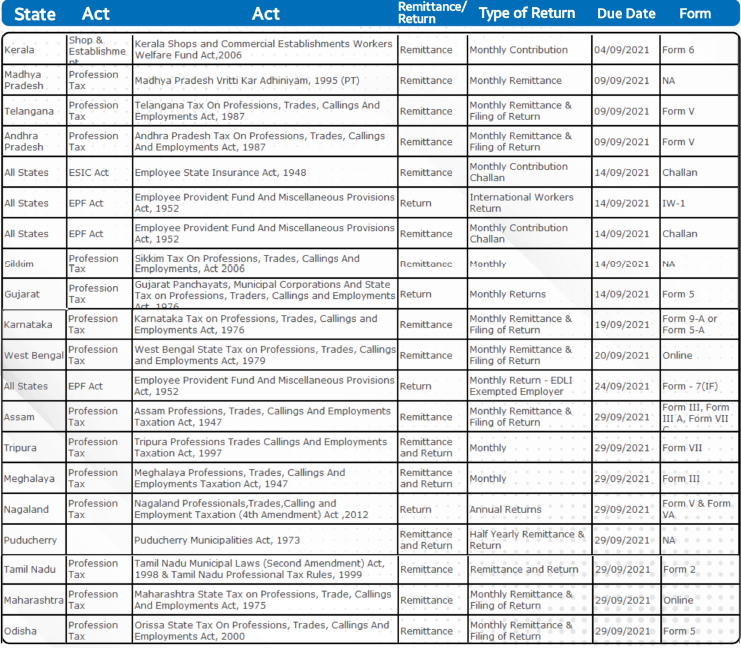

- Considering the low Aadhaar penetration in the EPFO’s administrative Zone of North East Region comprising of States of Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland & Tripura, time for mandatory seeding of Aadhaar in UAN for filing ECR is extended till 31.12.2021

2. Considering the concentration of establishments in remote localities & in areas affected by insurgency, frequent change in worksites of the workers and other attendant constraints in the Classes of establishments- Beedi making, Building and Construction and Plantation industries (Tea, Coffee, Cardamom, Pepper, Jute, Rubber, Cinchona. Cashewnuts etc.) time for mandatory seeding of Aadhaar in UAN for filing ECR is extended till 31.12.2021.

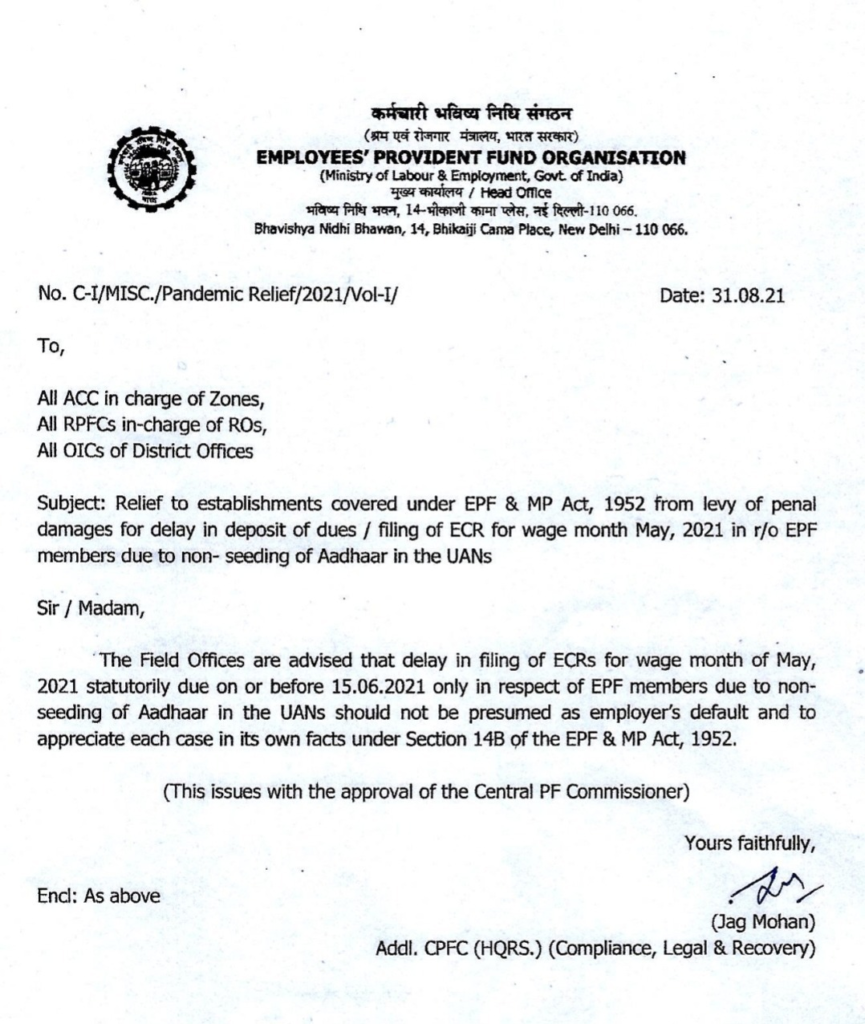

3. For areas and industries I class of establishments other than above, delay in filing of ECRs for wage months of August 2021 & September 2021 only in respect of EPF members due to non-seeding of Aadhaar in the UANs should not be presumed as employer’s default for levy of penal damages u/s 148 of the EPF & MP Act, 1952.

The 3rd category relates to other than sr No 1 & 2 wherein if any aadhar Pending task is to be complete before 15th October 2021 and we have hardly 35 days to complete the same. For October 2021 ECR we might not be able to file ECR where in UAN are not verified

Pls refer to the link of the video on how to modify the basic details & link the UAN with the Aadhar

Link Aadhar with UAN:-

Circular:-