In continuation to my earlier post on the Tripura Minimum wages https://blog.pcsmgmt.com/2021/07/tripura-minimum-wages-notification-april-2021.html below are the other class of industries Minimum wages the effective date is 1st Apr 2021

In continuation to my earlier post on the Tripura Minimum wages https://blog.pcsmgmt.com/2021/07/tripura-minimum-wages-notification-april-2021.html below are the other class of industries Minimum wages the effective date is 1st Apr 2021

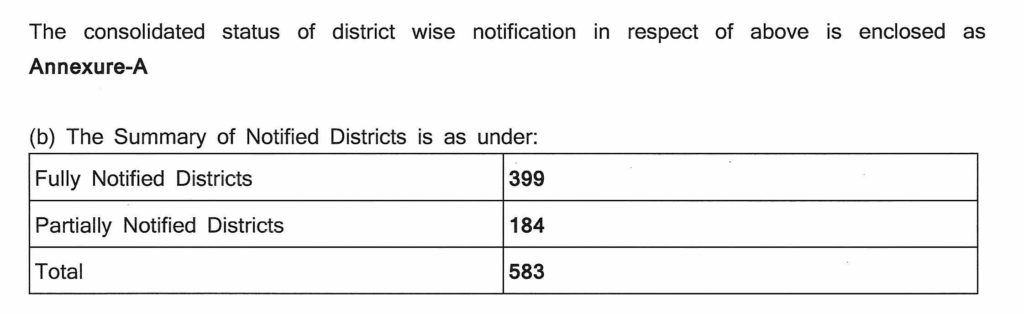

In exercise of the powers conferred under Section 87 & 88 read with Section 91-A of the Employees’ State Insurance Act,1948 (Act No.34 of 1948) the Governor of Andhra Pradesh hereby exempts Factories / Establishments in Andhra Pradesh State engaged in the seasonal processing and re-drying of un-manufactured leaf tobacco or processes incidental and connected there with from the operation of the said Act till 03.07.2022, with effect from the date of issue of notification subject to usual terms and conditions.

Government of Kerala Vide G.O.(MS) No.103/2013/LBR. dated 31-8-2013 of Labour and Skills (E) Department, and the G.O.(Ms) No. 34/2015/LBR. dated 26-03-2015 published in the Kerala Gazette extraordinary No.19 (Vol. IV ) dated 12-05-2015 in regards to Shop & Commercial Establishment & employment in Computer Software Sector

List of impaneled hospitals for providing cashless treatment for Pensioners and serving Employees of ESIC as of 17th June 2021

Pls find below is the List of Secondary Tie-up hospital in Indore Madhya Pradesh

The Labour comissioner of Andaman and Nicobar Island vide notification F.NO 16/1/MW/2019-20/LC&DET/1060, has declared the minimum rate of wages in the union territory of Andaman and Nicobar with effect from 1st July 2021

Atal Beemit Vyakti Kalyan Yojana finally notified by Govt. with the following highlights;

1. Valid from 1.7.2020 to 30.6.2022 ( Now Extended )

2. 2 years of employment is required in insurable employment just before his/her unemployment

3. Min. 78 days contribution is a must in each 4 preceding contribution periods just before unemployment.

4. The claim shall be due after 30 days from the date of unemployment.

5. The claim shall be settled by the ESIC within 15 days from the date of lodging the claim and money shall be transferred to the insured person’s bank account directly. Insured Person to lodge the claim directly to the ESIC Branch Office.

6. Salary shall be paid to the unemployed Insured Person @50% of average per day earned during the previous 4 contribution periods maximum for 90 days that is 3 months.

Gazette Copy:- ESIC Unemployment allowance-Gazette

Steps for Eligibility conditions & claim process

1. Login the IP portal on http://www.esic.in/EmployeePortal/login.aspx by entering his insurance number and captcha at the designatedplace.

2. On logging in the IP portal, the IP shall click the link provided for the creation of a claim for the Atal Beemit Vyakti Kalyan Yojana.

3. The system will check IP‘s eligibility and if IP is eligible for the relief underthe scheme it will take him to the next page where the IP will fill up the period for which he/ she seeks relief under the ABVKY and submit it to create a claim

4. The systemwill then promptthe eligible IP to print a copy of the claim thus created (form AB–1).

5. The claim thus generatedwill have the information which is available in the system, auto-filled in it.

6. The claim duly signed in the form of an affidaviton non• judicial stamp paper of minimum Rs 20/- value will be submitted by the IP to his designated branch office either in person or by speed post along with a self–attested photocopyof Aadhar card and that of the bank passbook or a canceled cheque.

7. The Bank details are to be matched with the canceled cheque in the IP Portal

Pls find below is the List of Secondary Tie-up hospital in 22 Districts of Maharashtra

Click one of our contacts below to chat on WhatsApp