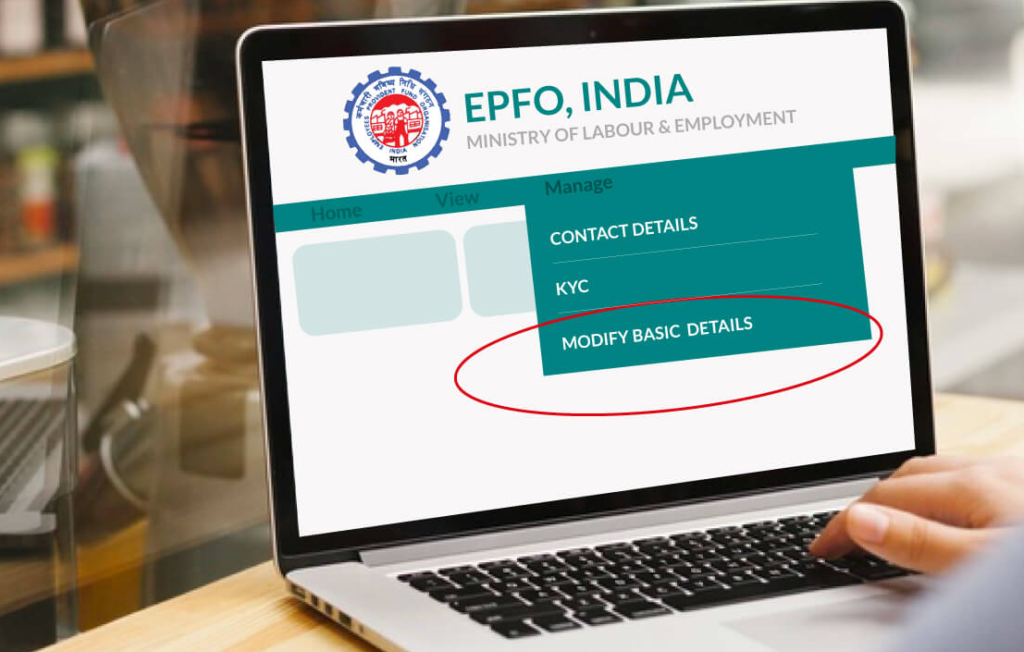

The contribution you make towards your Employees’ Provident Fund (EPF) from your monthly pay is a sort of forced savings that can help in amassing a portion of your retirement corpus. At times, the name and date of birth in the provident fund (PF) statement is not correct and does not match with what is there in your Aadhaar details The ultimate objective behind this is to ensure that funds are made available in a timely manner Hence it is important to ensure that every EPF / EPS member has provided correct information of his/her details to enable settlement of funds in a seamless manner. –Employees’ Provident Fund Organization (EPFO) allows subscribers to Modify the details of their Provident Fund (PF) accounts online via its official portal- unifiedportal-mem.epfindia.gov.in. This can then result in unnecessary delays and hassles when you try to withdraw the money at the time of retirement

Requirements to Change Name or date of birth

- You should have the UAN

2. The UAN should be activated

3. You can access the unified member portal

4. You must have the Aadhaar.

Valid documents eligible for change/update date of birth in EPF UAN

- Birth Certificate issued by Registrar of Births and Deaths.

2. Any School/Education related certificate.

3. Certificate-based on the service records of the Central/State Government Organizations.

4. Any other reliable documents issued by government departments.

5. In the absence of proof of birth as above, a Medical Certificate was issued by Civil Surgeon after examining the member medically and supported with an affidavit on oath by the member duly authenticated by a Competent Court.

6.Aadhaar/e-Aadhaar-The change of date of birth shall be accepted as per Aadhaar/e-Aadhaar up to the maximum range of plus or minus of THREE YEARS of the date of birth recorded earlier with EPFO. (Earlier it was just one year. However, superseding all earlier notifications, EPFO released a new notification on 3rd April 2020 and extended the period to 3 years).