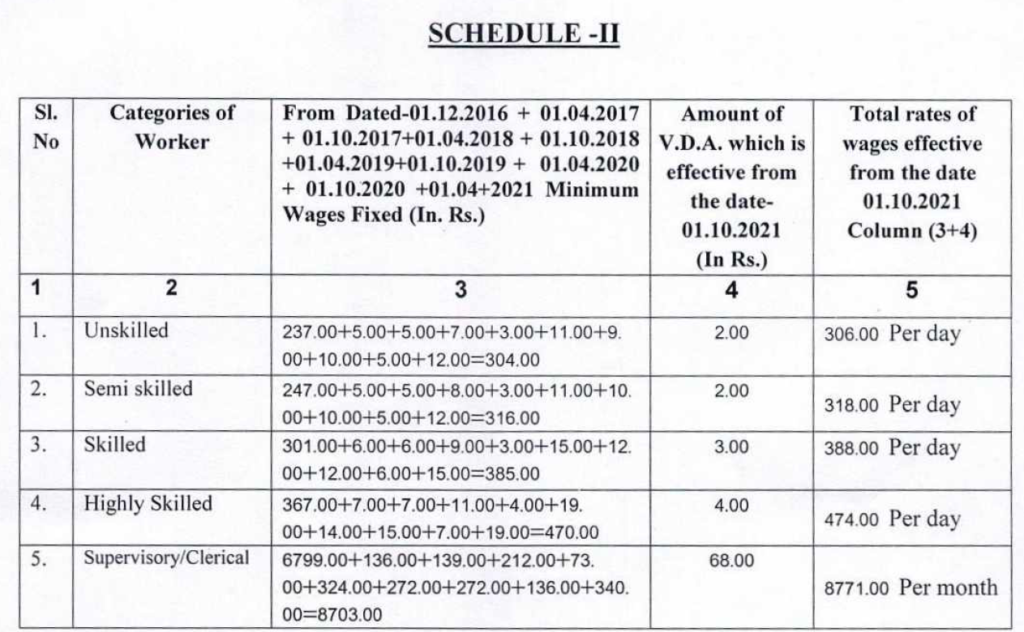

As per notification No-5/ M.W.- 40-16/202 1 L&R- 2847, the Government of Bihar has released Minimum Wages for the state of Bihar effective from 1st October 2021

As per notification No-5/ M.W.- 40-16/202 1 L&R- 2847, the Government of Bihar has released Minimum Wages for the state of Bihar effective from 1st October 2021

Madhya Pradesh, latest minimum wages applicable with effect from 1st October 2021 to 31st March 2022

| Nature of Employment | Basic Per Day | Basic Per Month | VDA Per Day | VDA Per Month | Total Per Day | Total Per Month |

| Unskilled | 250 | 6500 | 88.46 | 2300 | 338 | 8800 |

| Semi-skilled | 271.42 | 7057 | 100 | 2600 | 371 | 9657 |

| Skilled | 324.42 | 8435 | 100 | 2600 | 424 | 11035 |

| Highly Skilled | 374.42 | 9735 | 100 | 2600 | 474 | 12335 |

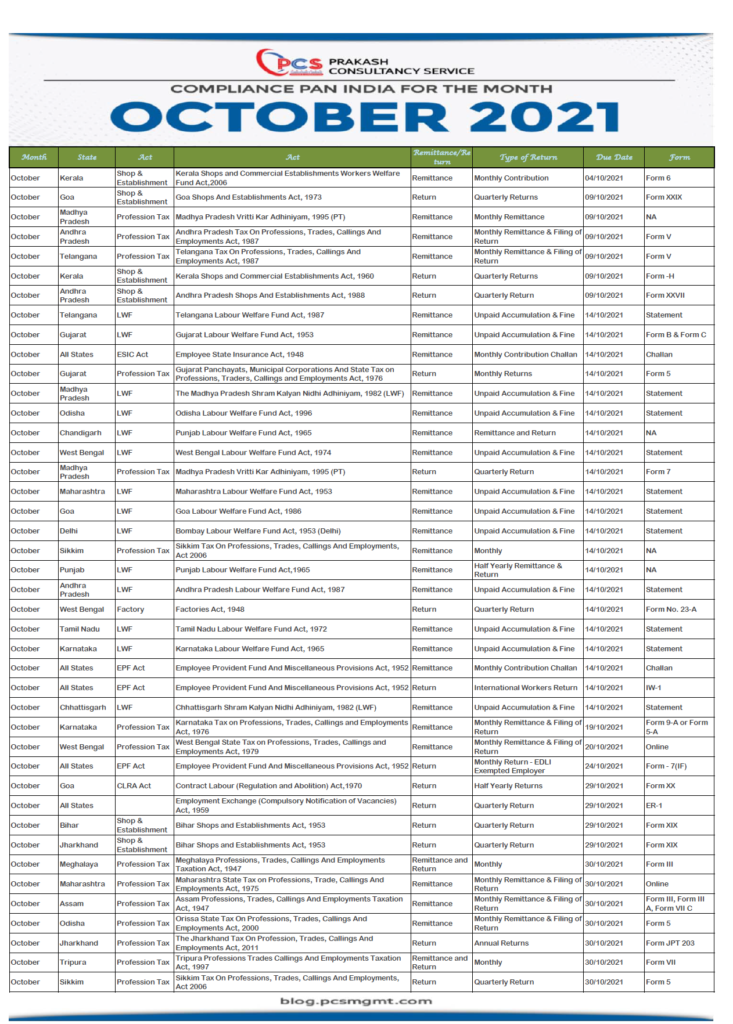

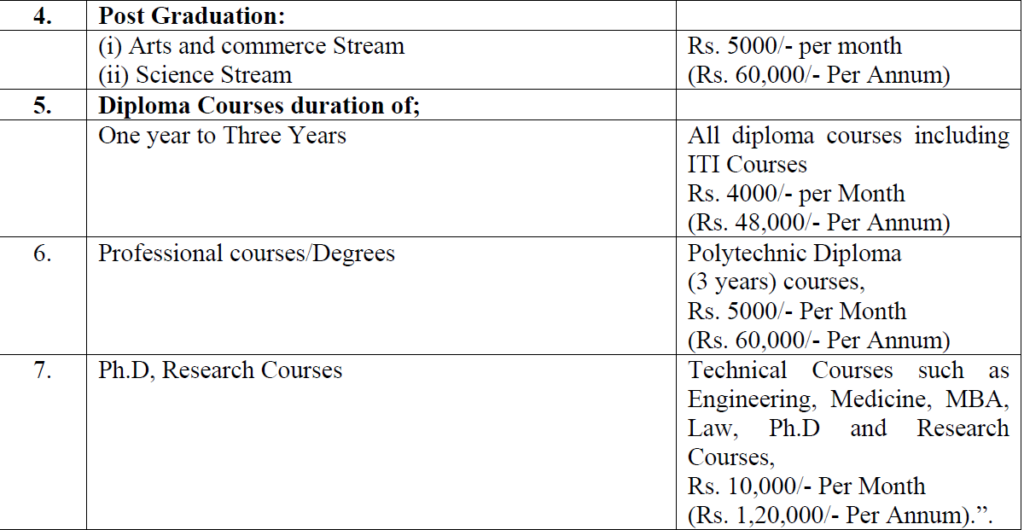

The Labour and Employment Department, Himachal Pradesh on September 24, 2021, has issued the Himachal Pradesh Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Amendment Rules, 2021 to further amend the Himachal Pradesh Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Rules, 2008. • In Rule 281(1) which specifies “The Board may provide financial assistance for the education of the children of the beneficiary from the Fund at the rates”, has been substituted.

Amendment of rule 281(1)

Addition of rules 298, 299, 300, 301 and 302

298 Female Birth Gift Scheme:-The Board may provide a sum of Rs. 51,000/- (fifty-one thousand) only in the shape of FDR which may be given to the beneficiary on the birth of his/her female child (up to two girls), which will be encashed on the completion of eighteen years of the said daughter. If the girl in whose name an FDR has been made, unfortunately, dies before attaining the age of eighteen years, the FDR will be transferred to the third girl child of the beneficiary if any, otherwise the entire amount will be paid to the nominee.

The Labour Department, Delhi on September 24, 2021, has issued the Draft Delhi Shops and Establishments Amendment) Rules, 2021 to further amend the Delhi Shops and Establishments Rules, 1954.

Amendment in the Delhi Shops and Establishments Rules, 1954 are as follows: –

• In Rule 3 which specifies “Form of submitting statement and other particulars”, has been substituted, namely: –

“The occupier of the establishment, within 90 days of the commencement of work of his establishment shall apply for the registration under the Act, online on the Shop and Establishment Portal of Labour Department”.

• In Rule 4 which specifies “Manner of registering establishments and form of registration certificate”, has been substituted, namely: –

“On submission of application online on the Shop & Establishment portal of Labour Department, Government of NCT of Delhi, the registration certificate shall be generated online in Form C”.

• In Rule 6 which specifies “Form and manner of notifying change”, has been substituted, namely: –

“The occupier shall notify any change in respect of any information under sub-section (1) of section 5 of the Act within 30 days after such change has taken place, online, on the Shop & Establishment Portal of Labour Department, Government of National Capital Territory of Delhi”.

• In Schedule I, II has been omitted.

The objection & suggestion will be taken up for consideration, after the expiry of a period of 15 days from the date of publication of this notification in the Delhi Gazette should be addressed to the Additional Secretary (Labour), C-Block, 5, Sham Nath, Marg, Delhi-110054.

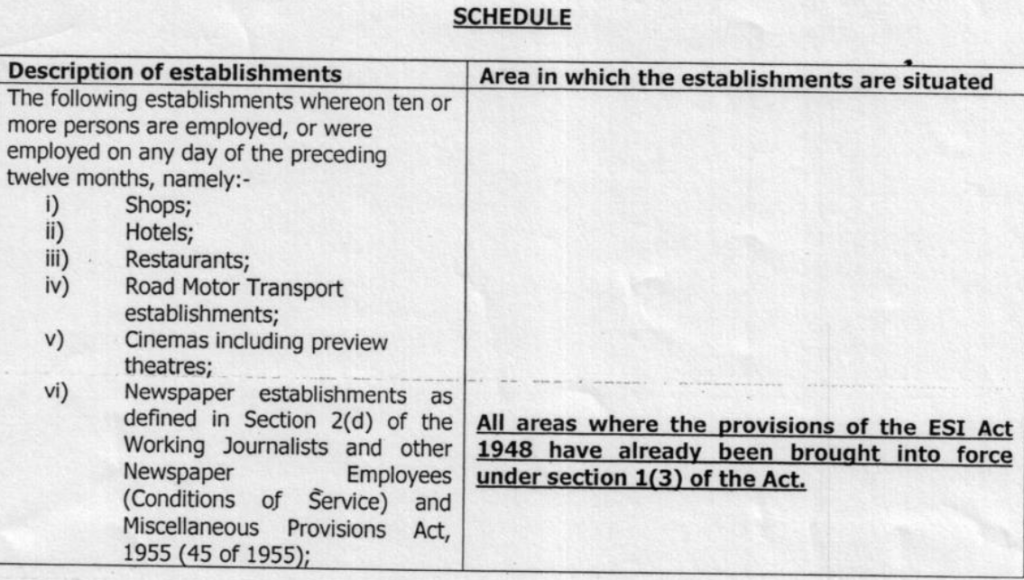

A notification of the Government of Manipur vide even number dated 29‘“ December 2020, the State Government in consultation with the Employees’ State Insurance Corporation and with the approval of the Central Government gave notice to is the intention to extend the provisions of the Employees’ State Insurance Act, 1948 (34 of 1948) to Municipal Corporation, Municipal Board, Municipal Council, and other Local bodies controlled by the State Government.

And whereas, no objections and suggestions have been received within the said period of 1 (one) the month of the said notification.

In the exercise of the power conferred by sub-section (5) of Section-l of the Employees’ State Insurance Act, 1948 (34 of 1948), and in supersession of all previous notification issued In this regard, the State Government of Manipur, and in consultation with the Employees State Insurance Corporation and with the approval of the Central Government, hereby extends the provisions of the said Act to the classes of establishment specified in Column (1) and situated within the areas specified in Column (2) of the Schedule in the State of Manipur as detailed below with immediate effect.

Whereas, the Governor, Himachal Pradesh is of the opinion that the minimum rates of wages in respect of category of workers in the Scheduled employment may be revised with effect from 01-04-2021

And whereas, as per provisions of (Act No. 11 of 1948) clause (a) of sub-section (1) of section 5 read with section 9 of the Minimum Wages Act, 1948, a Minimum Wages Advisory Committee was constituted vide Notification No: Shram (A) 4-2/2018-L, dated 30-07-2020. And whereas, a meeting of the said Committee was held on 14-07-2021 wherein

increase in Minimum wages payable to all the categories of workers in all the 19 scheduled employments were approved and recommednded w.e.f. 01-04-2021

Click one of our contacts below to chat on WhatsApp