Now EPFO has put more curbs for getting the E-Nomination to be initiated by the Employee as on a large scale the E-nomination is pending.

In my earlier blog, I had mentioned the benefits of the E-nomination necessary link is given below

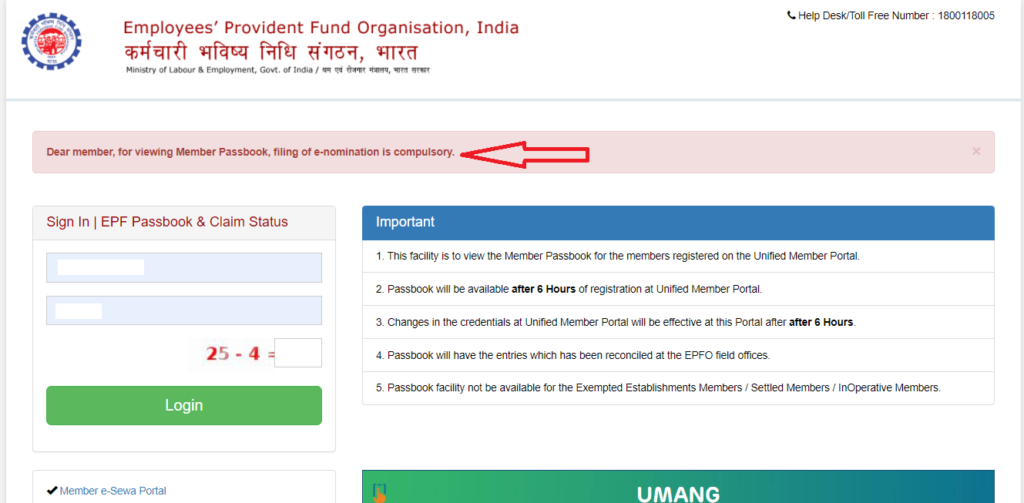

Now in order to view your Balance or any claim status, E-Nomination will be compulsory pls refer to the screenshot

How PCS can assist to achieve the above activity: Our team to support the establishments for a smooth e-Nomination functionality process following activities has been initiated.

Please note if no E-nomination is added digitally then employees won’t be able to avail of EPF Benefits in the future which would create hassle activities for employers to deal with. To avoid the same, kindly initiate the process immediately. To avail, any above activity from the PCS team kindly emails the respective coordinating person.

Let us achieve the target smoothly at the earliest.

From 8th Jan 2022 from 10am to 7pm our dedicated zoom id will be on for any queries to be solved on E-Nomination

Prakash Consultancy Services is inviting you to a scheduled Zoom meeting.

Topic: Prakash Consultancy Services’ Personal Meeting Room

Join Zoom Meeting

Meeting ID: 279 572 1304

Passcode: 1234

https://us02web.zoom.us/j/2795721304?pwd=OXlQMDEzZ1NpTVArKy9wQThGSXpjdz09

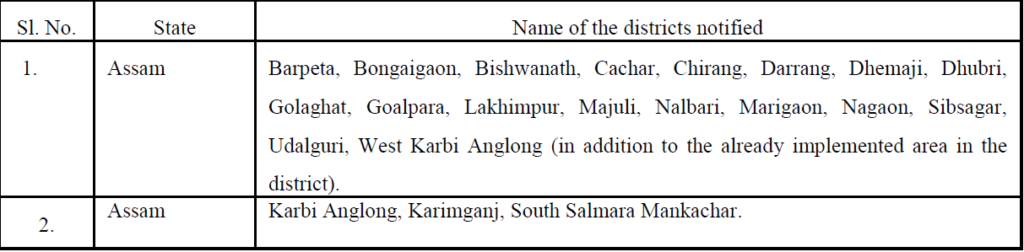

In exercise of the powers conferred by sub-section (3) of section 1 of the Employees’ State Insurance Act, 1948 (34 of 1948), the Central Government hereby appoints the 1st day of January 2022, as the date on which the provisions of the said Act, namely,-

(i) sections 38, 39, 40, 41, 42, 43 and sections 45A to 45H of Chapter IV;

(ii) sections 46 to 73 of Chapter V; and

(iii) sections 74, 75, sub-sections (2) to (4) of sections 76, 80, 82 and 83 of Chapter VI,

shall come into force in the entire areas of the following districts in the State of Assam:-

Rest pending States will be updated as the Notification is released

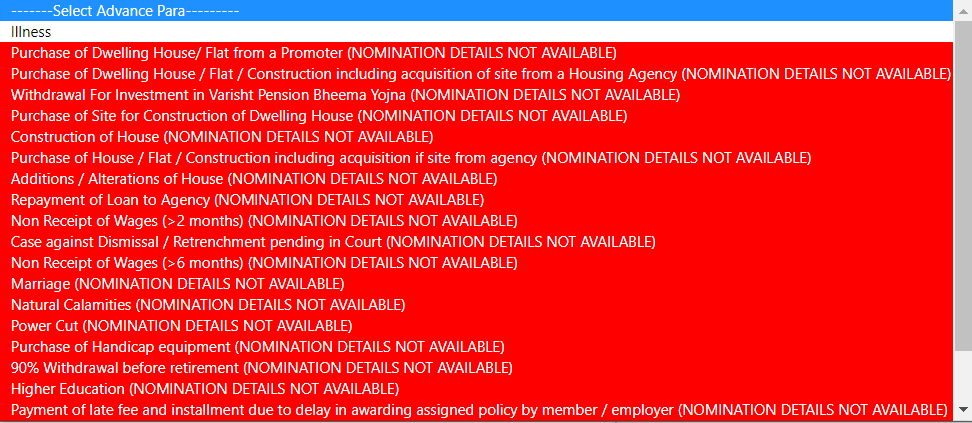

Now all EPFO members compulsory have to do the E-nomination in order to avail the various benefits as framed by EPFO in the act

The benefits of filing e-nomination are as follows:

1) Filing of e-nomination helps in getting Provident Fund (PF), Pension (EPS), and Insurance (EDLI) benefits easily in case of the death of the member

2) It also facilitates the nominee to file online claims

The EPFO members must be aware of the benefits of the different EPFO schemes. They are as follows:

Benefits of EPF

The EPFO members must be aware of the various benefits of the EPF scheme. They are as follows:

1) Accumulation plus interest upon retirement, resignation, death.

2) Partial withdrawals allowed for specific expenses such as house construction, higher education, marriage, illness, and others

Benefits of EPS

The benefits under the EPS scheme are as follows:

1) Monthly benefits for superannuation/ retirement, disability, survivor, widow (er), children

2) Amount of pension based on average salary during the preceding 12 months from the date of exit and total years of employment

3) Minimum pension on disablement

4) Past service benefits to participants of erstwhile Family Pension Scheme

Benefits of EDLI

The EDLI Scheme is an insurance scheme that provides life insurance benefits to all employees who are members of the Employees’ Provident Funds Scheme, 1952 or of PF Schemes exempted under Section 17 of the EPF & MP Act, 1952. The EDLI scheme is supported by a nominal contribution by the employers (@0.5 percent of monthly wages, up to the maximum wage limit of Rs 15,000).

No contribution is payable by the employees for availing of insurance cover under this Scheme. The benefits payable under EDLI Scheme have been enhanced by the Central Government.

New Message on EPF Member portal

How PCS can assist to achieve the above activity: Our team to support the establishments for a smooth e-Nomination functionality process following activities has been initiated.

Please note if no E-nomination is added digitally then employees won’t be able to avail of EPF Benefits in the future which would create hassle activities for employers to deal with. To avoid the same, kindly initiate the process immediately. To avail, any above activity from the PCS team kindly emails the respective coordinating person.

Let us achieve the target smoothly at the earliest.

Chandigarh Municipal Election on 24th Dec 2021 and under the provision to Subsection (i) of section 10 of the Punjab shops & commercial Establishment act 1958 as applicable to the union territory of Chandigarh,Friday 24th Dec 2021 a short leave for all Factories & shops & commercial Establishment falling in the area of Ward 1 to 35 of Municipal Corporation should be allowed for casting the votes

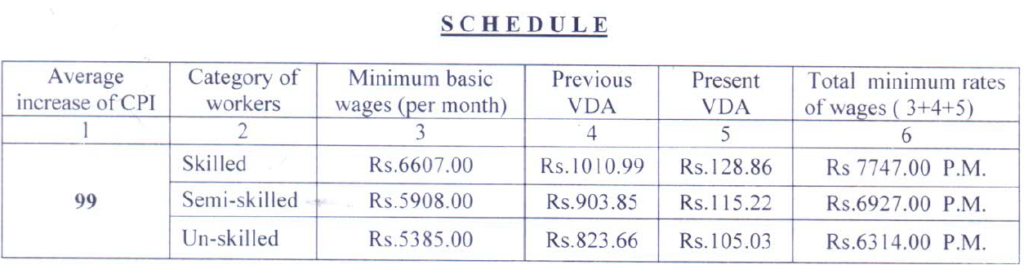

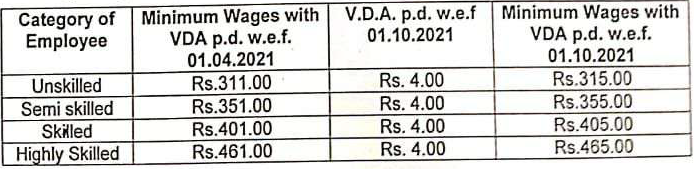

The Tripura Labour Department on December 04, 2021, has decided to revise the Variable Dearness Allowance (VDA) for different categories of workers engaged in the employment of shops and establishments in Tripura and shall be payable with effect from October 01, 2021.

Whereas, the total minimum wages per month for the following categories of workers are:

• Unskilled: Rs 6,314 per month

• Semi-skilled: Rs. 6,927 per month

• Skilled: Rs. 7,747 per month

The overtime rate shall be double of the ordinary rate of minimum wages.

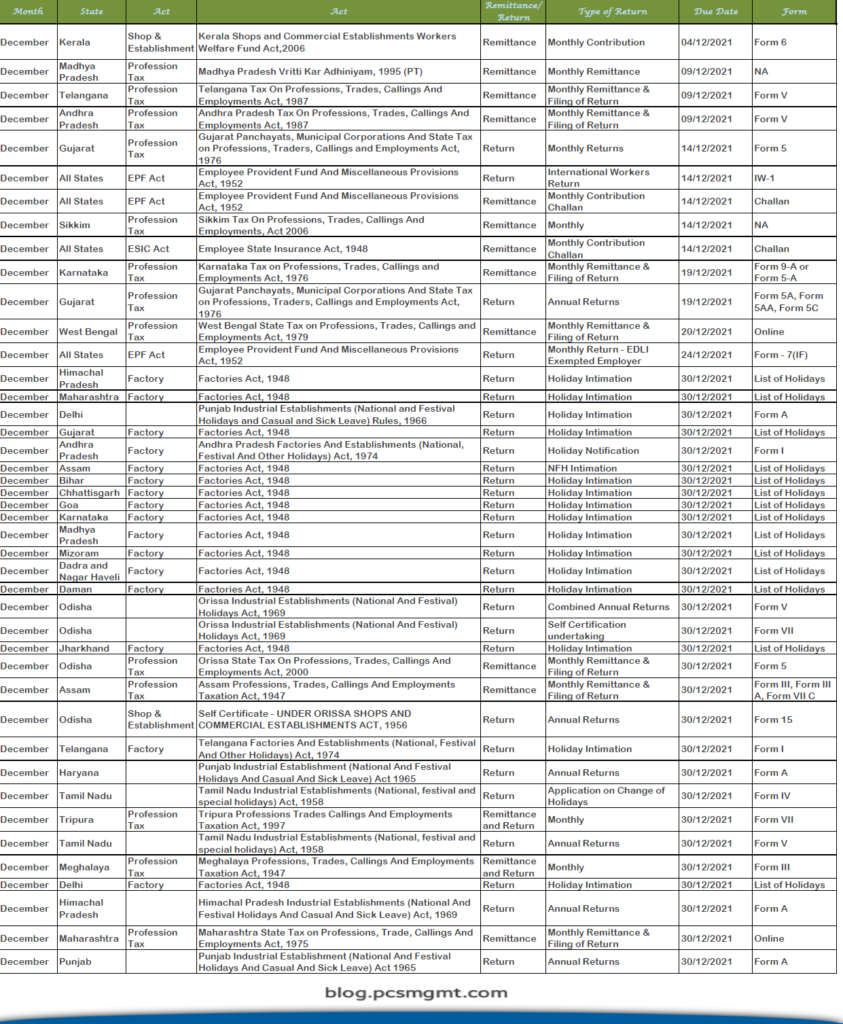

Appended below is the Pan India Compliance calendar for the month of November 2021, employer is under obligation to contribute towards some of the above-mentioned compliances for the welfare of the employees. Each of these compliances is again governed by a set of rules and formulas. It is proven to be a deliberate attempt to violate the provisions of the law, there could be imprisonment of the employer. Please, comply with the same in time to avoid any future non-compliance so that hefty penalties and fines are not charged by the respective dept

The Government of Odisha vide notification No.5639/LC, has released the Minimum Wages effective from 1st October 2021 for the State of Odisha

Click one of our contacts below to chat on WhatsApp