Bihar Minimum wages has been revised from 1st Apr 2022 to 30th Sep-2022

Bihar Minimum wages has been revised from 1st Apr 2022 to 30th Sep-2022

Central Minimum Wages Revised from 1st Apr 2022 to 30th Sep-2022

The Central Government hereby appoints the 1st day of April,2022, as the date on which the provisions of the said Act, namely,—

(i) sections 38, 39, 40, 41, 42, 43 and sections 45A to 45H of Chapter IV(Contribution)

(ii) sections 46 to 73 of Chapter V ( Benefits) and

(iii) sections 74, 75, sub-sections (2) to (4) of section 76, 80, 82 and 83 of Chapter VI (Adjudication of disputes and claims) shall come into force in all the areas of Nagapattinam district in the State of Tamil Nadu.

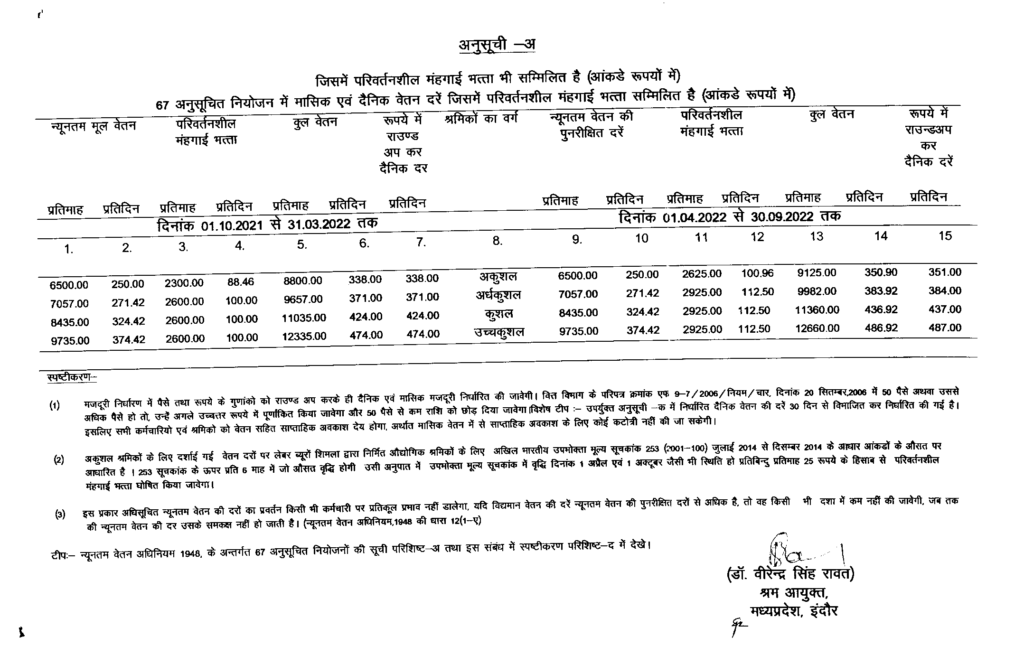

Madhya Pradesh Minimum wages has been revised from st Apr 2022 to 30th September 2022

Gujarat Minimum wages has been revised from 1st Apr 2022 to 30th Sept 2022

Gujarati Circular :-

English Version :-

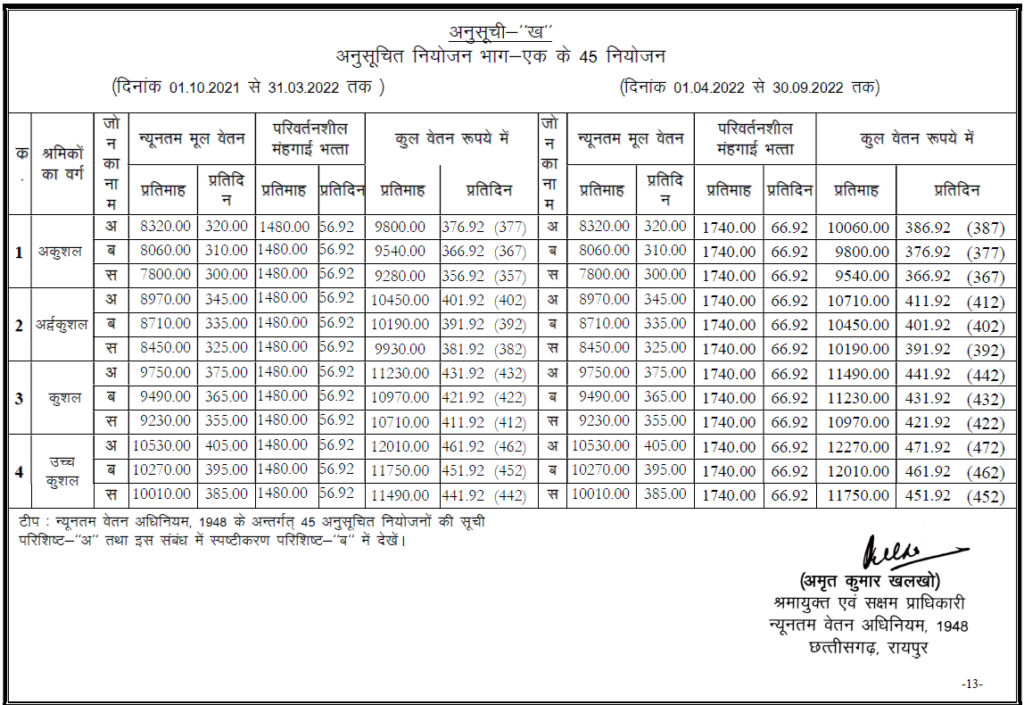

The Government of Chhattisgarh vide notification No/08/2022/1897, has revised the VDA effective from 1st April 2022 to 30th September 2022

Pls find below is the updated ESIC Tie Up Hospital list ( Super Speciality) (Gujarat/Punjab/Chandigarh/Goa)

As per the notification dated 8th March 2022 Madhya Pradesh Government has amended the following changes in regards to Restaurant & Eating house an exemption of the following conditions under Section 14- Sub Section (1)

It will be applicable to the whole state of Madhya Pradesh

Government of Uttar Pradesh vide notification No.2022-39(2)/12 has declared public holiday on account of Holi celebrating on 19th March 2022 (Saturday) along with the previous holiday declared on 18th March 2022. Therefore, 19th March 2022 has also been declared as a public holiday on account of Holi along with 18th March 2022.

The Governor of Punjab vide notification dated 3rd March 2022 formulates a scheme for the shops and establishments in the state by which exemption from Section 30 (conditions of employment of women) of the Punjab Shops and Commercial Establishment Act 1958 is granted. The exemption will be given on a case-to-case basis on receipt of applications from the establishments on the following terms and conditions:-

Click one of our contacts below to chat on WhatsApp