Odisha Minimum wages has been revised from 1st Apr 2022 to 30th Sep-2022 vide notification dated 30th Apr 2022

| Category | VDA per day with effect from April 01, 2022 | Minimum wages with VDA with effect from April 01, 2022 |

| Unskilled | Rs. 11.00 | Rs 326.00 |

| Semi-skilled | Rs. 11.00 | Rs 366.00 |

| Skilled | Rs. 11.00 | Rs 416.00 |

| Highly Skilled | Rs. 11.00 | Rs 476.00 |

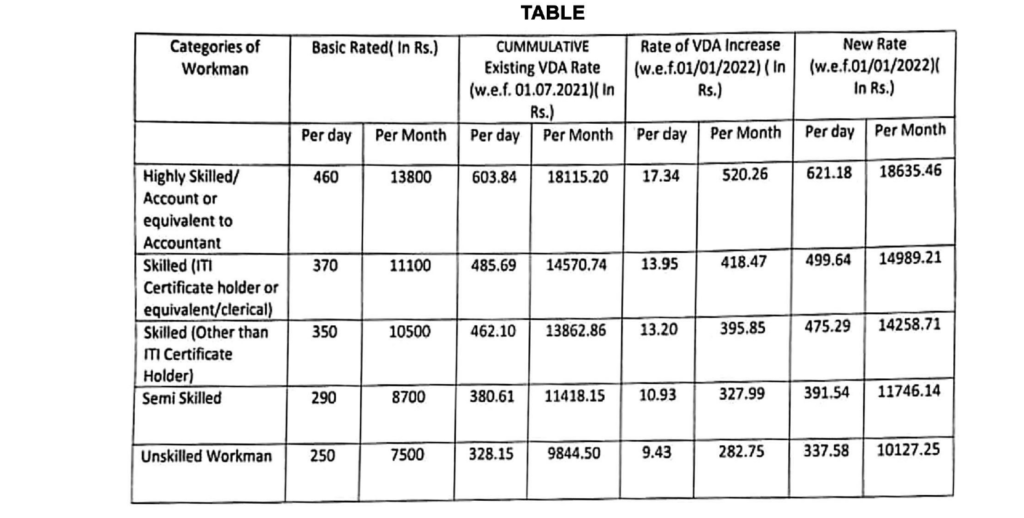

Assam Minimum wages has been hiked from 1st Jan 2022 to 30th June 2022 vide notification dated 20th Apr 2022

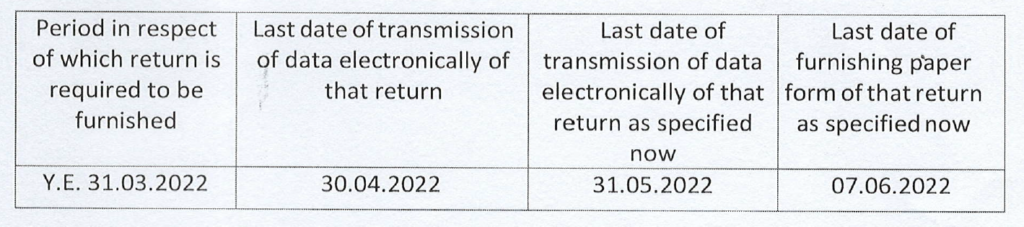

GOVERNMENT OF WEST BENGAL DIRECTORATE O F COMMERCIAL TAXES OFFICE OF TH E COMMISISONER OF COMMERCIAL TAXES AND PROFESSION TAX 14, BELIAGHATA ROAD, KOLKATA-7OOOl5 ORDER Dated: 29.04.2022

Now therefore, in exercise of the power conferred upon me under rule !2 of the West Bengal State Tax on Professions, Trades, Callings and Employments Rules, 1979 the last date of filing return in Form-lll for the period mentioned below is extended as specified in the following table:

Any return for the said period of Y.E, 3L.03.22 having been filed within the extended date, vide this order, as specified in the Table above, with the tax payable there-under having been paid within 30.04.22, shall be deemed to have been furnished within the prescribed date in terms of the proviso to sub rule (2) of rule 1.2 of the West Bengal State Tax on Professions, Trades, Callings and Employments Rules, 1979, and accordingly no date fee shall be payable under sub-section (2) of section (6) for such return

Keeping in view the problems being faced by the Employers in depositing ESI contribution for the contribution period March 2022, the Director General in exercise of powers vested under Regulation 100 has relaxed the provision as entered in Regulations 26 & 31 of the Employees’ State Insurance (General) Regulations, 1950.In this regard as a onetime opportunity, employers are allowed to deposit contribution for the month of March 2022 up to 30.04.2022 instead of 15.04.2022.

Accordingly, the employers are also allowed to file the Return of contribution up to 26.05.2022 instead of 11.05.2022 for the contribution period from October, 2021 to March, 2022. .

Only Payment due date has been extended & return of contribution due date has been extended

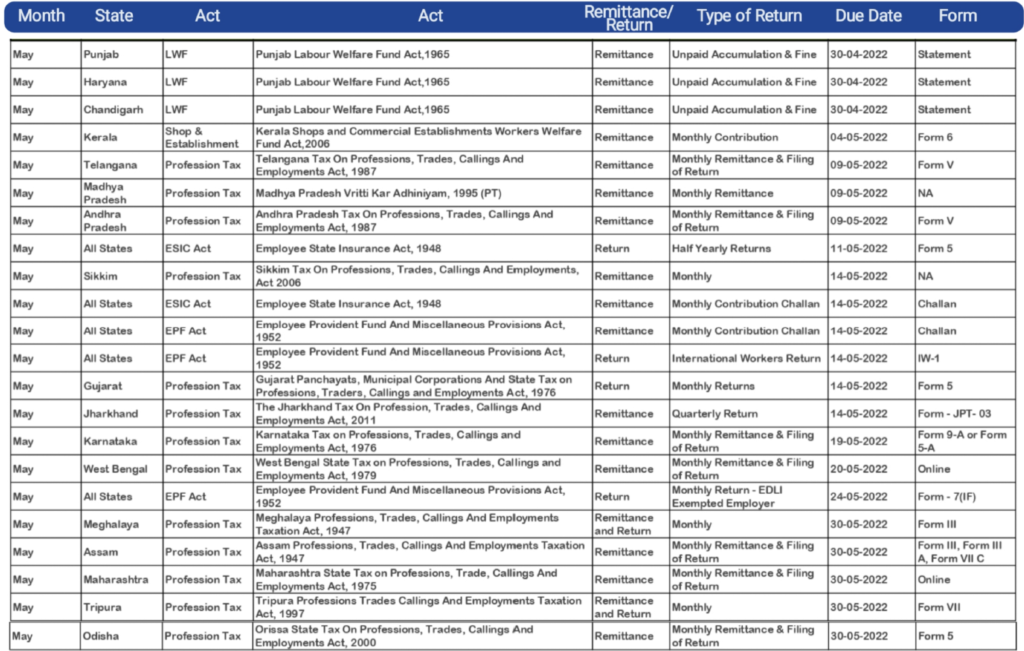

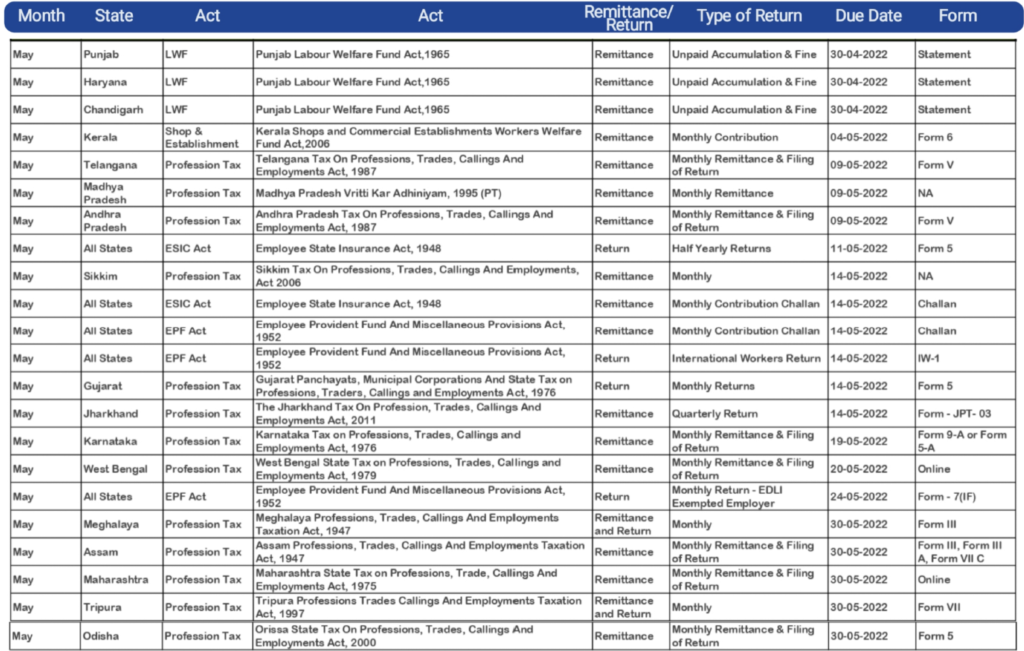

Pls find below is the list of

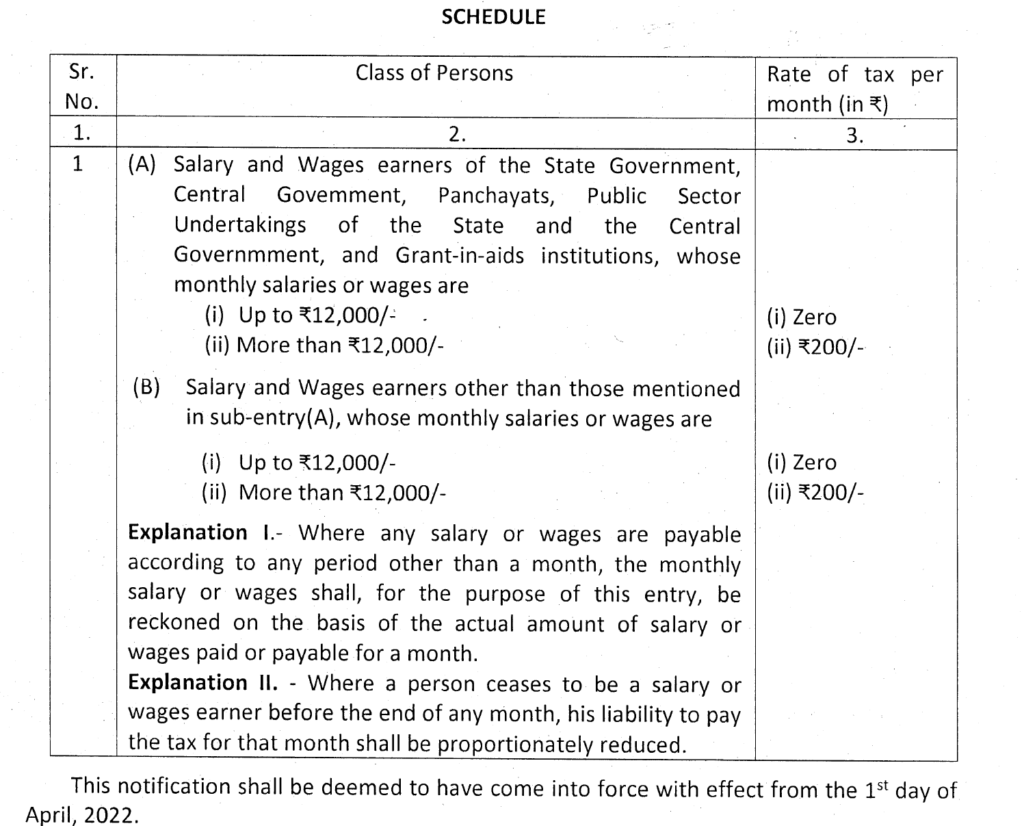

Gujarat Professional Tax on salary has been changed w.e.f. 1st April 2022

ESIC Central Rule 55 amended. As per this amendment an Insured Woman who availed Maternity Benefit need not pay 70 days contribution to become entitled to Sickness Benefit in the following Benefit Period. She need contribute only for the half number of remaining days in the relevant Contribution Period. Before this amendment many Insured Women who availed Maternity Benefit were deprived of Sickness Benefit for want of 70 days contribution. To get over this injustice the Rule has been amended that also with effect from 20.1.2017.

The Government of Tamil Nadu vide a notification dated 30th March 2022 publishes the Amendments to the Tamil Nadu Shops and Establishments Rules which deletes the Form P (a Register of Fines, deductions for Damages or Loss and Advances) and Q (register of wages) and inserts new Forms U, V, W and X to the Tamil Nadu Shops and Establishments Rules, 1948. The amendment also makes way to the employers to maintain registers electronically. The changes brought by the amendment are as follows-

The Government of Uttarakhand vide notification No 1064/4-01/13 has released Minimum Wages effective from 1st April 2022

Click one of our contacts below to chat on WhatsApp