|

Scheduled Employment

|

|

|

Agriculture

|

|

|

Blanket Manufacturing

|

|

|

Bone Mills

|

|

|

Brick Kilns

|

|

|

Cement pole or manufacture of Cement products.

|

|

|

Chemicals & Pharmaceuticals

|

|

|

Constructions, and maintenance of Irrigation works

|

|

|

Cotton Ginning and Pressing

|

|

|

Engineering Industry

|

|

|

Food Products (including cakes, biscuits, confectionary, Ice-cream & Ice-candy, Beverages)

|

|

|

Forest and Forestry

|

|

|

Fuel Coke

|

|

|

Handloom Industry

|

|

|

Katha Industry

|

|

|

Khandsari Industry

|

|

|

Kosa Industry

|

|

|

Lime Kiln

|

|

|

Local Authority

|

|

|

Murra Peha

|

|

|

Oil Mills

|

|

|

Plastic Industry

|

|

|

Potteries including manufacture of refractory goods, fire bricks, sanitary works, insulators tiles (excluding those made from cement) stone wire pipes, furnace lining bricks & other ceramic goods

|

|

|

Power Loom (including sizing and processing)

|

|

|

Printing Press

|

|

|

Public Motor Transport

|

|

|

Ramraj or Geru

|

|

|

Rice Mill, Floor Mill, or Dal Mill

|

|

|

Construction and maintenance of Roads and building operation

|

|

|

Saw Mill

|

|

|

Shop,Commercial establishment, Residential Hotel and Theatre

|

|

|

Stone breaking or stone crushing

|

|

|

Tobacco (including beedi making Manufactory)

|

|

|

Tiles Manufactory (excluding Cement titles)

|

|

|

Any Establishment in which manufacturing activity as defined under section 2 (K) of the Factories Act is carried out and is not covered under any of the other scheduled employments

|

Tamil Nadu Minimum Wages 1st Apr 2018 31st Mar 2019 VDA has been increased

VDA Circular :- TN – DA Notification – 2018 -19

Shop & Establishment :- MW – Shops Estb – TN – 2018-19

2018-2019

————————————————————————————————————————–

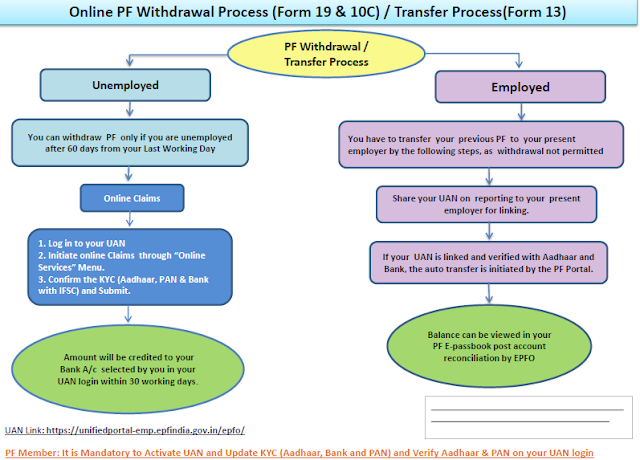

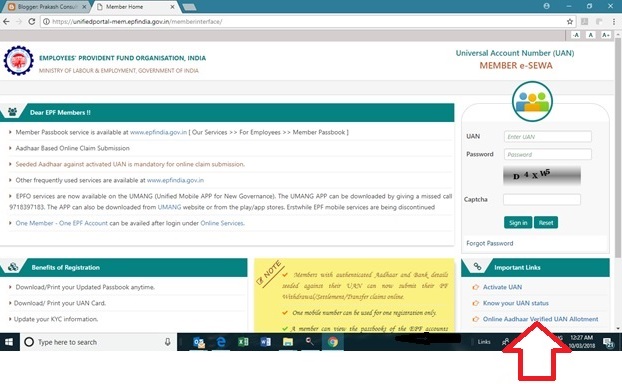

4th Step:- Online Claim Submission & Transfer Process

1.As indicated earlier, withdrawal of PF Claims can be done only by those members who are not employed.

2.Please check your Bank A/c No and IFSC from your KYC menu, update correct Bank details and other KYCs (KYC Option under Manage Menu) before initiating online withdrawal.

3.You will be receiving the OTPs to your registered mobile linked with your Aadhaar and PF. Hence, get your Aadhaar and PF updated with your current Mobile No.

4.In certain browsers, the claims form 19 & 10C will be indicated separately and combined in some browsers, you have to select based on the option available.

5.Portal or PAN/ Aadhaar servers may be down at the time of verification or during the claim process. Please keep trying it till your claim process is completed.

6.You can not claim the PF withdrawal on the portal through online, if you have not completed 60 days of waiting period from your last working day, as per the PF Norms.

7.If, PF Tenure less than 6 months, you can Claim only PF(Form 19), EPS( Form 10C) is not applicable.

8.If, PF Tenure is More than 9 years 6 months, you can Claim only PF(Form 19), for EPS(Form 10C) Member Should Obtain Scheme Certificate from RPFC

Download Full Process flow 👉 PF ONLINE WITHDRAWAL PROCESS-(19 & 10C)

Transfer Process :- Online Transfer-process

For any queries you can call me or email me on prakash@pcsmgmt.com my team will certainly help you

Dear all,

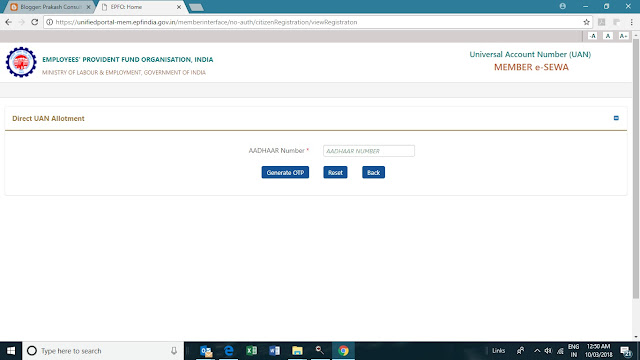

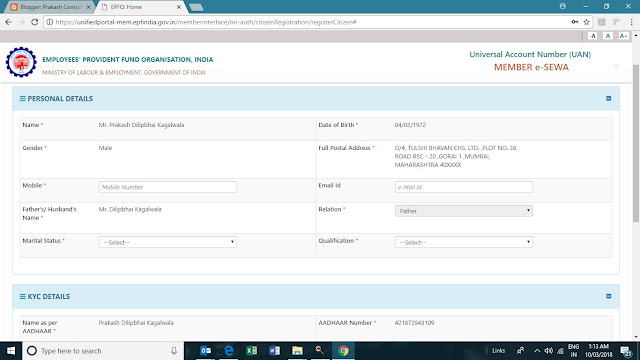

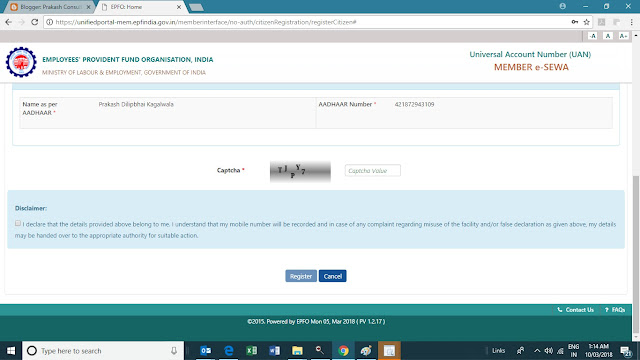

As we all are aware that EPFO has stop entering Enrollment ID for creating the New UAN Number and it becomes very difficult to generate the same through Normal Aadhar Number while inserting in the Employer Portal.

EPFO has come out with a new link or we can say a reversal process of creating New UAN Number with Aadhar Number

pls refer to the respective Link

Pls click on Online Aadhaar Verified UAN Allotment

The respective page will open pls insert the Aadhar Number ( Provided Mobile number should be registered with Aadhar Number )

Once we click the button register UAN Number will be generated

once UAN is generated we need to insert in the Employer Portal & employee has to activate the same

Rest all procedure remains the same

The Government of Tamil Nadu has decided to introduce a Bill to amend the Tamil Nadu Catering Establishments Act,1958. The Bill will have the following amendments:

- This Act may be called the Tamil Nadu Catering Establishments (Amendment) Act, 2018.

- It shall come into force on such date as the State Government may, by notification, appoint.

In Section 23 of the Tamil Nadu Catering Establishments Act, 1958, in sub-section (1), for the expression “with fine which, for a first offence, shall not be less than fifty rupees or more than one hundred and fifty rupees, for a second offence shall not be less than one hundred and fifty rupees or more than two hundred and fifty rupees and for a third or any subsequent offence shall not be less than two hundred and fifty rupees”, the expression “with fine which, for a first offence, may extend to five thousand rupees and for a second or subsequent offence, with fine which may extend to ten thousand rupees” shall be substituted.

Notification:- 👉Tamilnadu Catering Establishment ammedment 2018

|

State

|

Name of the Act

|

New Section

|

|

Tamil Nadu

|

Tamil Nadu Labour Welfare Fund Act, 1972. Rules 1973

|

In section 2 of the Tamil Nadu Labour Welfare Fund Act, 1972, in clause

(b), in sub-clause (i), in item (b), |

|

Ceiling limit In 1997

|

Ceiling limit Amendment 2018

|

|

|

3500/Month

|

15000/Month

|

|

|

Tamil Nadu Act 36 of

1972) |

Tamil Nadu Act 36 of

1972) Amendment – 2018 |

|

|

Excludes persons in supervisory category, drawing wages exceeding three thousand and

five hundred rupees per Month |

Many supervisory staff are excluded from the purview of the above Act. The Government have, therefore, decided to bring more number of workers under the purview of the said Tamil Nadu Act 36 of 1972 and to amend section 2(b)(i)(b) of the said Tamil Nadu Act 36 of 1972 suitably so as to enhance the ceiling limit of wages to fifteen thousand rupees per Month.

|

Notification :- The Tamil Nadu Labour Welfare Fund (Amendment) Act 2018

Marathi Version :-Maharashtra Da jan -2018.pdf

English Detail Version Maharashtra MW 01-01-2018 to 30-06-2018.pdf

New Delhi: Taking another step towards going paperless, retirement fund body EPFO on Tuesday said it has launched facilities for employers to pay dues and update ownership details online.

Employees’ Provident Fund Organisation (EPFO) has provided facility of online submission of Form 5A (Return of Ownership), it said in a statement.

EPFO added it has discontinued the physical submission of the form.

Earlier, the employers had to submit a physical copy of Form 5A to the concerned EPFO field office upon new registration of establishment and whenever there was any change in ownership details.

Now, employers can update Form 5A online and submit with e-signature. This will not only reduce the unnecessary paperwork but also avoid visits to EPFO field offices.

EPFO has also launched the facility for online payment of Section 14B and Section 7Q dues.

It said that for facilitating ease of doing business, it has launched the online functionality for calculation and payment of damages under Section 14B and interest under Section 7Q against belated remittances.

If an employer makes payment of dues after the due date, he/she is liable to pay damages (under Section 14B) and interest (under section 7Q).

So far, the EPFO used to send the notices to employers under Section 14B and Section 7Q against their belated payments.

Under the new functionality for belated payment, the employer can select the cases where he/she wants to make payment immediately.

The system will generate auto challan. The employer can know the 14B and 7Q dues immediately and make the payment accordingly, thereby avoiding the requirement of visits to EPFO field offices, it added.

circular-Form No 5A 👉 Form No 5A Online Submission