- Any amount payable as per return -should have been/ shall be paid on or before the due date.

- The aforesaid employers should submit the. monthly or, as the -case may be; annual returns pertaining to the periods April 2016 to June 2018 on or before 31st July 2018

- Needless to mention that no refund or adjustment against .any tax liability shall be allowed -where late fee has already.peen paid

Dear employers

As per section 6(1) of the Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975 (the Profession Tax Act 1975), every employer who has obtained Profession Tax Registration Certificate (PTRC)under the Profession Tax Act, 1975 has to furnish return in the prescribed format showing the salaries and wages paid by him and the amount of tax deducted by him in respect thereof. As per Rule 11(2A) of the Profession Tax Rules, 1975, such return shall be in electronic Form IIIB and payment shall be made before uploading the said return on the official website of the department). Section 6(2) of the Profession Tax Act, 1975 provides that a return without such proof of payment shall not be deemed to have been duly flied.

From 01/04/2018, the PTRC returns are being filed on the new web site www.mahagst.gov.in due to technical difficulties, many employers have not been able to upload returns. Further it is represented that they are facing technical difficulties in creating profile for accessing e-services on www.mahagst.gov.in

The issue has been examined and it is found that because of technical difficulties some of the ‘employers could not file the returns as framed under the act, Hence as per the rules/Powers framed under the act by various ammedment & circulars issued by the state government under the Provision of Section 6(3) Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975 the whole late fee payable by the registered employers in respect of the monthly or annual returns pertaining to the period Apr-2016 to June -2018 is being exempted subject to fulfillment eligibility conditions .mentioned below–

Eligibility Conditions:

Necessary Circular & FAQ( New Profession tax Website ) is appended below

👉Late Fee Exemption Circular :- Exemption for late fee

👉FAQ :- PROFESSION TAX FAQ

Profession Tax (P.Tax) slab in Madhya Pradesh have been revised. New rates will be applicable w.e.f. 01-04-2018.

Madhya Pradesh government in its finance budget 2018 have amended the professional tax slab rates for employees. The new PT rates aim at providing some relief to the salaried employees and increase their take home salary.

Professional Tax Slab In Madhya Pradesh For F.Y. 2018-19

| Annual Salary | Annual PT |

| Below Rs. 225000 | NIL |

| Rs. 225000 – Rs. 300000 | 1500 |

| Rs. 300000 – Rs. 400000 | 2000 |

| Above Rs. 400000 | 2500 |

PT is deducted from the monthly salary of the employees in equal installments and deposited with the department using professional tax

Below will be the actual monthly PT deduction rate:

| Monthly Salary | Monthly PT |

| Below Rs. 18750 | NIL |

| Rs. 18750 – Rs. 25000 | 125 |

| Rs. 25000 – Rs. 33333 | 167 |

| Above Rs. 33333 | 208 |

|

👉MP-BUDGET-2018-19 ( See Yellow Highlighted) |

As per EPFO circular dated 24th April 2018, the EPFO has intimated an amendment to the guidelines of Pradhan Mantri Rojgar Protsahan Yojana.

( Earlier this Scheme was introduce in the Month of Aug-2016 where in if the following conditions were full fill then only Employer could take the benefit of the same) earlier only 8.33 % benefit was given by the Govt 1.. The appoint date of the respective employee should be after 1st Apr 2016

2. He should not hold any UAN Number

3. His KYC should be verified.

4 His Gross Salary Should be Less then 15000.

In regards to the above EPFO Field officer had done a very good hard work to implement & explain the same. in the Start of the scheme many Hurdles had occurred in the online portal but now it is running smoothly.

Now as per the announcement in the finance bill 2018-2019 , and As per the amendment to the guidelines the Government of India will pay the full employer’s contribution (EPF and EPS both) w.e.f. 1st April 2018 for a period of three years to the new employees and to the existing beneficiaries for their remaining period of three years through EPFO. The last date of registration of beneficiary through establishment is 31st March 2019

Circular :- 👉Amendment_PMRPY_(employee-Employer)

( Earlier this Scheme was introduce in the Month of Aug-2016 where in if the following conditions were full fill then only Employer could take the benefit of the same) earlier only 8.33 % benefit was given by the Govt 1.. The appoint date of the respective employee should be after 1st Apr 2016

2. He should not hold any UAN Number

3. His KYC should be verified.

4 His Gross Salary Should be Less then 15000.

In regards to the above EPFO Field officer had done a very good hard work to implement & explain the same. in the Start of the scheme many Hurdles had occurred in the online portal but now it is running smoothly.

Now as per the announcement in the finance bill 2018-2019 , and As per the amendment to the guidelines the Government of India will pay the full employer’s contribution (EPF and EPS both) w.e.f. 1st April 2018 for a period of three years to the new employees and to the existing beneficiaries for their remaining period of three years through EPFO. The last date of registration of beneficiary through establishment is 31st March 2019

Circular :- 👉Amendment_PMRPY_(employee-Employer)

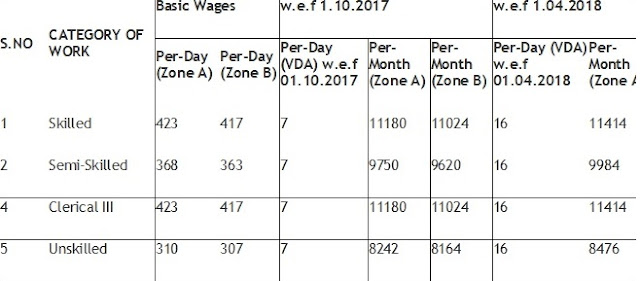

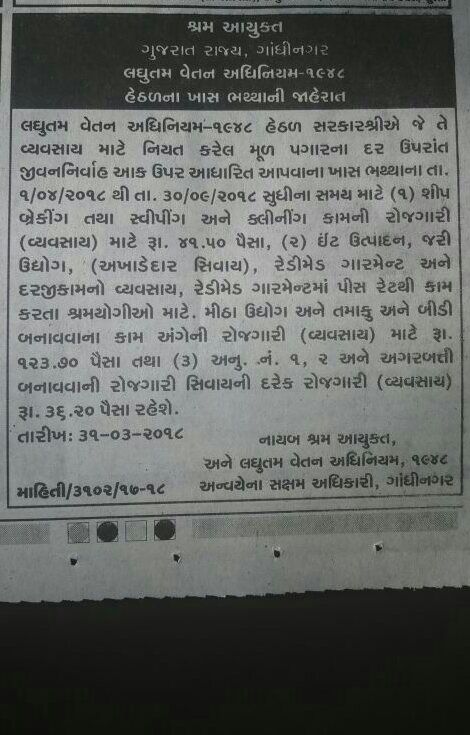

This is to inform that the Minimum wages in Goa has been revised with effect from 1.04.2018. The amended rates for all the categories are as mentioned below:-

Notification 👉VDA-Notification-w.e.f-01.04.2018-Goa

As per notification number 973/4-01/13, Government of Uttarakhand has released Minimum Wages for the state of Uttarakhand effective 1st April 2018

Notification :- 👉The Uttarakhand Minimum Wages Notification 1st Apr 2018

Notification :- 👉The Uttarakhand Minimum Wages Notification 1st Apr 2018

Bihar Minimum Wages 1st Apr 2018 to 30th Sep 2018

Notification :- 👉The Bihar Minimum Wages Notification 1st April 2018

Delhi Minimum Wages 1st Apr 2018 to 30th Sep- 2018 respective notification is appended below

As per notification Letter No. 186-215/Pravartan -(MW)/15, Government of Uttar Pradesh has released for the state of Uttar Pradesh effective 1st April 2018

👉 The Uttar Pradesh Minimum Wages Notification 1st April 2018

👉 The Uttar Pradesh Minimum Wages Notification 1st April 2018

New Minimum Wages Chhattisgarh 1st April 2018 to 30th Sep-2018

Notification:- 👉Chattisgarh Minimum Wages 01-04-18 30-09-2018

Notification:- 👉Chattisgarh Minimum Wages 01-04-18 30-09-2018

| Minimum Wage in Gujarat w.e.f 1st Apr 2018 to 30th Sep-2018 👇 Download Gujarat Minimum Wages 1st Apr-2018 to 30th Sep-2018 |