|

Scheduled Employment

|

|

|

Agriculture

|

|

|

Blanket Manufacturing

|

|

|

Bone Mills

|

|

|

Brick Kilns

|

|

|

Cement pole or manufacture of Cement products.

|

|

|

Chemicals & Pharmaceuticals

|

|

|

Constructions, and maintenance of Irrigation works

|

|

|

Cotton Ginning and Pressing

|

|

|

Engineering Industry

|

|

|

Food Products (including cakes, biscuits, confectionary, Ice-cream & Ice-candy, Beverages)

|

|

|

Forest and Forestry

|

|

|

Fuel Coke

|

|

|

Handloom Industry

|

|

|

Katha Industry

|

|

|

Khandsari Industry

|

|

|

Kosa Industry

|

|

|

Lime Kiln

|

|

|

Local Authority

|

|

|

Murra Peha

|

|

|

Oil Mills

|

|

|

Plastic Industry

|

|

|

Potteries including manufacture of refractory goods, fire bricks, sanitary works, insulators tiles (excluding those made from cement) stone wire pipes, furnace lining bricks & other ceramic goods

|

|

|

Power Loom (including sizing and processing)

|

|

|

Printing Press

|

|

|

Public Motor Transport

|

|

|

Ramraj or Geru

|

|

|

Rice Mill, Floor Mill, or Dal Mill

|

|

|

Construction and maintenance of Roads and building operation

|

|

|

Saw Mill

|

|

|

Shop,Commercial establishment, Residential Hotel and Theatre

|

|

|

Stone breaking or stone crushing

|

|

|

Tobacco (including beedi making Manufactory)

|

|

|

Tiles Manufactory (excluding Cement titles)

|

|

|

Any Establishment in which manufacturing activity as defined under section 2 (K) of the Factories Act is carried out and is not covered under any of the other scheduled employments

|

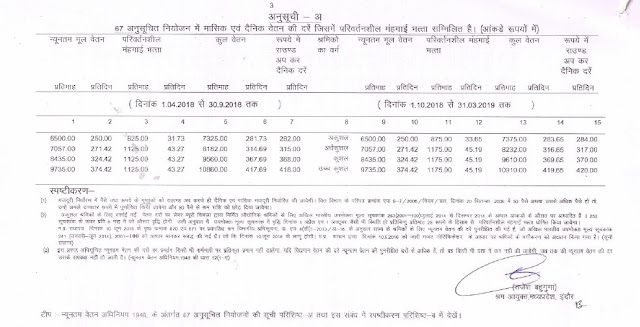

Madhya Pradesh Minimum wages from 1st Oct 2018 to 31st Mar-2018 the respective schedule of employment is as under

Dear all

Uttar Pradesh Minimum wages have been revised from 1st Oct 2018 to 31st Mar 2019

Original Notification:- The Uttar Pradesh Minimum Wages Notification 1st October 2018

English: –Up Minimum Wages 1t Oct 2018 o 31st Mar 2019

Disclosure of compliance of above Act in Annual Report is mandatory

The Ministry of Corporate Affairs has amended the Companies (Accounts) Rules, 2014, to make it part of the mandatory non-financial disclosures in annual reports of private companies under Section 134 of the legislation wherein non-disclosure attracts penal provisions.

Accordingly, all companies will have to provide “a statement that the Company has complied with provisions relating to the constitution of Internal Complaints Committee under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013”, a panel meant to inquire into sexual harassment complaints filed by women employees. Section 134 lists the disclosure framework that directors of companies have to comply within the annual reports.

Gazetted Notification:- 👉Notification-Under-Co.-Act-POSH

Haryana Minimum wages have been revised effective from 1st July 2018

|

S.NO.

|

Category

|

Monthly Wage

|

Daily Wage

|

|

|

1

|

UNSKILLED

|

8541.64

|

328.52

|

|

|

2

|

SEMI-SKILLED-A

|

8968.71

|

344.95

|

|

|

SEMI-SKILLED-B

|

9417.13

|

362.19

|

||

|

3

|

SKILLED-A

|

9887.99

|

380.30

|

|

|

SKILLED-B

|

10382.40

|

399.32

|

||

|

4

|

HIGHLY SKILLED

|

10901.52

|

419.28

|

|

|

5

|

Clerical & General Staff

|

(i) Below Matriculation

|

8968.71

|

344.95

|

|

(ii) Matriculation but not Graduate

|

9417.13

|

362.19

|

||

|

(iii) Graduate or above

|

9887.99

|

380.30

|

||

|

(iv) Steno Typist

|

9417.13

|

362.19

|

||

|

(v) Junior Scale Stenographer

|

9887.99

|

380.30

|

||

|

(vi) Senior Scale Stenographer

|

10382.40

|

399.32

|

||

|

(vii) Personal Assistant

|

10901.52

|

419.28

|

||

|

(viii) Private Secretary

|

11446.60

|

440.25

|

||

|

6

|

Data Entry Operator

|

9887.99

|

380.30

|

|

|

7

|

Driver

|

Light Vehicle

|

10382.40

|

399.32

|

|

Heavy Vehicle

|

10901.52

|

419.28

|

||

|

8

|

Security Guard

|

without weapon

|

8968.71

|

344.95

|

|

with weapon

|

10382.40

|

399.32

|

||

|

9

|

Security Inspector / Security Officer / Security Supervisor

|

10901.52

|

419.28

|

|

|

10

|

Safai Karamchari in any employment

|

9103.59

|

350.13

|

Notification 👉 The Haryana Minimum Wages Notification 1st July 2018

The Government of Tripura exercising powers under Section 3(2) of the Tripura Professionals, Trades, Callings, and Employments Taxation Act, 1997 has increased the rate of Professional Tax in the Schedule

|

Old Slab

|

New Slab (25th July 2018)

|

||

|

Payment Schedule

|

Monthly

|

Payment Schedule

|

Monthly

|

|

Gross Salary Earned

|

PT pm

|

Gross Salary Earned

|

PT pm

|

|

up to Rs 5000

|

Nil

|

up to Rs 7500

|

Nil

|

|

From 5001 to 7000

|

70

|

From 7501 to 15000

|

150

|

|

From 7001 to 9000

|

120

|

From 15001 and above

|

208

|

|

From 9001 to 12000

|

140

|

||

|

From 12001 to 15000

|

190

|

||

|

From 15001 and above

|

208

|

Maharashtra Minimum Wages 1st July 2018 to 31st December 2018 has been published

Marathi Version Notification:- Final D.A. 01.07.2018 to 31.12.18

Marathi Version Notification:- Final D.A. 01.07.2018 to 31.12.18

English Version with Basic wages: – Minimum-Mumbai-English-01-07-2018

Dear all,

As we all are aware that as EPF withdrawal is now online and in major cases Pan is not getting verified as Now NSDL has intiated a online process where in we can do the changes online

As we all are aware that as EPF withdrawal is now online and in major cases Pan is not getting verified as Now NSDL has intiated a online process where in we can do the changes online

Everyone has experienced a typo in their ID cards or other documents and most of us go ahead without ever getting it corrected.

Ever since the government made linking Aadhaar cards with PAN cards mandatory, people have been running about trying to get any mismatched information rectified. If the data on both cards do not match, it could lead to problems in the future. Changing details on a PAN card can now be done online as well. Here is how to go about it:

The first thing to do is visit the National Securities Depository Limited’s (NSDL) website. Once here, click the drop-down menu under Application type and select Changes or correction in existing PAN data/Reprint of PAN card. Fill in all the correct details, enter the captcha code to prove you are human and then hit Submit.

Once the submission is over, the next step involves choosing how PAN documents should be submitted. The e-KYC option needs an Aadhaar card,

Important instructions for paperless PAN application through e-KYC / e-Sign

1. To avail e-KYC / e-Sign Services, Aadhaar is mandatory and details given in Aadhaar should be exactly matched with applicant’s Full name, Date of Birth and Gender as mentioned in this application form to authenticate Aadhaar.

2. Once authentication of Aadhaar is successful then one-time password (OTP) would be sent on your mobile number/email ID linked with your Aadhaar to generate Aadhaar Based e-Sign.

3. To check registered mobile number/email ID in Aadhaar, please visit at https://resident.uidai.gov.in/verify-email-mobile.

4. In e-Sign Service, an applicant needs to upload Photo, Sign and supporting document as per prescribed format

5. In e-KYC & e-Sign (Paperless), no need to upload Photo, Sign and supporting document. The photograph used in Aadhaar card would be printed in PAN card.

6.e-KYC & e-Sign (Paperless) and e-Sign facility are not available for Minor applicants and other categories of applicants as provided u/s 160 of Income-tax Act, 1961 where Representative Assessee is appointed by the applicant.

the e-Sign option needs scanned images of the documents submitted or the documents can be physically sent to the nearest NSDL collection center. Choose the most suitable option and hit Next.

Fill out the details on the next page carefully, especially ones marked with a red asterisk. All details should exactly match the ones on the Aadhaar card and select which field requires the appropriate correction.

The next step is filling in address details followed by uploading and submitting accepted proof of identity, age, and address.

If the proof submitted is an Aadhaar card, then the Aadhaar number will have to be entered in order to proceed.

After hitting Submit, a preview of the application form will pop up. Verify all details, make any necessary changes and then proceed towards payment.

Payment

The processing fee is different for addresses within and outside India: Rs 110 from domestic addresses and Rs 1,020 for addresses outside the country.

Payment can be made through a demand draft, debit or credit cards or net banking.

A demand draft (if used) should be in favor of NSDL – PAN and payable at Mumbai.

After clicking Pay confirm, a page will appear indicating whether the transaction was successful or not. If yes, a transaction number and a bank reference number will be shown. Both should be saved and then choose Continue.

The next step will be authenticating via Aadhaar. Tick the box and then Authenticate.

If the personal details match those in the Aadhaar card, click Continue with e-Sign/e-KYC.

Generate OTP, enter it and then hit Submit.

The next page will feature the application as it was submitted. This can either be downloaded directly from the page or from the acknowledgment email.

The new PAN card will be printed and sent to the address provided.

This is the entire process on how to make changes to a PAN card to match it with the Aadhaar.

@Courtesy https://www.moneycontrol.com

As there have been many states amendment in the profession tax slab & we had already uploaded the respective notification time to time in our blogs & in order to have a consolidated all states ( Pan India) slab has been prepared for ready reference

|

The Profession Tax assessment and collection is coming under the provision of tax on professions, trades, calling & employments, under the Tamilnadu Municipal Laws (Second Amendment) Act 1998 Profession Tax is higher source of income next to Property Tax. The Profession Tax assessment is calculated based of the Half Yearly gross income for the following categories.

Every Company transacts business and every person who is engaged actively or otherwise in any Profession, Trade, Calling and Employment with the Greater Chennai Corporation city limits has to pay half-yearly Profession Tax, as per section 138 C of Tamilnadu Municipal Laws Second Amendment Act 59 of 1998. The tax rates are given below in the table in Form-2. for assessment of Profession Tax has to make an application for registration.

Based on the gross income declared by the Half Yearly Profession Tax will be calculated as per the Table given below:

After 10 Years the respective act has been amended he new slab is given below

|

||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||

Notification 👉CHENNAI PT SLAB NEW 2018

Dear Employer

Good News Reduction of PF Admin Charges from 0.65 % to 0.50% the said reduction is effective from 1st June 2018 subject to a minimum sum of seventy-five rupees per month for every non-functional establishment having no contributory member and five hundred rupees per month per establishment for other establishments.

Notification 👇

Download:- Reduction of PF Admin Charges

Now the total challan amount will be

Ac No. 1 :- 12+3.67%

Ac No 10 :- 8.33%

Ac No 2 :- 0.5%

Ac No 21:- 0.5%

Ac No 22:- Nil……..

Total contribution will be 25 %

Good News Reduction of PF Admin Charges from 0.65 % to 0.50% the said reduction is effective from 1st June 2018 subject to a minimum sum of seventy-five rupees per month for every non-functional establishment having no contributory member and five hundred rupees per month per establishment for other establishments.

Notification 👇

Download:- Reduction of PF Admin Charges

Now the total challan amount will be

Ac No. 1 :- 12+3.67%

Ac No 10 :- 8.33%

Ac No 2 :- 0.5%

Ac No 21:- 0.5%

Ac No 22:- Nil……..

Total contribution will be 25 %

For your Knowledge purpose & record purpose appended below is the road map of EPF ADMINISTRATIVE CHARGES PAYABLE BY THE EMPLOYERS OF UN–EXEMPTED ESTABLISHMENTS

|

EPF ADMINISTRATIVE CHARGES PAYABLE BY THE EMPLOYERS OF UN–EXEMPTED ESTABLISHMENTS

|

||

|

Period

|

Rate

|

Reckoned on

|

|

01.11.1952 to 31.12.1962

|

3%

|

Total employers’ and employees’ contributions.

|

|

01.01.1963 to 30.09.1964

|

3%

|

Total employer’s and employees’ contributions payable @ 6.25%.

|

|

2.4%

|

Total employer’s and employees’ contributions payable @ 8%.

|

|

|

01.10.1964 to 30.11.1978

|

0.37%

|

On total pay on which contributions are payable.

|

|

01.12.1978 to 30.09.1986

|

0.37%

|

On total pay on which contributions are payable. Minimum

Administrative charges payable per month per establishment was

Rs. 5/-.

|

|

01.10.1986 to 31.07.1998

|

0.65%

|

On total pay on which contributions are payable. Minimum

Administrative charges payable per month per establishment was

Rs. 5/-.

|

|

01.08.1998 to 31–12–2014

|

1.10%

|

On total pay on which contributions are payable. Minimum

Administrative charges payable per month per establishment is Rs.

5/-.

|

|

01.01.2015 to 31.03.2017

|

0.85%

|

On total pay on which contributions are payable. Minimum

Administrative charges payable per month per establishment is Rs.

500/-.

|

|

01.04.2017 onwards

|

0.65%

|

On total pay on which contributions are payable. Minimum

Administrative charges payable per month per establishment is Rs.

500/-.

|