🔎 Introduction

The Employees’ Provident Fund Organisation (EPFO) has redesigned the Electronic Challan-cum-Return (ECR) filing system. The Re-Engineered ECR introduces a stricter, more transparent process that links return filing, challan generation, and payment into a single workflow.

For employers and compliance teams, this reform means fewer loopholes but higher responsibility. Mistakes that were once manageable can now block filings, create bottlenecks, or trigger automatic penalties.

🏛 What is the Re-Engineered ECR?

The system integrates:

- 🗂 Return Filing – Regular, Supplementary, and Revised Returns.

- 🧾 Challan Generation – with unique TRRN (Temporary Return Reference Number).

- 💻 Payment – linked directly to the return.

Once a return is approved, it ❌ cannot be cancelled. Errors must be corrected through a Revised Return. Employers therefore need strong internal checks before approval.

📑 Types of Returns

1️⃣ Regular Return

- 📅 Filed every wage month for all active members.

- 📊 Contribution rate: 12% (default) or 10% for notified establishments.

- ⏳ First 4 months after rollout → partial filing allowed.

- 🚨 From the 5th month onwards → Regular Return will be accepted only if all active members of earlier months are filed.

2️⃣ Supplementary Return

- 👥 Used to add new employees missed in the Regular Return.

- 🔄 Multiple Supplementary Returns allowed for a month.

- ⚠️ Restriction: a member once added cannot be repeated in another Supplementary Return for that month.

3️⃣ Revised Return

- ✍️ Used to correct wrong wages, contributions, or member details already filed.

- 🔄 Once approved, it overwrites earlier filed data.

- 📉 Downward revisions: allowed only before challan/payment.

- 📈 Upward revisions: allowed anytime.

🛠 Filing Workflow – Step by Step

- 🔐 Login to EPFO Employer Portal.

- 📤 Upload the .txt file in prescribed format.

- ✅ Approve or ❌ Reject after validation.

- 📊 On approval → System generates Due Deposit Balance Summary.

-

💰 Select payment type:

- Full Payment

- Part Payment (via contribution file)

- Admin/Inspection Charges

- Interest (7Q) & Damages (14B)

- 🧾 Generate challan → TRRN assigned.

- 🏦 Make payment via net banking.

⚠️ Key Compliance Risks

- 👤 Missed Members → From the 5th month, filings will be blocked if even one earlier active member is not filed.

- 🚪 Unmarked Exits → If exit dates are not recorded, employees remain active and block new returns.

- 🛑 No Cancellation → Once approved, returns cannot be withdrawn. Only Revised Return can fix errors.

- 💸 Automatic Penalties → Section 7Q (interest) and Section 14B (damages) apply for delays or misreporting, with challans auto-generated.

✅ Best Practices for Employers

- 🚪 Record employee exits promptly in the portal.

- 👥 Add new joinees immediately via Supplementary Return.

- 🔍 Verify every return statement carefully before approval.

- 💾 Save TRRNs, challans, and bank receipts as compliance proof.

- 📋 Maintain a monthly checklist linking payroll data, active member list, and contribution files.

❓ Frequently Asked Questions — EPFO Re-Engineered ECR (Deep Dive)

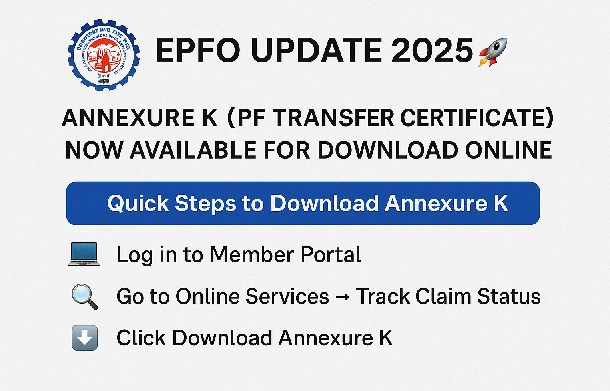

1) 🏛 What exactly changed in the “Re-Engineered ECR”?

The filing flow is now tightly integrated: upload → validate → approve → summary → challan (TRRN) → bank payment. Once a return is approved, you can’t cancel it. Corrections go through a Revised Return only. You also get stricter checks on member coverage, especially after the 4-month relaxation window.

2) 🔐 Where do I start filing in the employer portal?

Login → Payments → Return Filing (Quick Links) → Return Filing Home Page → Return Monthly Dashboard. Choose wage month, hit Search, then View/Upload to proceed.

3) 🧾 What file format is accepted?

A single .txt file in the exact schema. If the portal sees format or data issues, it generates an error file. Download it, fix the rows it flags, and re-upload.

Pro tip: Always run an internal validation (UAN present, wage values numeric, contribution math correct, correct contribution rate) before upload.

4) 👥 Who must be included in a Regular Return?

All active members for that wage month. During the first 4 months post-rollout, EPFO lets you file a partial Regular Return. From month 5 onward, your Regular Return is accepted only if all earlier active members are already filed. One missed member can block you.

5) 🚪 How should we handle exits so filings don’t get blocked?

Record the Exit Date promptly on the portal. If an exit isn’t marked, that person still counts as “active” and can block future Regular Returns. Make “exit updates” a month-end ritual.

6) 📊 Should I pick 12% or 10% contribution?

Select the legally applicable rate for your establishment (most use 12%; certain notified classes are 10%). Pick it at upload. If you select the wrong rate and approve, you’ll need a Revised Return.

7) ✅ What does “Approve” actually do?

After upload, the system shows a Return Statement. If you Approve, the system locks that dataset and generates a Due Deposit Balance Summary. From there you move into challan generation and payment.

Rule of thumb: If anything looks off, Reject instead of Approve. Fix. Re-upload.

8) ❌ Can I cancel an uploaded return after approval?

No. Once approved, a return cannot be cancelled. If data is wrong, file a Revised Return. If payment is already initiated, downward changes aren’t allowed for that month; upward changes are fine via Revised Return.

9) 🔁 When should I use a Supplementary Return?

Only to add new joinees you missed in the Regular Return. You can file multiple Supplementary Returns for the same month, but each member can be added only once for that month. It isn’t for wage corrections—use Revised Return for that.

10) ✍️ When should I use a Revised Return?

Use it to correct wrong wages, contributions, or member details that were already filed (in Regular or Supplementary). On approval, it overwrites the prior data.

- Downward revisions: allowed only before challan/payment for that month.

- Upward revisions: allowed anytime.

Also, you can’t file a Revised Return while another return for that month is “in process.”

11) 🧮 What is the “Due Deposit Balance Summary”?

After approval, the portal shows your account-wise dues for that month (what’s payable vs what’s already covered). From here you can choose Full Payment, Part Payment, Admin/Inspection Charges, or 7Q/14B.

12) 💳 What’s the difference between Full Payment and Part Payment?

- Full Payment: One shot challan covering all dues for the month.

- Part Payment: You upload a contribution file for a portion of dues, approve that file, then generate a challan just for that portion. You can repeat until the balance is zero.

Use Part Payment if you’re regularising phased recoveries or staging cash flows while staying compliant.

13) 🔢 What is TRRN and why is it critical?

TRRN (Temporary Return Reference Number) is the unique ID for each challan. It links your return, the payable amount, and your bank payment. It’s your audit-grade proof. Always archive TRRNs and bank receipts by month and by entity.

14) 🏦 Can I cancel a challan?

In-process challans (generated but not paid) generally show options like Pay or Cancel. If you haven’t paid and something’s off (wrong amount, wrong account mix), cancel and regenerate correctly. Once paid, you can’t cancel—use the returns workflow to correct future dues.

15) ⏳ How do 7Q (interest) and 14B (damages) fit in?

The portal provides a direct challan entry for 7Q (interest) and 14B (damages). If liabilities exist, prepare those challans and pay them alongside or after contribution challans. Treat them as statutory clean-up; they’re not optional.

16) 🧩 We’re stuck in month 5 because earlier members are still missing. What’s the way out?

Two steps only:

- Fix status: Mark exits for leavers on the portal; fix UAN/KYC issues.

- Supplementary Return: Add the still-active, missed members for those earlier months.

Once approved, the system unlocks your current Regular Return.

No bypass exists—close the gaps or you stay blocked.

17) 🧰 What’s inside the error file and how do we use it well?

The error file highlights row-level problems (format, missing UAN, invalid values, etc.). Correct exactly what it lists; don’t guess. Re-generate your .txt cleanly and re-upload. Build a small internal “common errors” sheet so the same mistakes don’t recur.

18) 🧪 What are the safest pre-approval checks?

- UAN present, not deactivated.

- Gross wages, EPF wages, and contribution math tally.

- Contribution rate matches establishment.

- New joinees included (or planned for Supplementary).

- Leavers marked Exited in the portal.

- No duplicate rows for the same UAN/month.

Download the Return Statement and sanity-scan before hitting Approve.

19) 🧯 We approved the return with wrong wages. What now?

If no payment yet: file a Revised Return with the correct wages.

If payment already made:

- For downward corrections, you can’t revise that month’s paid dues. Adjust through permissible future workflows as advised by statute/EPFO office.

- For upward corrections, file a Revised Return and pay the difference.

20) 🧑💻 Can we run multiple returns in parallel for the same month?

No. If a return (Regular/Supplementary/Revised) is in process for that wage month, you can’t start another for that month. Finish, approve (or reject), then proceed.

21) 📚 What should we archive for audit defence?

- Active Member List (downloaded pre-filing).

- Return Statement PDFs.

- Due Deposit Balance Summary.

- Contribution file approvals (for Part Payment).

- TRRNs, challans, and bank receipts.

- Any 7Q/14B challans and receipts.

- Email trail for late joinee data/exit confirmations from client teams.

22) 🧭 How do we train our team to avoid bottlenecks?

- Monthly cut-off checklist: exits marked, joinees verified, payroll vs Active Member List reconciled.

- Two-person rule: one prepares .txt, a second reviews Return Statement.

- Error library: keep a living doc of common validation failures and fixes.

- Tracker: log TRRN, challan date, amount, bank reference—by entity and month.

23) 🧷 Can I add the same employee twice in Supplementary Return?

No. The system won’t allow the same member again for the same wage month. Add once, correctly. If the wages are wrong, that’s a Revised Return job, not Supplementary.

24) 🧭 How should we decide between Immediate Supplementary vs Waiting for Revised?

- Missed new joinee → Supplementary immediately.

- Wrong data for someone already filed → Revised Return.

- Unsure? Ask: “Is this a new person for this month or a data correction?” New = Supplementary; Correction = Revised.

25) 🧩 Any quick, practical example set?

A) New joinee missed

- Regular Return already approved; Rahul (joined mid-month) not included.

- File Supplementary with Rahul. Approve → Summary → Challan (TRRN) → Pay.

B) Wrong wages

- Priya’s EPF wages understated.

- If unpaid yet → Revised Return with corrected wages → new summary → challan → pay.

- If already paid → only upward correction is possible via Revised Return; pay the difference.

C) Month-5 block

- Two people show “active” for April because exits not recorded.

- Mark exits in portal (correct last working days).

- File Supplementary for any truly active missed members.

- Proceed to current month Regular Return once approved.

26) 🧱 What are the most common pitfalls—and the fixes?

- Pitfall: Approving before reading the Return Statement.

Fix: Always download and check the statement—then approve. - Pitfall: Not marking exits.

Fix: Add “Exit update” to your month-end payroll checklist. - Pitfall: Mixing “new joinee” vs “correction” in the wrong return type.

Fix: New joinee → Supplementary; Correction → Revised. - Pitfall: Losing TRRNs/receipts.

Fix: Centralised tracker + folder structure by entity/month.

27) 🧭 Bottom line—what mindset works best with the new ECR?

Think discipline over rework: close exits on time, capture joinees fast, verify before approval, and treat TRRN like gold. If you do these four things consistently, you’ll avoid blocks, interest, and damages—and your audits will be painless.

Official Circular :-