Government of Tripura vide notification number No.F.87 (30)-LAB/ENF/MW/SHOPS/2002(A)/1800-17, released minimum wage for the state of Tripura effective from 1st April 2020

Ahmedabad Employer in this epidemic situation as arisen, many employers were not able to pay the regular dues of Profession tax as deducted from salary to the Municipal corporation.

Good News is that now Profession tax payment can be paid online necessary procedure is given below

Procedure for Online Payment:- Ahmedabad Online_Prof_Tax_Payment_(PRC)_process

Hope now other municipal corporation also start the online payment option in Gujarat.

Good News is that now Profession tax payment can be paid online necessary procedure is given below

Procedure for Online Payment:- Ahmedabad Online_Prof_Tax_Payment_(PRC)_process

Hope now other municipal corporation also start the online payment option in Gujarat.

It is brought to your kind notice that the Ministry of Labour & Employment, Govt. of India has published a Gazette Notification (attached) bearing no.: S.O. 1513(E ) dated 18th May 2020 to further, provide liquidity in the hands of employers and employees as financial support due to COVID -19.

The followings are the important notes/information for your kind reference and consideration before taking/initiating any steps by covered ‘establishment/company/organization’ under the EPF & MP Act, 1952 to further seek the monetary benefits under the present scheme/notification:

- That the said notification is not applicable on any establishment, other than Central Public Sector Enterprises and State Public Sector Enterprises and other establishments owned by, or under the control of the Central Government or the State Government, as the case may be, in respect of wages payable by it for the months of May, June, and July 2020

- That any establishment shall not be eligible in case any establishments eligible for relief under the Pradhan Mantri Garib Kalyan Yojana guidelines issued by the Employees’ Provident Fund Organization vide its Office Memorandum No.C-1/Misc./2020-21/Vol.II/Pt. dated 9th April 2020 ”.

- That the said monetary benefits scheme is presently applicable for limited wages period i.e. May paid in June, June paid in July and July paid in August 2020.

|

Account Head

|

Up to wage month

April 2020

|

From wage months

May 2020 to July 2020

|

|

Employee’s PF Contribution – A/c .No: 1

|

12%

|

10%

|

|

Employer’s PF Contribution – A/c. No: 1

|

3.67% (12%–8.33%)

|

1.67% (10%–8.33%)

|

|

Employer’s EPS Contribution – A/c. No: 10

|

8.33%

|

8.33%

|

|

EDLI Contribution – A/c. No: 21

|

0.50%

|

0.50%

|

|

Administrative Charges – A/c. No: 2

|

0.50% (Mini.Rs.500/-)

|

0.50% (Mini.Rs.500/-)

|

|

No change in inspection charges in A/c.No.22 in respect of EDLI exempted establishments

|

||

Keeping view of above and add to it, we have received many queries from employers and employees in respect on the followings in this regard EPFO has shared the respective Faq on the same

In the respective FAQ, many points are clear as per the queries received.

Now it is option to the company/Service providers ( Contractors) to change the contribution rate from 12 % to 10 % as per the Management decision & Principal Employer but I would suggest that there is no need to change the rate of contribution for the following reason

For example, if the monthly basic salary is Rs 30,000, the employee contribution towards his or her EPF would be Rs 3,600 a month (12 percent of basic pay), while the equal amount is contributed by the employer each month. If the contribution rate is reduced to 10 percent, Rs 3,000 a month becomes the PF contribution by the employee and the take-home pay will increase by Rs 600.

1. Impact on CTC

The employer’s contribution to EPF is a part of the CTC. As the employer is supposed to match the mandatory contribution rate, if it is reduced to 10 percent, the employer’s contribution to reduces. Thus, CTC too will see a fall, unless adjusted by the employer under some other head. Once adjusted and the employer decides to pay the 2 percent differential under some head, the take-home pay will increase, and for three months the workload of changing of CTC will also increase

The employer’s contribution to EPF is a part of the CTC. As the employer is supposed to match the mandatory contribution rate, if it is reduced to 10 percent, the employer’s contribution to reduces. Thus, CTC too will see a fall, unless adjusted by the employer under some other head. Once adjusted and the employer decides to pay the 2 percent differential under some head, the take-home pay will increase, and for three months the workload of changing of CTC will also increase

2. Impact on taxes saved.

As per the above take-home increase, Your contribution towards PF qualifies for tax benefit section 80C of the Income-tax Act. If the proposals go through, lesser contributions will mean that much less of tax benefit. For example, if annual contribution towards PF falls by Rs 7,200, then for someone paying 31.2 percent tax (highest slab), then you will save nearly Rs 2,250 lesser tax. One can, however, invest in products like in ELSS to save tax up to Rs 1.5 lakh in a year

As per the above take-home increase, Your contribution towards PF qualifies for tax benefit section 80C of the Income-tax Act. If the proposals go through, lesser contributions will mean that much less of tax benefit. For example, if annual contribution towards PF falls by Rs 7,200, then for someone paying 31.2 percent tax (highest slab), then you will save nearly Rs 2,250 lesser tax. One can, however, invest in products like in ELSS to save tax up to Rs 1.5 lakh in a year

3. Cumulative Interest Loss.

As EPF is on every month is giving Cumulative rate of Interest on a monthly basis if the contribution reduce Employee will be losing the Interest of three months which will be at a reduced rate, on both Employee Share & Employer Share.

From the above observation & referring to the Faq of the EPFO, I would suggest not to reduce the contribution rate as reducing the rate is not going to benefit either employee nor employer

Reduce rate Notification:- EPFO Reduces The Contribution Rate To Ten Per Cent From Existing Rate Of Twelve Per Cent

Faq on reduce rate:- FAQ_Reduced_rate_of_contribution

One more good news from ESIC as due to this epidemic many employers were not able to file the return or make the payment of Feb-2020 & Mar 2020, as per earlier circular wherein ESIC had extended the date pf payment of ESIC dues for Feb-2020 & Mar-2020 till 15th May 2020

Then also many Employers were not able to file the return or pay the dues of Feb-2020 & Mar-2020 till the extended date of payment i.e. 15th May 2020.

The employers are now allowed to file the return of Contribution up to 11.06.2020 for the contribution period from October 2019 to March 2020

Circular:- 👉ESIC Extension of Feb-2020 Mar 2020

Then also many Employers were not able to file the return or pay the dues of Feb-2020 & Mar-2020 till the extended date of payment i.e. 15th May 2020.

The employers are now allowed to file the return of Contribution up to 11.06.2020 for the contribution period from October 2019 to March 2020

Circular:- 👉ESIC Extension of Feb-2020 Mar 2020

As per Government Notification NO.J / 3432179 / 2020, CPI points for minimum wage calculation has been released for the state of Andhra Pradesh with effect from 1st April 2020

Govt Notification:-The Andhra Pradesh Minimum Wages Notification 1st April 2020

=============================================================

Shop &Establishment:-Andhra – Minimum wages – Shops and Estb – Apr-2020 to Sep-2020

Hotel &Restaurant:-Andhra – Minimum wages – Hotels – 1st Apr 2020 to 30th Sep 2020

Security Agencies:- Andhra – Minimum wages – Security – 1st Apr 2020 to 30th Sep 2020

Govt Notification:-The Andhra Pradesh Minimum Wages Notification 1st April 2020

=============================================================

Shop &Establishment:-Andhra – Minimum wages – Shops and Estb – Apr-2020 to Sep-2020

Hotel &Restaurant:-Andhra – Minimum wages – Hotels – 1st Apr 2020 to 30th Sep 2020

Security Agencies:- Andhra – Minimum wages – Security – 1st Apr 2020 to 30th Sep 2020

As per the press note released, Commissioner of Labour Telangana, Hyderabad and the Competent Authority under the Minimum Wages Act, 1948 has declared the CPI points for calculation of variable dearness allowance for the state of Telangana with effect from 1st April 2020

VDA Notification:-The Telangana Minimum Wages Notification 1st Apr 2020

=================================================

Shop & Establishment :-Telangana MW calculations – Shops & Estb – Apr-2020 to 30th Sep-2020

Hotel & Restaurant:-Telangana MW calculations – Hotels – 1st Apr 2020 to 30th Sep 2020

Security Agencies:- Telangana MW calculations – Security – 01.04.2020 to 30.09.2020

VDA Notification:-The Telangana Minimum Wages Notification 1st Apr 2020

=================================================

Shop & Establishment :-Telangana MW calculations – Shops & Estb – Apr-2020 to 30th Sep-2020

Hotel & Restaurant:-Telangana MW calculations – Hotels – 1st Apr 2020 to 30th Sep 2020

Security Agencies:- Telangana MW calculations – Security – 01.04.2020 to 30.09.2020

Kindly refer to Trade Circular no. 4T of 2020 dated 19/03/2020. By this circular the whole of the late fee payable by the registered employer in respect of monthly or annual returns pertaining to periods up to March 2020 was exempted due to technical difficulties faced by the taxpayers subject to fulfillment of eligibility conditions.

As these technical difficulties are still continuing, it is proposed to extend the date of filing returns without payment of the late fees.

Eligibility Conditions:-

i) Any amount payable (tax+ interest) as per return should have been/shall be paid on or before the filing of returns.

ii) The aforesaid employers should submit the returns pertaining to any periods up to March 2020 on or before 31 May 2020.

Needless to mention that no refund or adjustment against any tax liability shall be allowed where the late fee has already been paid.

Revocation of Late fee exemption:

If it is found that the employer has not fulfilled the conditions or has submitted false information to avail the benefit of exemption then, his exemption of late fee shall be revoked and action will be taken against him as per the provisions of law.

Circular:- 👉 Extension for PT returns-Maharashtra

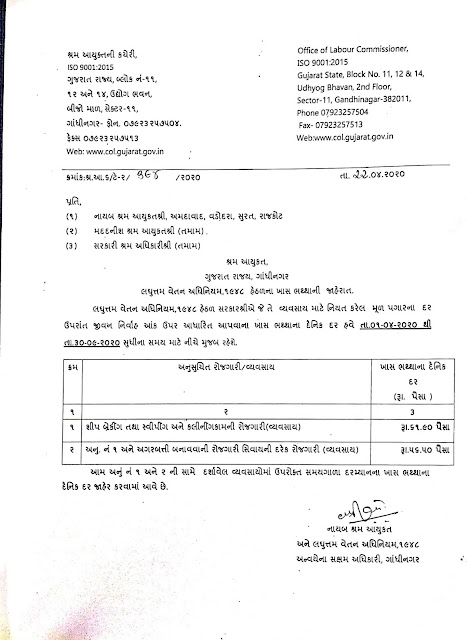

As per the notification on Dt. 22-04-2020 regarding. The State Government declared the fresh basic rates of Salary/Wages for the period from Dt. 01-04-2020 to 30-09-2020 for 46 business in Zone – I & Zone – II. The same may please be paid during the above period.

English Detail Notification:- 👉Gujarat Minimum Wages 1st Apr-2020 to 30th Sep-2020

Gazette notification relating to the removal of difficulties order under the Karnataka Tax on Professions, Trades, callings and Employments Act, 1976.

The Order may be called the Karnataka Tax on Professions, Trades, Callings, and Employments (Removal of Difficulties) Order, 2020.

The change in remittance dates are as follows,

The PT Contribution for March 2020 payable by April 20, 2020, has got extended to May 20, 2020.

The PT Enrolment fees for 2020-21 payable by April 30, 2020, have got extended to May 30, 2020.

Circular :- 👉PT ORDER GAZETTE COPY.