Extension of Filing Dates for Profession Tax Returns in West Bengal: What You Need to Know

The Government of West Bengal’s Directorate of Commercial Taxes has recently issued an important update regarding the filing of Profession Tax returns for the year ending 31st March 2024. This extension is crucial for taxpayers in the state and comes as a relief amidst the prevailing circumstances. Here’s a detailed breakdown of the new dates and their implications.

Background

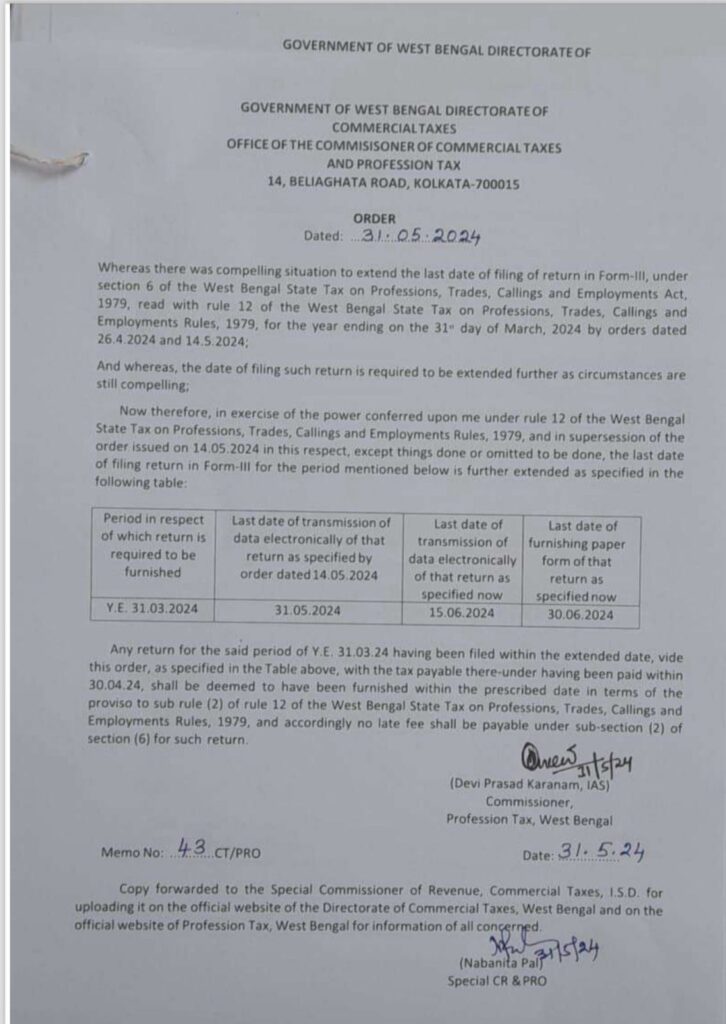

Due to compelling situations that necessitated an extension, the Directorate has pushed the deadlines for filing returns in Form-III. This decision was made under the provisions of Section 6 of the West Bengal State Tax on Professions, Trades, Callings and Employments Act, 1979, read with Rule 12 of the corresponding Rules.

New Filing Deadlines

The new deadlines are as follows:

- Electronic Transmission of Returns: The last date to transmit the return data electronically has been extended to 31st May 2024.

- Electronic Transmission of Return Data: Taxpayers now have until 15th June 2024 to electronically transmit the detailed data of their returns.

- Submission of Paper Forms: The final date for submitting the physical paper forms of the returns is now 30th June 2024.

These extensions provide additional time for taxpayers to comply with the filing requirements without facing penalties.

Implications for Taxpayers

- Timely Compliance: Any returns for the year ending 31st March 2024, filed within these extended dates, along with the tax payments made by 30th April 2024, will be considered as filed within the prescribed period. This means no late fees will be applicable for these returns.

- Avoidance of Penalties: This extension ensures that taxpayers have sufficient time to prepare and submit their returns accurately, thereby avoiding any potential penalties for late filing.

Official Communication

The order was officially dated on 31st May 2024 and was signed by Devi Prasad Karanam, IAS, Commissioner, Profession Tax, West Bengal. Nabanita Pal, Special CR & PRO, also authenticated the communication. The order emphasizes that the extensions were necessary due to ongoing compelling circumstances that affected the original deadlines.

Conclusion

This extension is a significant step by the West Bengal Directorate of Commercial Taxes to accommodate taxpayers amidst challenging times. Taxpayers are advised to take note of these new dates and ensure compliance to avoid any late fees or penalties.

For further details or specific queries, taxpayers can refer to the official website of the Directorate of Commercial Taxes, West Bengal.

Stay informed and ensure timely compliance to benefit from this extended filing period.