Enhancing Financial Security: The Latest Amendments to the Employees’ Pension Scheme (EPS) 1995

The Employees’ Pension Scheme (EPS) 1995 has been a pillar of financial security for millions of Indian workers. Recently, the Ministry of Labour and Employment announced significant amendments to this scheme, aiming to improve the pension benefits for retirees. This blog explores these amendments in depth, explaining what they mean for employees and employers alike.

Understanding the Employees’ Pension Scheme (EPS) 1995

The EPS was established under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. It ensures that employees have a steady income post-retirement. The scheme is funded by contributions from both employees and employers:

- Employee’s Contribution: 12% of basic salary and dearness allowance.

- Employer’s Contribution: 8.33% of basic salary and dearness allowance goes towards EPS, while the remaining 3.67% goes to the Employees’ Provident Fund (EPF).

Purpose of the Amendments

The latest amendments aim to adjust the factors used to calculate pension benefits, reflecting economic changes such as inflation and the rising cost of living. These changes are designed to enhance the financial security of retirees.

Detailed Explanation of the Amendments

Revised Factors in Table B

Table B in the EPS 1995 specifies factors used to calculate the pension amount based on the employee’s age at retirement. The new factors introduced by the Employees’ Pension (Amendment) Scheme, 2024, are as follows:

Years | New Factor |

|---|---|

Less than 35 years | 14.2271 |

Less than 36 years | 15.36555 |

Less than 37 years | 16.59509 |

Less than 38 years | 17.92303 |

Less than 39 years | 19.35722 |

Less than 40 years | 20.90618 |

Less than 41 years | 22.57909 |

Less than 42 years | 24.38586 |

Original Table B for Comparison

Here is the original Table B, showing factors used for past service benefits:

Years | Factor |

|---|---|

Less than 1 | 1.039 |

Less than 2 | 1.122 |

Less than 3 | 1.212 |

Less than 4 | 1.309 |

Less than 5 | 1.413 |

Less than 6 | 1.526 |

Less than 7 | 1.649 |

Less than 8 | 1.781 |

Less than 9 | 1.923 |

Less than 10 | 2.077 |

Less than 11 | 2.243 |

Less than 12 | 2.423 |

Less than 13 | 2.616 |

Less than 14 | 2.826 |

Less than 15 | 3.052 |

Less than 16 | 3.296 |

Less than 17 | 3.560 |

Less than 18 | 3.845 |

Less than 19 | 4.152 |

Less than 20 | 4.485 |

Less than 21 | 4.843 |

Less than 22 | 5.231 |

Less than 23 | 5.649 |

Less than 24 | 6.101 |

Less than 25 | 6.589 |

Less than 26 | 7.117 |

Less than 27 | 7.686 |

Less than 28 | 8.301 |

Less than 29 | 8.965 |

Less than 30 | 9.682 |

Less than 31 | 10.457 |

Less than 32 | 11.294 |

Less than 33 | 12.197 |

Less than 34 | 13.173 |

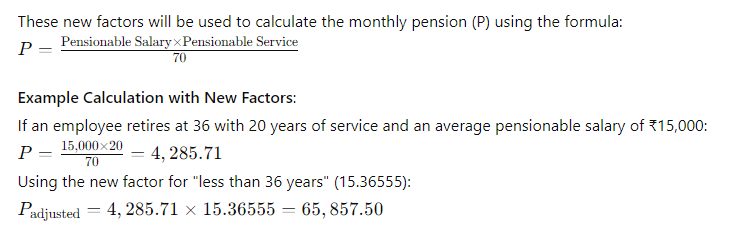

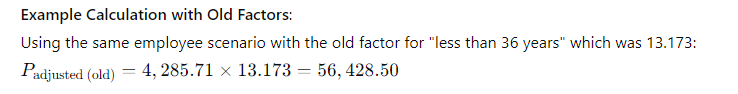

Comparing Old and New Calculations

By comparing the adjusted pensions:

- Old Factor Calculation: ₹56,428.50

- New Factor Calculation: ₹65,857.50

The difference in pension due to the updated factor is ₹9,429.00, representing an increase of approximately 16.7%.

Effective Date

The amendments are effective from the date of their publication in the Official Gazette, i.e., June 14, 2024. All pension calculations post this date will use the revised factors.

Implications of the Amendments

- Enhanced Pension Benefits: The new factors result in higher pension payouts for employees, significantly improving their financial well-being post-retirement.

- Financial Security: Increased pension amounts help retirees manage inflation and rising living costs more effectively, ensuring better financial stability.

- Incentivizing Longer Service: Employees might be motivated to extend their service duration to maximize pension benefits, potentially reducing turnover rates.

- Employer Contributions: Employers may need to reassess their financial commitments to EPS, as the increased factors could lead to higher contributions towards the pension fund.

Conclusion

The Employees’ Pension (Amendment) Scheme, 2024, represents a significant step forward in enhancing the pension framework under EPS 1995. By updating the factors used in pension calculations, the government aims to provide better retirement benefits to employees, ensuring financial security in their later years.

Understanding these changes is crucial for both employees and employers. Employees should stay informed about their pension entitlements and plan their retirement accordingly. Employers must ensure compliance with the new regulations and adjust their financial strategies to accommodate the increased pension liabilities.