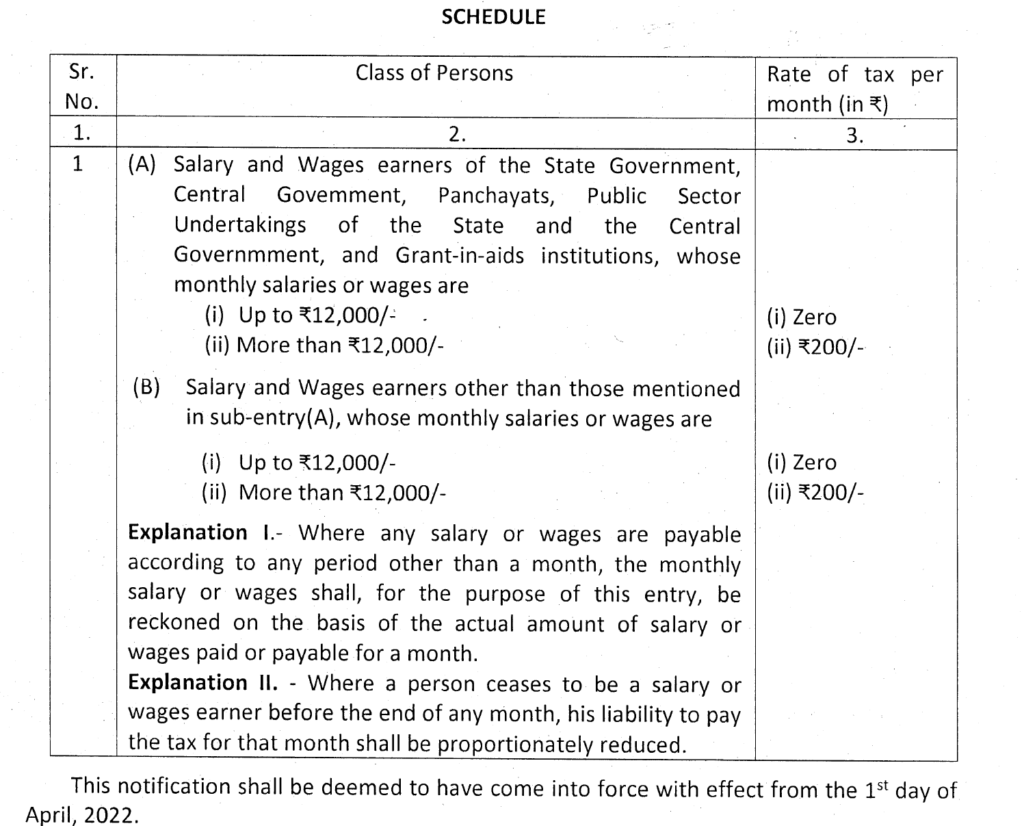

Gujarat Professional Tax on salary has been changed w.e.f. 1st April 2022

Gujarat Professional Tax on salary has been changed w.e.f. 1st April 2022

ESIC Central Rule 55 amended. As per this amendment an Insured Woman who availed Maternity Benefit need not pay 70 days contribution to become entitled to Sickness Benefit in the following Benefit Period. She need contribute only for the half number of remaining days in the relevant Contribution Period. Before this amendment many Insured Women who availed Maternity Benefit were deprived of Sickness Benefit for want of 70 days contribution. To get over this injustice the Rule has been amended that also with effect from 20.1.2017.

The Government of Tamil Nadu vide a notification dated 30th March 2022 publishes the Amendments to the Tamil Nadu Shops and Establishments Rules which deletes the Form P (a Register of Fines, deductions for Damages or Loss and Advances) and Q (register of wages) and inserts new Forms U, V, W and X to the Tamil Nadu Shops and Establishments Rules, 1948. The amendment also makes way to the employers to maintain registers electronically. The changes brought by the amendment are as follows-

The Government of Uttarakhand vide notification No 1064/4-01/13 has released Minimum Wages effective from 1st April 2022

Bihar Minimum wages has been revised from 1st Apr 2022 to 30th Sep-2022

Central Minimum Wages Revised from 1st Apr 2022 to 30th Sep-2022

The Central Government hereby appoints the 1st day of April,2022, as the date on which the provisions of the said Act, namely,—

(i) sections 38, 39, 40, 41, 42, 43 and sections 45A to 45H of Chapter IV(Contribution)

(ii) sections 46 to 73 of Chapter V ( Benefits) and

(iii) sections 74, 75, sub-sections (2) to (4) of section 76, 80, 82 and 83 of Chapter VI (Adjudication of disputes and claims) shall come into force in all the areas of Nagapattinam district in the State of Tamil Nadu.

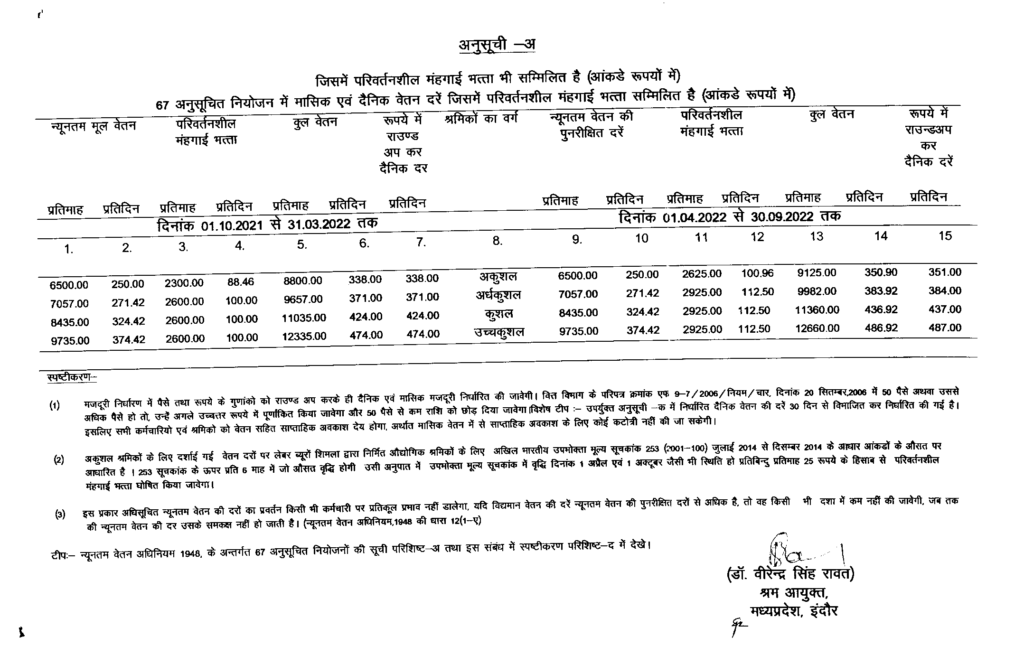

Madhya Pradesh Minimum wages has been revised from st Apr 2022 to 30th September 2022

Gujarat Minimum wages has been revised from 1st Apr 2022 to 30th Sept 2022

Gujarati Circular :-

English Version :-

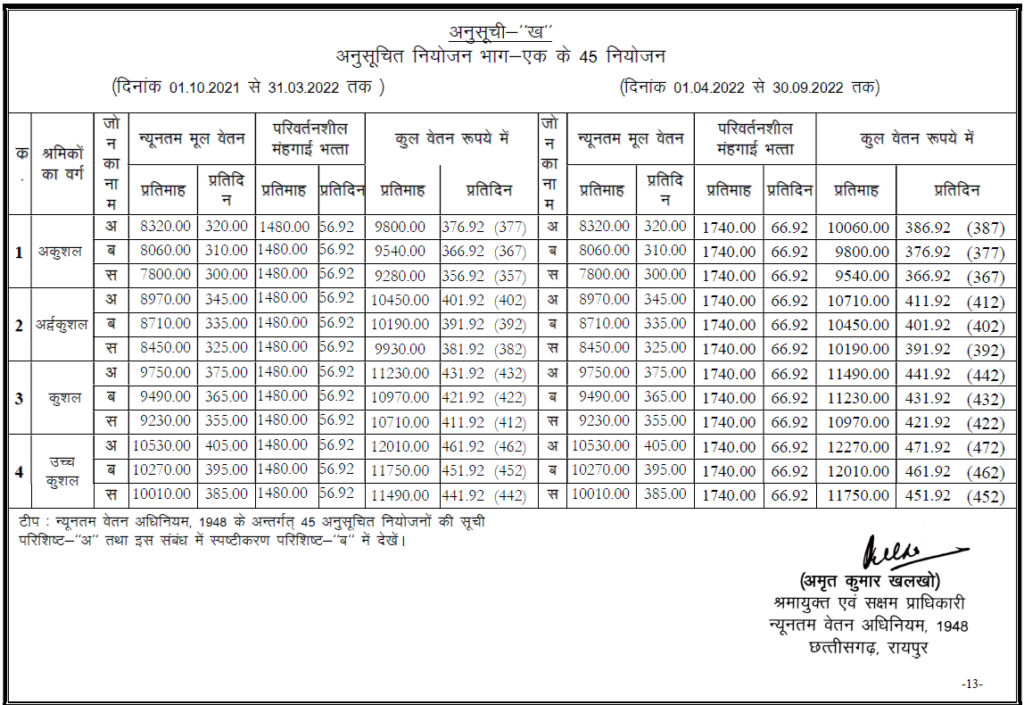

The Government of Chhattisgarh vide notification No/08/2022/1897, has revised the VDA effective from 1st April 2022 to 30th September 2022