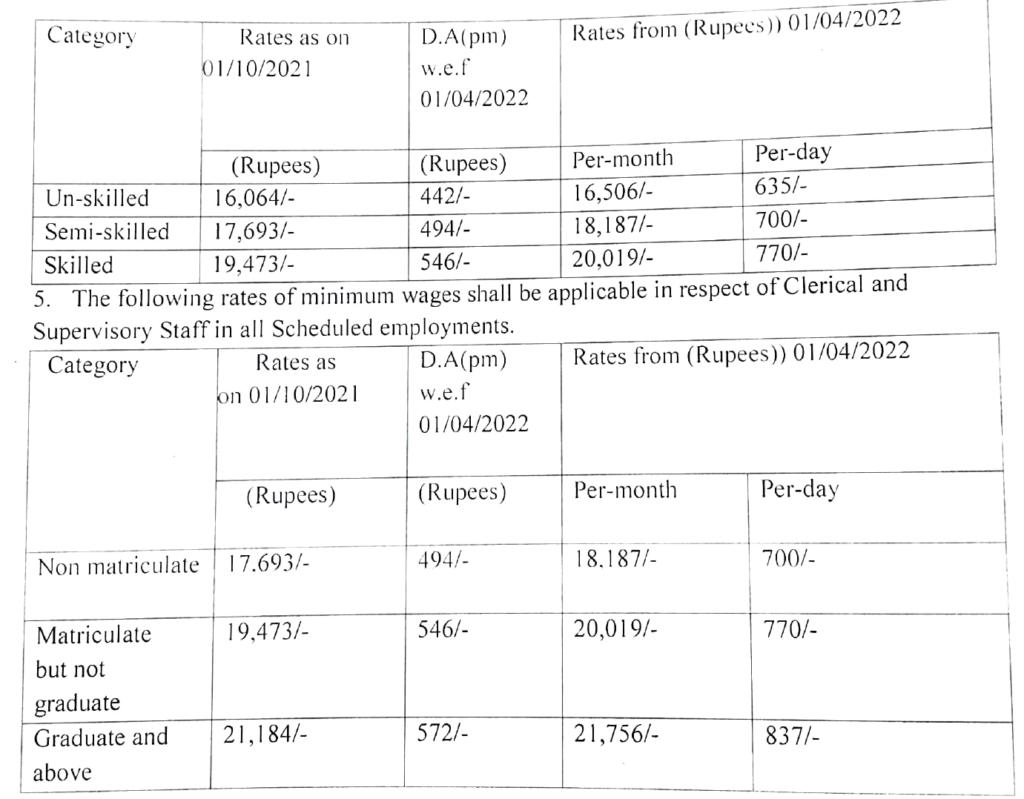

The Government of Himachal Pradesh vide notification No. Shram(A)4-2/2018-P-II dated 28th May 2022, released the minimum wages effective from 1st April 2022. Please refer to the notifications for more details

The Government of Himachal Pradesh vide notification No. Shram(A)4-2/2018-P-II dated 28th May 2022, released the minimum wages effective from 1st April 2022. Please refer to the notifications for more details

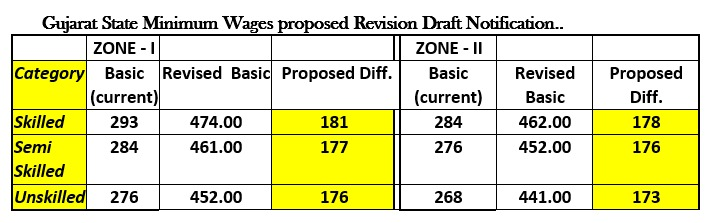

The Govt. of Gujarat has proposed revision of Basic Minimum Wages for which they have issued a Draft Notification with the list of the Scheduled employment, copy attached herewith for your kind information and perusal. Last revision was done in Jan’2015. The draft will be published in Gazette shortly with Two months grace period Inviting suggestions/ objections.

Whereas the Government of National Capital Territory of Delhi had last revised the minimum rates of wages in Schedule Employments under the Minimum Wages 12(142)/02/MW/VII/3636 dated 22/10/2019. And whereas, in the abovementioned notification, it was stipulated that the Dearness Allowance will be payable on the basis of six monthly average index numbers of January to June and July to December, on 1st April and 1St October respectively.

The following revised rates of minimum wages shall be applicable in respect of unskilled, semiskilled and skilled categories in all schedules employment:-

The Government of Maharashtra vide notification No. PFT-1222/C.R.8/Taxation-3 has extended the last date of filing returns for employers, who could not pay taxes or upload returns due to technical difficulties of the automation system, under the Maharashtra State Tax on Professions, Trades, Callings and Employments Rules, 1975, from March 2022 to May 31st, 2022. Please refer to the notification for more details

Odisha Minimum wages has been revised from 1st Apr 2022 to 30th Sep-2022 vide notification dated 30th Apr 2022

| Category | VDA per day with effect from April 01, 2022 | Minimum wages with VDA with effect from April 01, 2022 |

| Unskilled | Rs. 11.00 | Rs 326.00 |

| Semi-skilled | Rs. 11.00 | Rs 366.00 |

| Skilled | Rs. 11.00 | Rs 416.00 |

| Highly Skilled | Rs. 11.00 | Rs 476.00 |

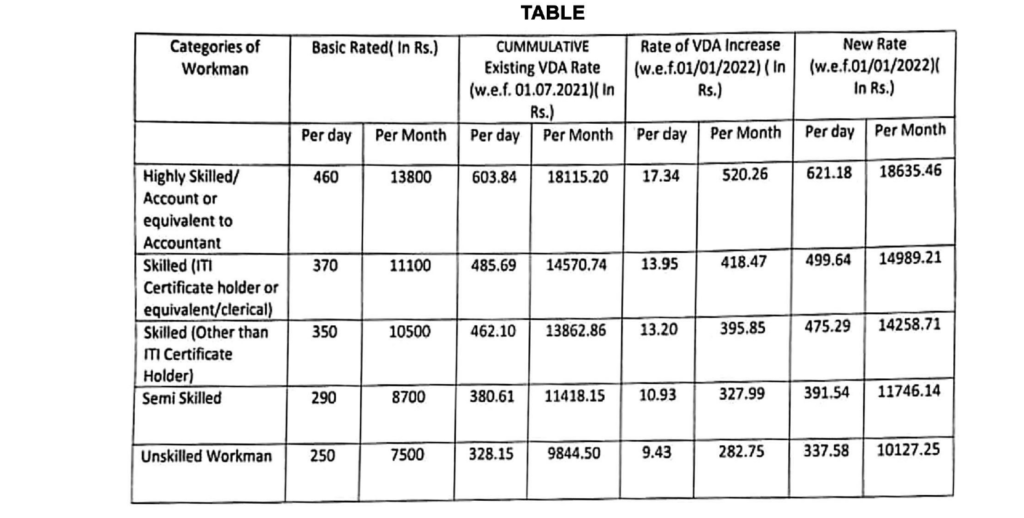

Assam Minimum wages has been hiked from 1st Jan 2022 to 30th June 2022 vide notification dated 20th Apr 2022

GOVERNMENT OF WEST BENGAL DIRECTORATE O F COMMERCIAL TAXES OFFICE OF TH E COMMISISONER OF COMMERCIAL TAXES AND PROFESSION TAX 14, BELIAGHATA ROAD, KOLKATA-7OOOl5 ORDER Dated: 29.04.2022

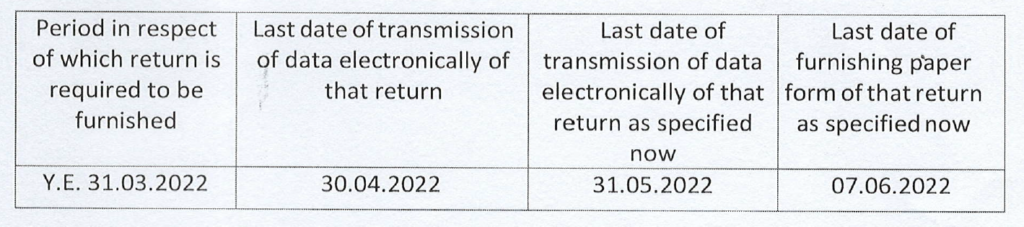

Now therefore, in exercise of the power conferred upon me under rule !2 of the West Bengal State Tax on Professions, Trades, Callings and Employments Rules, 1979 the last date of filing return in Form-lll for the period mentioned below is extended as specified in the following table:

Any return for the said period of Y.E, 3L.03.22 having been filed within the extended date, vide this order, as specified in the Table above, with the tax payable there-under having been paid within 30.04.22, shall be deemed to have been furnished within the prescribed date in terms of the proviso to sub rule (2) of rule 1.2 of the West Bengal State Tax on Professions, Trades, Callings and Employments Rules, 1979, and accordingly no date fee shall be payable under sub-section (2) of section (6) for such return

Keeping in view the problems being faced by the Employers in depositing ESI contribution for the contribution period March 2022, the Director General in exercise of powers vested under Regulation 100 has relaxed the provision as entered in Regulations 26 & 31 of the Employees’ State Insurance (General) Regulations, 1950.In this regard as a onetime opportunity, employers are allowed to deposit contribution for the month of March 2022 up to 30.04.2022 instead of 15.04.2022.

Accordingly, the employers are also allowed to file the Return of contribution up to 26.05.2022 instead of 11.05.2022 for the contribution period from October, 2021 to March, 2022. .

Only Payment due date has been extended & return of contribution due date has been extended

Pls find below is the list of