📅 Date: 13th October 2025

📍 Venue: New Delhi

👤 Chaired by: Dr. Mansukh Mandaviya, Hon’ble Union Minister for Labour & Employment and Youth Affairs & Sports

🗂️ Event: 238th Meeting of the Central Board of Trustees (CBT), Employees’ Provident Fund Organisation (EPFO)

🔹 Overview

The Central Board of Trustees (CBT) of the Employees’ Provident Fund Organisation (EPFO) held its 238th meeting on 13th October 2025, chaired by Dr. Mansukh Mandaviya, Union Minister for Labour & Employment and Youth Affairs & Sports.

Also present were Vice-Chairman Sushri Shobha Karandlaje, Co-Vice-Chairperson Ms. Vandana Gurnani, Mr. Ramesh Krishnamurthi (Secretary, Labour & Employment), and the Central Provident Fund Commissioner.

During the meeting, the Board approved several transformative policy changes, reflecting EPFO’s ongoing commitment to ease of living for members, ease of compliance for employers, and transparent governance.

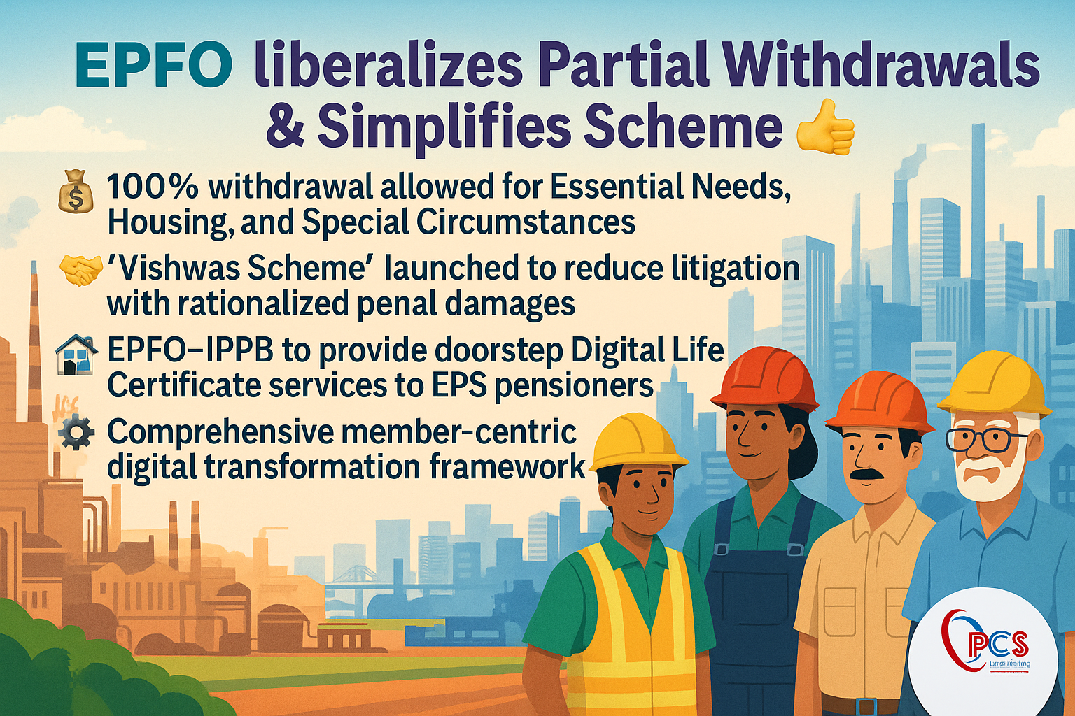

🔹 1. Liberalised & Simplified Partial Withdrawals

The Board approved simplified and liberalised provisions for EPF withdrawals, combining 13 complex rules into one streamlined framework.

✅ Key Highlights

|

Category |

Coverage |

New Rule / Limit |

Earlier Rule |

|---|---|---|---|

|

Essential Needs |

Illness, Education, Marriage |

– Education withdrawals allowed up to 10× of monthly wages. |

Multiple sub-clauses; separate service periods & documents. |

|

Housing Needs |

Purchase, construction, or repayment of home loan |

Members can withdraw up to 100% of eligible balance (employee + employer share). |

Capped at 90% with several forms and declarations. |

|

Special Circumstances |

Calamities, unemployment, epidemic, closure of establishment |

Members can apply without specifying reasons. |

Required declaration with detailed justification. |

🔍 Service Condition & Auto-Settlement

- Service Requirement: Uniformly reduced to 12 months.

- Minimum Balance: 25% of corpus must remain for continuous interest accumulation (8.25% p.a.).

- Automation: 100% system-based auto-settlement of partial claims to ensure instant disbursal.

📊 Impact:

These changes remove administrative bottlenecks, reduce rejection rates, and simplify access for over 7 crore active members.

🔹 2. Revised Timeline for Final Withdrawals

|

Type of Settlement |

Earlier Period |

Revised Period |

|---|---|---|

|

Premature Final EPF Settlement |

2 months |

12 months |

|

Final Pension Withdrawal (EPS-95) |

2 months |

36 months |

This ensures members maintain their accounts for a longer period, optimising retirement corpus accumulation while enabling access in genuine need-based situations.

🔹 3. Vishwas Scheme – Rationalised Penal Damages

To reduce litigation and encourage voluntary compliance, EPFO has launched the Vishwas Scheme, rationalising the penal damages under Section 14B of the EPF & MP Act, 1952.

⚖️ Context

As of May 2025, EPFO reported:

- Outstanding penal damages: ₹2,406 crore

- Over 6,000 litigation cases pending in High Courts, CGITs, and the Supreme Court

- Around 21,000 potential cases under e-proceedings portal

Historically, damage rates ranged from 5%–25% per annum (and up to 37% before 2008). These punitive rates led to massive litigation.

🧾 Key Provisions of Vishwas Scheme

|

Default Duration |

Revised Damages |

Earlier Rate |

|---|---|---|

|

≤ 2 months |

0.25% per month |

Flat 1% |

|

≤ 4 months |

0.50% per month |

Flat 1% |

|

> 4 months |

1.00% per month |

Flat 1% |

🔸 Applicability

The scheme covers:

- Pending litigation under Section 14B (CGIT, High Courts, Supreme Court)

- Finalised but unpaid 14B orders

- Pre-adjudication notices awaiting final order

📆 Validity

- Operative for 6 months, extendable by another 6.

- Compliance under the scheme will abate all pending cases automatically.

💬 Benefit:

- Predictable penalty regime.

- Reduced legal expenditure and disputes.

- Faster recovery of dues and improved trust in EPFO’s processes.

🔹 4. Doorstep Digital Life Certificate (DLC) for Pensioners

EPFO has approved a MoU with India Post Payments Bank (IPPB) to provide doorstep Digital Life Certificate (DLC) services for EPS-95 pensioners.

|

Feature |

Description |

|---|---|

|

Cost |

₹50 per certificate – fully borne by EPFO |

|

Beneficiaries |

All EPS-95 pensioners (urban and rural) |

|

Delivery Mode |

Through IPPB’s postmen and Gramin Dak Sevaks |

|

Integration |

With Centralised Pension Payment System (CPPS) |

🎯 Impact: Pensioners, especially in remote locations, can now verify life certificates from home — ensuring uninterrupted pension continuity and improved convenience.

🔹 5. EPFO 3.0 – Comprehensive Digital Transformation

EPFO has adopted a Core Banking + Cloud Native + API-First architecture called EPFO 3.0, focusing on automation, transparency, and real-time service delivery.

🚀 Key Modules Launched

|

Module |

Description |

Impact |

|---|---|---|

|

Re-engineered ECR Filing |

Simplified 4-step workflow (Upload → Validate → Generate → Pay). Real-time checks and integrated challan management. |

Faster reconciliation, reduced rejections, automated validations. |

|

Re-engineered User Management |

Enables creation of new offices via system (not possible since 2017). |

Strengthens district-level service coverage. |

|

Upgraded e-Office (v7) |

Enhanced document management and file tracking. |

Faster approvals and reduced backlog. |

|

SPARROW for APAR |

Online appraisal system for officers/staff. |

Promotes transparency and efficiency. |

💡 Benefits of EPFO 3.0

- Instant claim processing

- 24×7 availability

- Multilingual user interface

- Seamless payroll-linked contributions

- Improved data integrity & faster grievance redressal

🔹 6. Financial Governance – Appointment of Fund Managers

The CBT approved appointment of four Fund Managers to handle EPFO’s debt portfolio for 5 years.

This follows recommendations from the Selection Committee and Investment Committee, comprising CBT members, senior officials, and an external investment expert.

🎯 Goal: Strengthen portfolio diversification, prudent asset management, and maximise member returns on EPF savings.

🔹 7. Additional Announcements

🔸 PM-Viksit Bharat Rozgar Yojana (PM-VBRY)

- Announced by Hon’ble Prime Minister on 15th August 2025.

- Outlay of ₹99,446 crore; aims to create 3.5 crore jobs (Aug 2025–Jul 2027).

- August 2025 performance:

- 79,098 establishments under Part B (employer side)

- 6 lakh first-time employees under Part A

- 16.78 lakh UANs created using Face Authentication Technology (FAT).

🔸 Global Recognition

India honoured with ISSA Award 2025 at the World Social Security Forum, Malaysia, for expanding social security coverage from 19% (2015) to 64.3% (2025).

India also gains a seat on the ISSA Bureau, enabling leadership in international social-security collaboration.

🔸 India–UK DCC Agreement

Allows Indian employees on short-term deputation to continue contributing to their home-country PF accounts for up to 36 months – avoiding double contributions.

🔸 Operational Efficiency

- Interest @ 8.25% credited to all members by July 2025 — the earliest ever.

- Launch of Passbook Lite and Online Annexure-K for seamless account transfer visibility.

- Establishment of new zonal and regional offices to bring EPFO services closer to workers nationwide.

🧾 8. Summary of Key Highlights

|

Focus Area |

Key Decision |

Impact |

|---|---|---|

|

Member Convenience |

Simplified 100% EPF withdrawals |

Faster, paperless claim settlement |

|

Employer Relief |

Vishwas Scheme for penal damages |

Litigation-free compliance environment |

|

Pensioner Support |

Doorstep DLC via IPPB |

Ease of living for EPS-95 pensioners |

|

Technology Reform |

EPFO 3.0 Digital Framework |

Automation, real-time processing |

|

Governance & Finance |

Appointment of fund managers |

Prudent investment and transparency |

|

Social Security Expansion |

PM-VBRY & ISSA recognition |

3.5 crore jobs + global leadership |

🧭 9. Conclusion

The 238th CBT meeting marks a transformational milestone for the EPFO.

From liberalised withdrawals to graded penalties, and from digital automation to doorstep pensioner services — every reform moves India’s social-security framework towards efficiency, equity, and empowerment.

💬 Dr. Mansukh Mandaviya stated:

“EPFO’s reforms reflect the Government’s commitment to ensure ease of living for members, ease of compliance for employers, and transparent governance for all.”