📄 Introduction

The Employees’ Provident Fund Organisation (EPFO) has always been at the centre of India’s social security system. With over 27 crore members contributing through various establishments, efficient record management and transparency in services have been a constant demand.

On 18 September 2025, EPFO introduced a major digital update: members can now download Annexure K (PF Transfer Certificate) directly from the EPFO Member Portal 💻. This facility, earlier restricted to inter-office communication, is now openly accessible to members, making PF transfers smoother, faster, and more transparent.

This move supports EPFO’s mission of “ease of compliance, ease of living” for both employers and employees.

📄 What is Annexure K?

Annexure K is a Transfer Certificate issued when a member changes jobs and transfers their Provident Fund (PF) accumulations. It is generated after the processing of Form 13 (Transfer Claim) and is crucial for seamless consolidation of PF accounts.

Contents of Annexure K include:

T C_ Annexure K

- 💰 PF balance with interest from the previous establishment.

- ⏳ Complete EPS service history required for pension calculation.

- 🏢 Employment details of both old and new establishments.

This certificate is prepared by the Transferor Office (source PF office) and sent to the Transferee Office (destination PF office). Now, with this update, the same certificate is downloadable by members themselves.

🔑 Why is Annexure K Important?

Changing jobs often means transferring your PF balance from one account to another. Without proper records, disputes and delays become common. Annexure K acts as the official proof of transfer.

- ✅ Proof of transfer completion – Ensures your PF balance is credited to your new PF account.

- 📊 EPS service continuity – Prevents loss of pensionable service, which is critical for retirement benefits.

- 📢 Grievance resolution – Helps when PF transfer is “approved but not reflecting” in the passbook.

- 🔍 Employer & auditor checks – Used during audits, reconciliations, and statutory compliance verification.

- 🛡️ Legal safeguard – Acts as documentary evidence in case of disputes with EPFO or employers.

💻 How to Download Annexure K from EPFO Member Portal

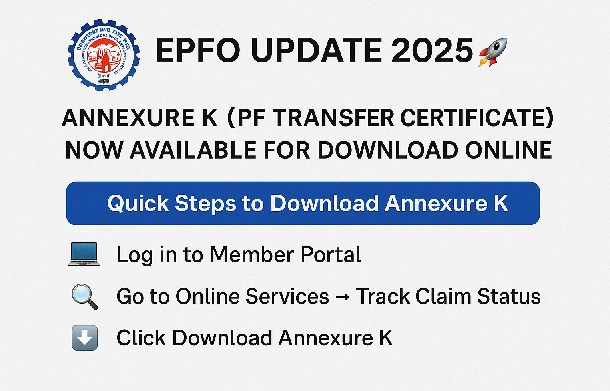

The new facility is available under Online Services on the EPFO Member Portal:

T C_ Annexure K

👉 Step 1: Log in to the EPFO Member Portal using your UAN & password 🌐.

👉 Step 2: Navigate to Online Services → Track Claim Status.

👉 Step 3: Choose the relevant PF transfer claim.

👉 Step 4: Click Download Annexure K 📄.

The document will be generated instantly as a PDF.

🌟 Benefits of the New EPFO Facility

- ⚡ Time efficiency: Members no longer need to visit PF offices.

- 🔒 Greater transparency: Members can directly verify PF transfer details.

- 👥 Member empowerment: Shifts control from office-dependent to member-driven.

- 📢 Faster grievance redressal: Members can attach Annexure K while raising online complaints.

- 📂 Audit readiness: HR teams can easily reconcile PF transfers during internal or statutory audits.

📊 Practical Scenarios Where Annexure K is Crucial

- 🔄 Job Switch Verification – After joining a new organisation, verify that your old PF balance is successfully credited.

- 📝 Pending PF Claim Settlement – Share Annexure K with EPFO if transfer credits are delayed.

- ⏳ Retirement & Pension Planning – Track and consolidate your total pensionable service under EPS.

- 📂 Employer Compliance Audits – Employers and consultants can cross-check transfers for statutory filings.

- 🛡️ Dispute Cases – Strong supporting document in case of mismatch between EPFO records and actual contributions.

🔎 FAQs on Annexure K

Q1. Is Annexure K required for every PF transfer?

👉 Yes, Annexure K is automatically generated once a Form 13 transfer claim is processed.

Q2. Can I download Annexure K for past transfers too?

👉 Yes, the new facility allows members to download Annexure K for both old and new processed claims.

Q3. What if my PF transfer is “approved” but not showing in my passbook?

👉 Download Annexure K and submit it to the destination PF office for reconciliation.

Q4. Does Annexure K affect my EPS (pension) service history?

👉 Absolutely. Annexure K carries your complete EPS service record, which is vital for pension eligibility.

Q5. Where can I raise issues if Annexure K details are wrong?

👉 You can raise a grievance on EPFiGMS (EPFO grievance portal) and attach the Annexure K copy for reference.

🚀 EPFO’s Digital Push – Bigger Picture

This update isn’t standalone. It’s part of EPFO’s larger move towards technology-driven, member-centric services. In recent years, EPFO has introduced:

- Online UAN activation & Aadhaar authentication 🔑

- Auto-transfer of PF balances upon new employment 🔄

- UMANG app integration for PF services 📱

- Online pension tracking and e-nomination filing ⏳

Together, these changes highlight EPFO’s commitment to transparency, speed, and digital convenience for millions of employees.

✨ Conclusion

The availability of Annexure K on the EPFO Member Portal is a milestone update. It eliminates dependency on PF offices, speeds up claim settlements, and provides employees with the power to verify their PF transfers independently.

Bottom line: The next time you change jobs or face PF transfer issues, don’t wait. Just log in to your EPFO Member Portal → Online Services → Track Claim Status → Download Annexure K ✅.

This single document can save weeks of delay, protect your pension service history, and give you complete clarity on your PF transfers.

📢 Stay connected with Prakash Consultancy Services (PCS) for regular updates on EPFO, ESIC, PT, LWF, Shops Act, and other labour law compliances.