The Labour Department of Puducherry has issued a revised notification regarding minimum wages for various industries and employment categories, effective from September 2024. The notification aims to ensure fair compensation for workers across different sectors by revising the wage structure. It is important for employers to comply with these new rates to avoid penalties under the Minimum Wages Act, 1948.

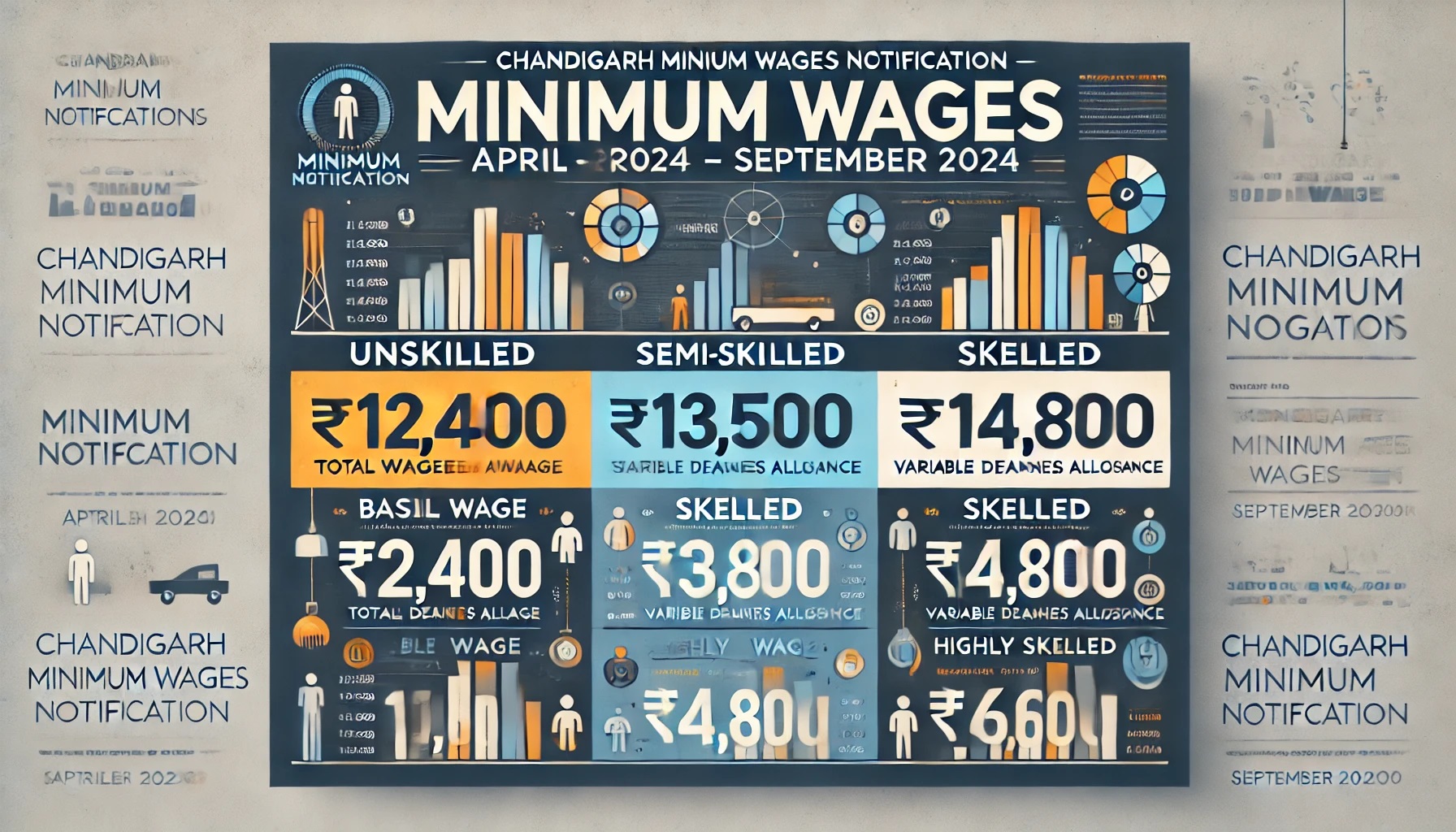

Comprehensive Minimum Wages for All Employment Categories (Effective September 2024)

Below is a detailed table outlining the minimum wages for different categories of employment in Puducherry. The rates cover various skill levels, from unskilled to highly skilled workers, across multiple industries:

|

Industry/Category of Employment |

Unskilled |

Semi-skilled |

Skilled |

Highly Skilled |

|---|---|---|---|---|

|

Shops and Establishments |

₹11,131 |

₹11,695 |

₹12,340 |

₹12,970 |

|

Security Services |

₹14,550 |

₹15,115 |

₹15,796 |

₹16,380 |

|

Tailoring Industry |

₹11,870 |

₹12,425 |

₹13,045 |

₹13,630 |

|

Automobile Workshops and Servicing |

₹15,296 |

₹15,956 |

₹16,617 |

₹17,181 |

|

Electronics and Electrical Manufacturing |

₹15,056 |

₹15,596 |

₹16,256 |

₹16,900 |

|

Construction Industry |

₹14,420 |

₹14,980 |

₹15,620 |

₹16,250 |

|

Hotels and Restaurants |

₹11,970 |

₹12,540 |

₹13,170 |

₹13,820 |

|

Plastic and Rubber Manufacturing |

₹14,750 |

₹15,330 |

₹15,960 |

₹16,580 |

|

Chemical and Fertilizer Industry |

₹16,080 |

₹16,760 |

₹17,390 |

₹17,990 |

|

Textiles and Garments |

₹13,980 |

₹14,550 |

₹15,180 |

₹15,780 |

|

Leather and Footwear Manufacturing |

₹14,280 |

₹14,850 |

₹15,490 |

₹16,120 |

|

Furniture Manufacturing |

₹14,760 |

₹15,340 |

₹15,970 |

₹16,610 |

|

Printing and Packaging Industry |

₹15,420 |

₹16,010 |

₹16,650 |

₹17,290 |

|

Glass and Ceramics Manufacturing |

₹15,620 |

₹16,210 |

₹16,860 |

₹17,510 |

Key Highlights of the Notification:

- Uniform Wage Structure: The notification applies uniformly across all regions in Puducherry, ensuring that both male and female workers receive equal pay for equal work as mandated by the Equal Remuneration Act.

- Dearness Allowance (DA): In addition to the basic wages, workers are entitled to a Dearness Allowance (DA), which will be adjusted periodically based on the Consumer Price Index (CPI). The DA serves to offset inflation and ensure that wages keep pace with rising living costs.

- Apprentices and Trainees: The minimum wages notification also covers apprentices and trainees in various industries, ensuring fair remuneration during their training periods.

- Compliance Mandate: Employers must implement the revised wage rates immediately, and failure to do so may lead to penalties under the Minimum Wages Act, 1948.

- Impact on Employers: The revision in minimum wages aims to provide better living standards for workers while ensuring employers comply with fair compensation practices. It is important for employers to update their payroll systems and maintain wage records as required by law.

Understanding the Wage Structure

- Basic Wage: The specified minimum wage for different employment categories, covering various skill levels.

- Dearness Allowance (DA): An additional amount paid over the basic wage to accommodate for inflation, based on CPI changes.

- Gross Pay: The total pay, combining both basic wage and DA, which employees should receive.

Importance of the Minimum Wage Notification

This notification reflects the government’s commitment to safeguarding workers’ rights and promoting fair compensation practices. Employers are required to review their wage structures and ensure that the revised rates are applied across all categories of employment. By adhering to these standards, companies not only comply with legal requirements but also foster a positive work environment, boosting employee morale and productivity.

Legal Implications for Non-Compliance

Non-compliance with the minimum wage revisions can attract legal penalties, including fines and imprisonment, as per the provisions of the Minimum Wages Act, 1948. It is crucial for employers to stay informed about updates in the CPI and subsequent adjustments to the DA to remain compliant.

Conclusion

The revised minimum wages in Puducherry for September 2024 mark a significant update for various industries. Employers must update payroll processes, adjust salaries where required, and stay informed about future CPI adjustments. Ensuring compliance with the new wage structure not only protects businesses from legal penalties but also contributes to the well-being of the workforce.