With the implementation of the Code on Wages, 2019 and the Code on Social Security, 2020, employers across India are witnessing a paradigm shift in wage definition, employee coverability, and statutory contribution calculations. Traditional assumptions around PF, ESIC, and Gratuity compliance are no longer sufficient, and even minor misinterpretations may result in non-compliance, financial exposure, and regulatory scrutiny.

In order to support employers, HR professionals, payroll teams, and compliance consultants in this transition, HRMThread, in collaboration with PCSMGMT, has launched an Online PF-ESIC-Gratuity Compliance Calculator — a practical, user-friendly tool designed specifically for compliance verification under the new Labour Codes regime.

Why This Calculator Is a Game-Changer

The new Labour Codes introduce a uniform definition of “wages”, significantly impacting:

-

PF applicability and contribution base

-

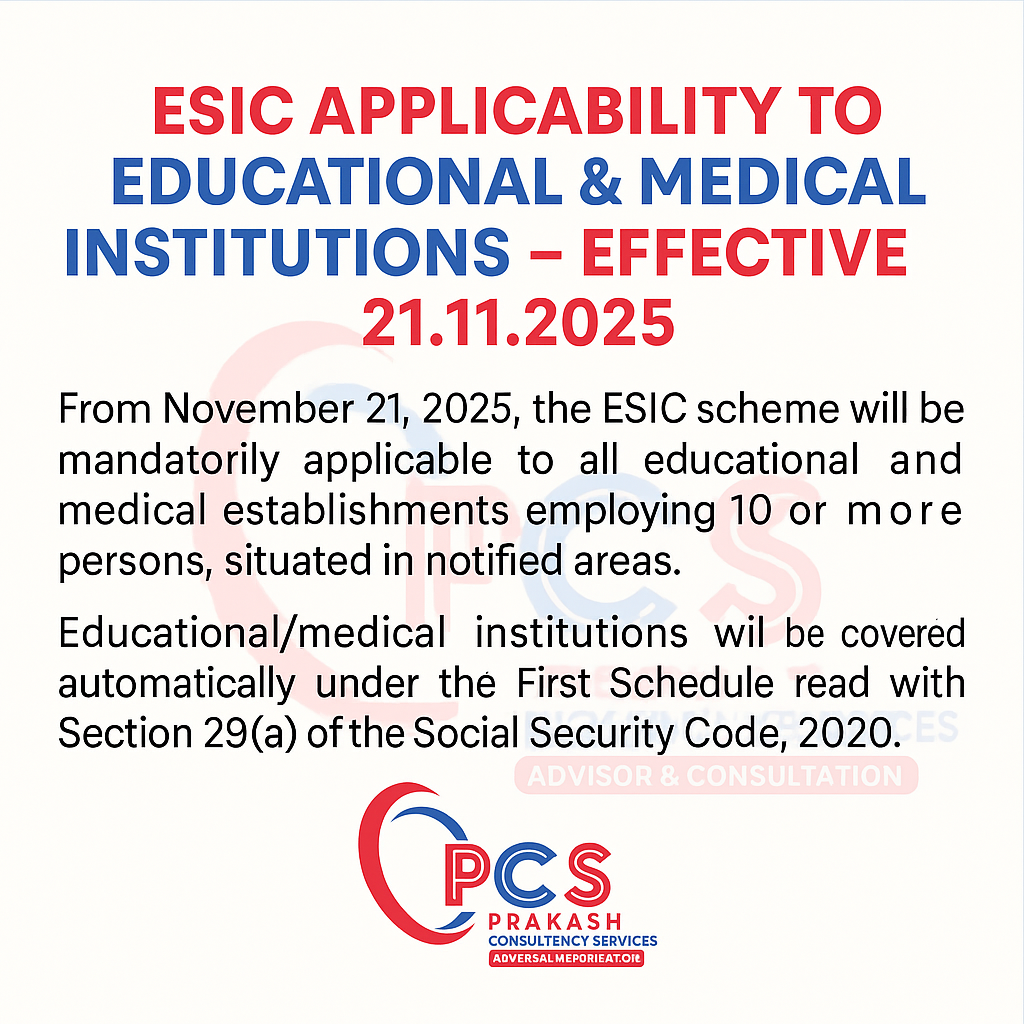

ESIC eligibility and employee coverability

-

Gratuity calculation and long-term liability

Several employees who were earlier outside statutory coverage may now become mandatorily coverable, particularly under ESIC, due to changes in wage components and exclusions. Manual calculations or legacy payroll logic may no longer be reliable.

What the Online Calculator Helps You Achieve

The PF-ESIC-Gratuity Compliance Calculator enables establishments to:

-

✔ Check PF and ESIC eligibility based on revised wage definitions

-

✔ Verify ESIC coverability under Section 2(88) of the Social Security Code

-

✔ Accurately compute PF, ESIC, and Gratuity contributions

-

✔ Identify new inclusions or exclusions arising from Labour Code implementation

-

✔ Strengthen statutory compliance and reduce future litigation risk

Built for Compliance, Designed for Clarity

This calculator has been developed keeping in mind the practical challenges faced by employers during implementation, and acts as a decision-support tool rather than a mere arithmetic calculator. It bridges the gap between legal provisions and payroll execution, ensuring compliance remains accurate, auditable, and defensible.

As organizations prepare themselves for deeper enforcement of the new Labour Codes, tools like this become essential to ensure correct interpretation, proactive compliance, and operational efficiency.