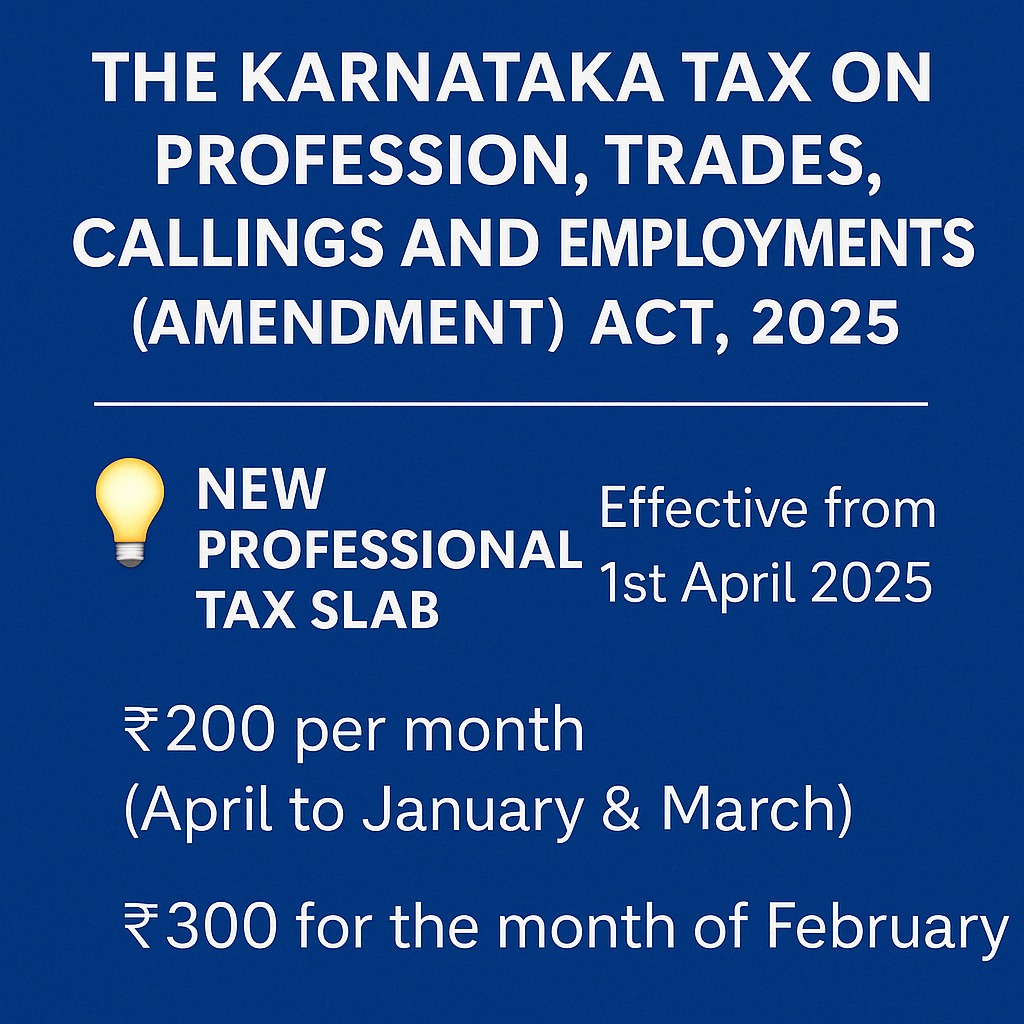

📢 Karnataka Professional Tax Slab Revised – Amendment Act 2025 Notified | New PT Slab Effective from 1st April 2025

Published on: April 16, 2025

Author: Prakash Consultancy Services

Category: Statutory Compliance | Karnataka Labour Laws | Professional Tax

🏛️ Introduction

In a key legislative development, the Government of Karnataka has revised the monthly Professional Tax (PT) slab structure through Karnataka Act No. 33 of 2025, notified in the Karnataka Gazette (Extraordinary) on 15th April 2025. The amendment, effective from 1st April 2025, modifies the PT rate for the month of February alone, aiming to streamline the state’s revenue mechanism while keeping compliance simple for businesses and professionals.

📘 Amendment Snapshot – Karnataka PT Act, 2025

|

Particulars |

Details |

|---|---|

|

Act Name |

The Karnataka Tax on Profession, Trades, Callings and Employments (Amendment) Act, 2025 |

|

Act Number |

Karnataka Act No. 33 of 2025 |

|

Gazette Date |

15th April 2025 |

|

Governor’s Assent |

10th April 2025 |

|

Effective Date |

1st April 2025 |

|

Amended Item |

Schedule – Serial No. 1 (PT Slab) |

💰 Revised Professional Tax Slab – Effective April 2025

|

Month |

PT Amount Payable per Employee |

|---|---|

|

April to January |

₹200/month |

|

February |

₹300 |

|

March |

₹200 |

⚠️ Note: The rate for February has been increased to ₹300. No changes for the remaining months.

👥 Who Is Liable to Pay?

|

Type of Person |

Responsibility |

|---|---|

|

Employer |

Deduct PT monthly from employees and remit |

|

Employee (under salary bracket) |

PT is deducted from the salary |

|

Freelancers/Consultants |

Must self-register and pay PT |

|

Business Entities |

Pay PT for Directors, Partners, Proprietors (based on status and turnover) |

📋 Return Filing Requirements

|

Return/Form |

Timeline |

|---|---|

|

Monthly PT Payment |

20th of following month |

|

Annual Return (Form 5) |

30th April every year |

⚠️ Penalties and Interest – Post Amendment

Even though the Amendment Act, 2025 revised the tax slab only, the existing penalty and interest provisions under the Act remain applicable and are summarised below:

📌 Section 11 – Interest on Delayed Payment

- If PT is not paid on time, interest is levied at 1.5% per month on the outstanding tax amount.

- 📅 Effective From: Assessment Year 2023 onwards

- Formula:

Interest = Tax Due × 1.5% × Number of Months Delayed

📌 Section 12 – Penalty for Non-Payment

- A penalty of 10% of the tax amount due is levied if tax is not paid voluntarily before notice is served.

- Example: If ₹2,500 is unpaid PT, penalty = ₹250

📌 Belated Filing Fee for Form 5 (Annual Return)

- As per Rule 6(3):

- ₹250 per month per return for late submission

- No change in this fee post-amendment

- This fee applies in addition to interest and penalty

🔎 Example: Total Liability in Case of Delay

|

Scenario |

Details |

|---|---|

|

Employee Count |

30 |

|

Month of Delay |

February 2025 |

|

PT Due |

₹300 × 30 = ₹9,000 |

|

Delay |

2 months |

📊 Calculation:

|

Component |

Amount |

|---|---|

|

Interest (1.5% × 2) |

₹9,000 × 3% = ₹270 |

|

Penalty (10%) |

₹9,000 × 10% = ₹900 |

|

Late Fee |

₹250 |

|

Total Due |

₹9,000 + ₹270 + ₹900 + ₹250 = ₹10,420 |

📝 Compliance Advisory for Employers

- ✅ Update payroll software for new PT slab effective April 2025

- ✅ Apply ₹300 deduction for February and ₹200 for other months

- ✅ Ensure Form 5 reflects accurate data and is filed before 30th April

- ✅ Maintain a PT Register and keep proof of challan and Form 5 submission

📘 Download Official Notification

📥