📅 Notification: G.S.R. 749(E) dated 10th October 2025

📜 Issued By: Ministry of Labour & Employment, Government of India

👷♂️ Effective Period: From 1st November 2025 to 30th April 2026

⚖️ Reference: Employees’ Provident Funds & Miscellaneous Provisions Act, 1952

🌟 Introduction

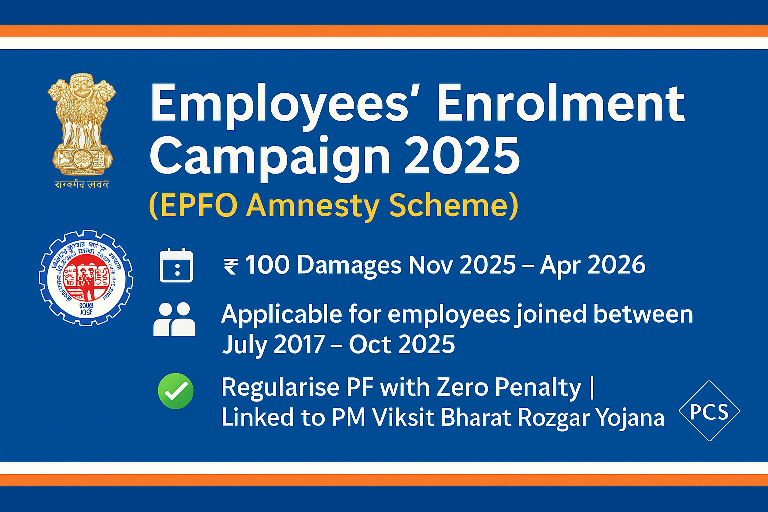

The Ministry of Labour & Employment has introduced a special amnesty window titled “Employees’ Enrolment Campaign, 2025 (EEC 2025)” under the Employees’ Provident Funds Scheme, 1952.

This scheme provides employers — whether covered or uncovered under EPFO — a one-time opportunity to voluntarily enrol un-enrolled employees and regularise pending PF compliance for the period 1st July 2017 to 31st October 2025, with nominal damages of ₹100 and a waiver of the employee’s share of contribution.

📘 Legal Reference

The campaign is notified through G.S.R. 749(E) dated 10 October 2025, by inserting Paragraph 82B in the EPF Scheme, 1952.

It is issued under the powers conferred by Section 5 read with Section 7(1) of the EPF & MP Act, 1952.

🔹 Key Highlights of Employees’ Enrolment Campaign 2025

Particulars | Details |

|---|---|

Scheme Name | Employees’ Enrolment Campaign, 2025 (EEC 2025) |

Effective Dates | 1 November 2025 to 30 April 2026 |

Coverage Period | 1 July 2017 to 31 October 2025 |

Eligible Employers | All establishments, covered or not covered under EPFO |

Eligible Employees | Employees who joined between 1 July 2017 – 31 October 2025, are alive and employed on the date of declaration |

Damages | ₹100 only (one-time) |

Employee Share | Waived if not deducted earlier |

Interest u/s 7Q | Payable on employer share |

Admin Charges | Payable |

Declaration Portal | Online via EPFO Portal |

Linked Scheme | Pradhan Mantri-Viksit Bharat Rojgar Yojana (PMVBRY) |

🧾 Step-by-Step Compliance Process

1️⃣ Create UAN using UMANG App

Employers must ensure Face Authentication UAN creation for each eligible employee through the UMANG Application before declaration.

2️⃣ Generate and File ECR

Prepare an Electronic Challan-cum-Return (ECR) for the declared employees, covering:

Employer’s share contribution

Interest under Section 7Q

Applicable administrative charges

₹100 damages (one-time only)

3️⃣ Make Online Declaration

Submit the declaration under Employees’ Enrolment Campaign, 2025 via the EPFO portal, linking it with the relevant TRRN/ECR.

4️⃣ Continue Regular Compliance

From the month of declaration, the employer must continue regular monthly compliance under EPF, EPS, and EDLI schemes.

💸 Financial Benefits Under the Scheme

Component | Payable by Employer | Remarks |

|---|---|---|

Employer Share | ✅ Yes | For entire past period from date of joining |

Employee Share | ❌ Waived | If not deducted earlier |

Interest (u/s 7Q) | ✅ Yes | On employer’s share only |

Admin Charges | ✅ Yes | As applicable |

Damages | 💰 ₹100 only | One-time lump sum for all three schemes |

⚙️ Damages Table – New Table-2 under Para 32-A

Period of Default | Rate of Damages |

|---|---|

1 July 2017 – 31 October 2025 | ₹100 (one-time, lump sum) |

⚠️ Important Conditions

Multiple declarations are not allowed.

All eligible employees must be declared in a single submission.

Declarations made with false information or suppression of facts will be void ab initio and attract penal action.

Cases concluded under Section 7A / Para 26B / Para 8 before the scheme date will not be reopened.

No suo-motu action by EPFO against employers who submit declaration and undertaking confirming no dues.

- Period before 1 July 2017 is not covered under this campaign.

🤝 Linkage with Pradhan Mantri-Viksit Bharat Rojgar Yojana (PMVBRY)

✅ Eligibility for PMVBRY Benefits

Employers who register under EEC 2025 or declare additional employees will also be eligible for PMVBRY benefits, subject to scheme conditions.

Part | Benefit Description |

|---|---|

Part A | Applies to new employees joining after declaration or inquiry conclusion. |

Part B | Applies after six months from declaration or inquiry conclusion — valid up to 31 July 2027. Additional employees declared under EEC 2025 will be added to the employer’s baseline count. |

Adjustment Clause | If PMVBRY benefits already availed, future dues will be adjusted or recovered accordingly. |

🧩 Impact for Employers

✅ Advantages

Legal regularisation of past PF omissions since 2017.

Waiver of employee share if not deducted.

Fixed ₹100 damage — huge saving compared to normal rates.

No penalty or prosecution if declared truthfully.

Eligibility to claim PMVBRY incentives for new hires.

⚠️ Precautions

Ensure correct employment data before declaration.

Generate valid UANs through Face Authentication (UMANG).

Maintain proof of wages, attendance, and employment continuity.

📅 Validity Period

Commences: 1 November 2025

Ends: 30 April 2026

Employers should utilise this six-month golden

opportunity to cleanse old PF records and align with EPFO compliance

before routine inspections resume.