Many employees forget to transfer the balance from their previous provident fund (PF) accounts when they change jobs. Some of them even withdraw the money from PF account. Since PF is meant for one’s retirement years, financial experts suggest that the accumulated savings should not be withdrawn during one’s working years. To encourage employees consolidate multiple accounts, Employees’ Provident Fund Organisation (EPFO) has launched a special drive called “One Employee-One EPF Account”

@Courtesy http://profit.ndtv.com/

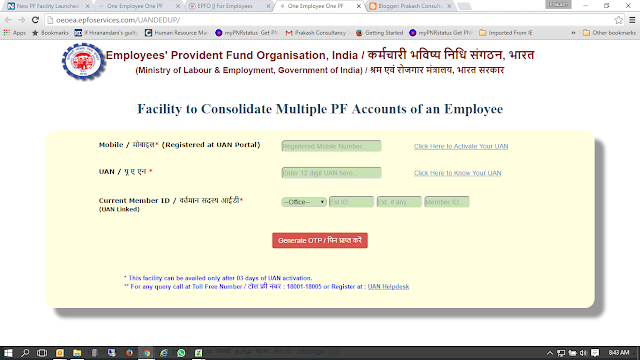

http://oeoea.epfoservices.com/UANDEDUP/

Here re is a 10-point Step :

- EPFO has set up a special portal for the “One Employee-One EPF Account” drive. Under this drive EPFO will actively help those who want to transfer the balance from their past PF accounts to current PF account which is linked to universal account number (UAN).

- You need to enter your activated UAN along with your current UAN-linked PF number and mobile number registered with the EPFO.

- Both your UAN and PF number is mentioned on your salary slip. If your UAN is already activated, you will be directed to the next page after you enter One-Time-Password (OTP) that you will receive on filling up the details

- Then you will be asked to enter the details of your past PF numbers that you want to be transferred to your current PF account. Up to 10 past PF numbers can be added under this facility.

- The numbers provided by you are sent to EPFO offices in which your past PF money was deposited. The offices will in turn get in touch with the employers. After the employer verifies the PF claim, the transfer will be done.

- The EPFO regional office will get in touch with you in case you face any problem after filing PF balance transfer request.

- Although the facility to transfer PF balance online existed earlier, it could be used if the details of the previous PF accounts are available in the EPFO database and the employers have digital signatures.

- The retirement fund body has been advising subscribers to link all their PF account numbers with the Universal Account Number (UAN). With the enactment of the Aadhaar Act, 2016, EPFO is seeking to make Aadhaar the primary identifier for consolidating PF accounts.

- The UAN was launched in October 2014 to enable members have continuity in their PF membership on change in jobs. The UAN remains portable throughout the lifetime of an employee. All active subscribers have been allotted a UAN which needs to be linked to AAdhar, PAN and bank account.

- Employee contributes 12 per cent of basic salary to PF. The employer too has to contribute the same amount towards Employees’ Provident Fund as its share.

Leave a Reply